UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The August ADP report showed 428,000 private sector jobs added which missed estimates for 900,000. Some investors wondered why this didn’t cause stocks to fall. Stocks probably ignored this report because it was wildly too pessimistic in July. The initial report in July showed 167,000 jobs created. That was revised up to 212,000 which is wildly below the BLS’s initial reading of 1.462 million. The BLS consensus estimate for August is 1.358 million. Keep in mind, there will be government jobs created because of the census. Renaissance Macro estimates there will be 230,000 temporary census jobs added in this report.

This is still a solid ADP report even though it came in less than half of the consensus. Of the 19.7 million jobs lost in the recession, 8.5 million or 43% have been recovered in the past few months. Economists will point to how much further the economy has to go. However, investors like to look towards the future. It could be bright if Abbott’s testing lowers the spread of COVID-19. There might be another burst in hiring in the leisure and hospitality industry especially. Even without this new testing, the 7 day average of new deaths per day has fallen to 905 which is the lowest since July 22nd. Finally, the decline in new cases is making its way to deaths.

As you can see from the chart above, ADP payrolls are 8.7% off the pre-COVID-19 peak. At the trough of the last recession, payrolls were down 7.4%. In other words, according to this metric, it might take a couple months to get to the worst of the last recession. The unemployment rate is expected to already fall below the previous peak as economists are projecting it to fall to 9.8%.

Small firms did the worst in the ADP report as they added just 52,000 jobs. Mid-sized firms added 79,000 jobs and large firms added 298,000 jobs. If the BLS report comes in better than the ADP report, it will likely be because of small firms. The goods producing sector added 40,000 jobs and the service providing sector added 389,000 jobs. Leisure and hospitality added the most as there were 129,000 new jobs in that industry.

Information lost 1,000 jobs even though we are in a tech bubble in the stock market. We saw Salesforce.com announce layoffs with its last quarter. Therefore, it wouldn’t be a dramatic negative for the labor market if the tech bubble bursts. If another industry or sector gets investor capital to grow, it will be better for the overall economy. It’s not healthy for the economy be to be dominated by a few companies that don’t employ many people relative to their size.

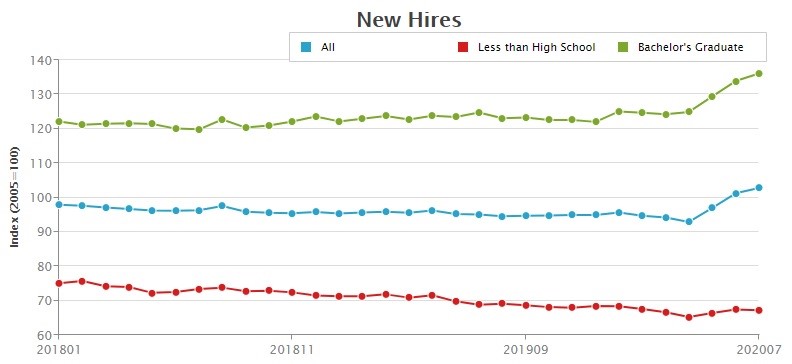

Less Than High School Not Doing Well

Those with less education and lower wages were helped the most by the stimulus, but they haven’t gotten their jobs back. The chart below shows (small business) new hires for those with less than a high school degree compared to those with a bachelor’s degree since 2018. The new hires volume index for those without a high school degree went from 65.2 in April to 67.2 in July. On the other hand, those with a college degree have seen much greater improvement. Their index went from 124.9 to 136.1 in the same period.

Investors Are Manic

Euphoria is an extreme form of optimism. Mania is when investors are so desperate to buy stocks, they will pay any price and are obsessed about the market. September 2020 is a mania just like January 2018. As you can see from the chart below, the S&P 500’s 14 day RSI is the highest since January 2018. It is 82.9 as of Wednesday. It peaked at 86.7 on January 26th. That was directly before the short VIX trade blew up causing stocks to correct sharply. AAII shows portfolio weighting is almost identical to February 2020 before the crash. Investors have 64.8% of their money in stocks which is slightly below February when they had 66.1%. Investors have 16.3% of their money in cash which is slightly above February when they had 14.8% in cash.

Corporate Debt Addiction

We all know corporate debt is exceedingly high. The new stat many don’t know is the percentage of firms without any debt. With interest rates so low, it’s stupid not to take out debt unless your business is highly unstable or has high operational leverage. For example, an energy company shouldn’t carry much debt because it is subject to the risk of declining oil prices. The fracking bubble of the 2010s was fueled by excessive debt taken out at the exact wrong time as oil prices were unsustainably high given the added supply from fracking.

As you can see from the chart above, at the end of 2018, 15% of small caps had no debt. Now it’s in the low single digits. There was a much more drastic decline for small caps than large caps. One of the risks of being a small company is the lack of access to capital.

Raising debt is smart in the short term because the money is practically free. It’s also imperative for firms that aren’t profitable and are on their last legs. As you can see from the chart below, the share of zombie companies has exploded in the past 30 years since interest rates have fallen. Zombie firms have an interest coverage ratio below 1 and a Tobin’s Q below the median firm in the sector over 2 years. These firms need to borrow more money to avoid bankruptcy. The probability of these firms staying zombies has increased. It’s a debt spiral.

Conclusion

The August ADP report missed estimates by a lot, but investors are excited for a great BLS report which is expected to show well over 1 million jobs created. Those with less education have been less likely to be rehired since the recovery started. This is a stock market mania like January 2018. Very few small firms have no debt which is much different from a few years ago. The percentage of zombies keeps increasing. These firms are increasingly likely to stay zombies.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.