UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

We are going to review the updated Q2 earnings data from The Earnings Scout and FactSet. The Earnings Scout’s data says we aren’t in an earnings recession, while according to FactSet’s data it’s still inconclusive. However, asking if this is an earnings recession is the wrong question. There is no formal definition of an earnings recession, but if you take it to mean 2 quarters of negative yearly growth, determining if one exists is meaningless; the current situation explains why.

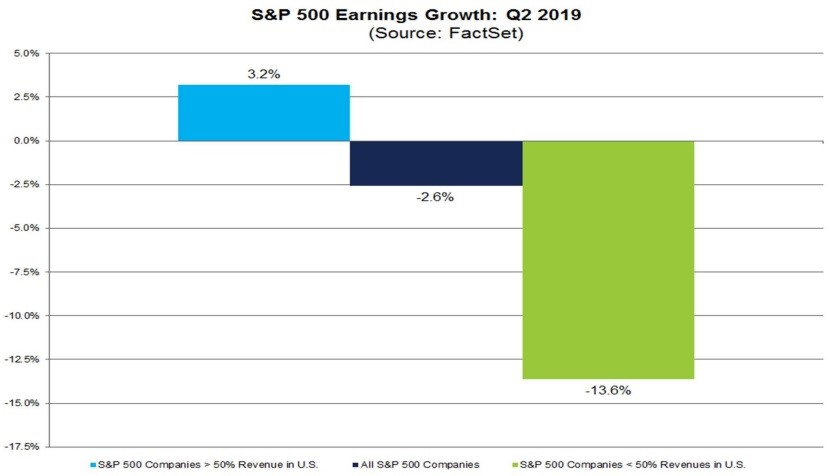

Using FactSet’s numbers, EPS growth was negative by less than 1 point in Q1 following a very tough comparison. Currently, blended Q2 EPS growth is -2.6%. Whether Q1 earnings growth was negative by 1 point or positive by one point should be irrelevant to your investing decisions. It barely affects the trailing PE ratio. An ‘earnings recession’ isn’t like an economic recession which portends more risk. The last earnings recession in the first half of 2016 was followed by a huge ramp in earnings growth in 2017 and 2018.

Latest Q2 Results: Big Wins For Communication Services

Let’s look at the latest Q2 results from The Earnings Scout first. With 44% of S&P 500 firms reporting earnings, 76% have beaten EPS estimates with 5.47% growth and 62% have beaten sales estimates with 4.39% growth. The average sales surprise was 1.51% and the average EPS surprise was 2.6%. 57% of S&P 500 companies that have reported so far have had their 3Q 2019 EPS estimates cut following the results. The average estimate cut has been -0.97%. That result shows improvement as Q1 estimates were cut 3.31% and Q2 estimates were cut 1.93%.

The communication services sector has had an amazing quarter so far. You can see in the list below of the largest 15 firms’ earnings results, there are a few firms in this sector which have had amazing growth.

The sector has had 15.03% EPS growth with a 14.02% average surprise and 17.76% sales growth with a 5.71% average surprise. You can see, Facebook, Alphabet, and Microsoft all reported double digit EPS growth.

Big Decline In International EPS

The numbers from FactSet aren’t as great, but there is no sign of a terrible quarter here either. With 44% of firms reporting results, blended EPS growth is -2.6%. It started the quarter at -2.7% and was -3.4% in the prior week. Growth is going up because firms are beating estimates as usual. 77% of firms have beaten EPS estimates by an average of 5.4%. Both are above the 5 year average. It’s the same for sales estimates which have been beaten 61.2% of the time by an average of 1.2%. EPS growth will be close to the flatline by the end of the quarter.

This quarter has been mired by weakness from international firms. As you can see from the chart below, firms with more than half of their revenues coming from abroad had a 13.6% decline in EPS. They had a 2.4% decline in revenues.

On the other hand, U.S. centered businesses have had 3.2% EPS growth and 6.4% sales growth. International weakness is being driven by tech.

Very Good Q2 GDP Report

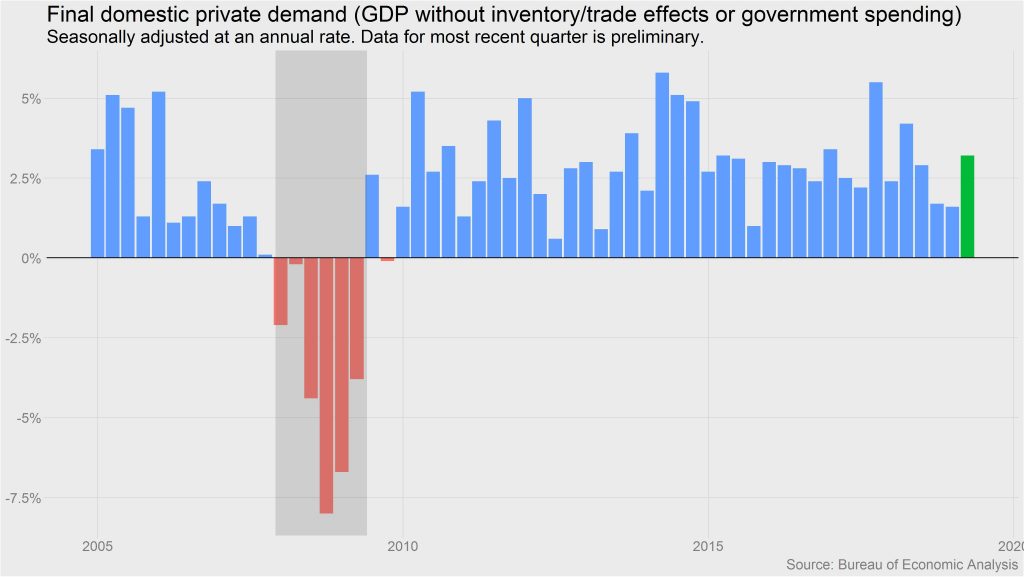

The Q2 GDP report was great because of the consumer. Headline results aren’t nearly as important as final domestic private demand, which we will get into. Real quarter over quarter growth was 2.1% which beat estimates for 1.9% and fell from 3.1%. Real consumer spending growth was 4.3% which beat estimates for 3.9% and last quarter’s 1.1% growth. The solid real wage growth is finally transitioning to strong real spending growth.

The chart below shows what matters, real final sales growth.

Growth improved from 1.6% to 3.2%. You can say this slowdown is defined by the weakness in Q4 2018 and Q1 2019. The last slowdown was defined by the weakness in Q4 2015. Does that mean the slowdown is over? That’s a stretch because these are only the advanced Q2 numbers.

The Details Of The GDP Report

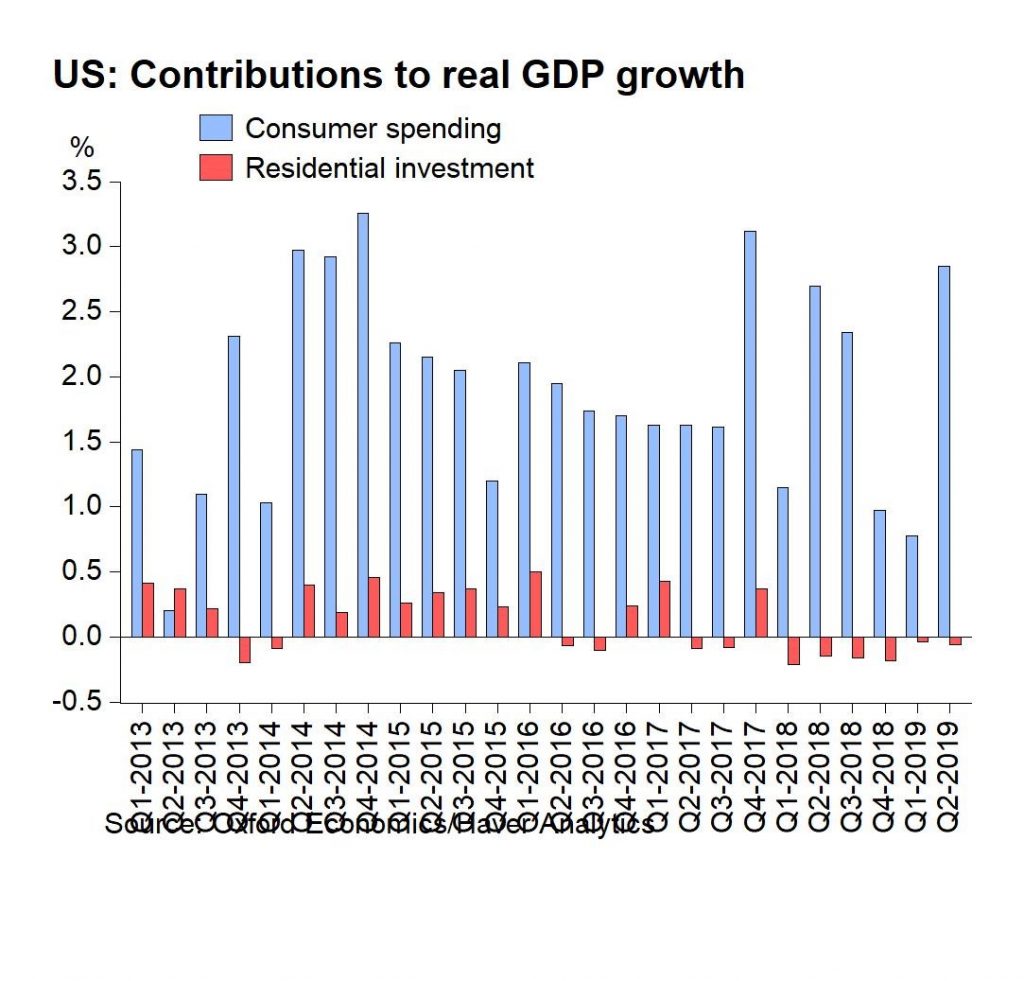

This report was driven by the consumer (good) and government spending (bad). It was hurt by net exports (good), inventory investment (good), residential fixed investment (bad), and non-residential fixed investment (bad). That’s 3 bad and 3 good readings. This report was good because consumer spending helped growth by significantly more than residential and non-residential fixed investment hurt it.

Huge Increase In Government Spending

Consumer spending helped GDP growth by 2.85%. Government spending growth was 5% which is the fastest growth in a decade. That helped GDP growth by 0.85%.

If you zero in on non-defense federal spending, quarterly growth was an enormous 15.9% which is the fastest increase in 20 years and the 2nd biggest increase in 30 years. Spending growth was higher than during the financial crisis when the unemployment rate went above 10%.

The good news is inventory investment pulled growth down by 0.86%. That’s good because inventory investment will need to keep up with demand growth which means higher GDP growth in the future. Further good news is growth was pulled down by net exports by 0.65%. If the consumer is strong, causing imports to grow quicker than exports, it’s not a negative even though it hurts GDP growth. GDP growth was more negatively impacted by net exports and inventory investment than it was help by government spending. Q1 GDP growth was inflated and Q2 growth was suppressed.

Another Decline In Real Residential Investment Growth

The worst part of this report was that real residential investment growth was negative for the 6th straight time. The recent negative revisions to new home sales didn’t help. As you can see from the chart below, the 1.5% decline in this category brought down GDP growth by 6 basis points. Non-residential fixed investment growth was -0.6% which hurt GDP growth by 8 basis points. This decline was the first since Q1 2016.

Conclusion

Q2 earnings season is going well. There probably won’t be a technical earnings recession, but nothing bad automatically happens if growth is negative 2 quarters in a row. The last time it happened, earnings were on the cusp of a huge increase. The Q2 GDP report was mostly good because consumption growth was amazing. The weak points which were non-residential and residential fixed investment had a very small impact on GDP growth. We think it’s best to look at growth excluding net exports, inventory investment, and government spending growth. Through that lens, quarterly growth doubled from Q1. If real final sales growth stays strong, the second half should see higher headline growth because inventory investment will need to pick up. The government is either spending excessively relative to history or that report needs to be revised.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.