UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

If this was a normal economic slowdown for cyclical reasons, there would be much more focus on the Fed as it would be trying to save the economy from a recession similar to its actions in 2019 during that slowdown. However, now we have the coronavirus which limits the Fed’s ability to save markets and the economy. There is less faith in the Fed than usual. Monetary policy is in part a confidence game, so this lack of confidence limits what the Fed can do no matter how creative it gets.

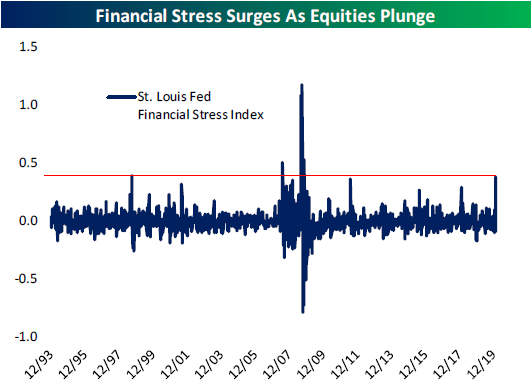

Let’s set the scene. The entire yield curve is still below the Fed funds rate even though the Fed just cut rates by 50 basis points last week. There is a 67% chance the Fed will cut rates 75 basis points on March 18th. The Fed is now in its quiet period, but it’s safe to say if the market expects 3 cuts, the Fed will likely deliver. To get 3 cuts, we’d probably need to see fear which means low stock prices. The chart below shows the financial stress index spiked the most in a week since the 2008 financial crisis. However, on an absolute basis it is still very low. It’s the highest since October 2019. Do you remember October being a very stressful month? It wasn’t.

According to Goldman Sachs, besides zero interest rates which are quickly becoming a given, the Fed has a few other options. The Fed can go with aggressively dovish forward guidance and another round of QE where it purchases mortgage backed securities and treasuries. The table below gives you a handy list of what the Fed can buy. The Fed won’t be buying corporate bonds nor stocks like some other central banks, at least not yet. The Fed probably won’t go with negative interest rates.

Interestingly, with forward guidance, QE, and the rate cuts this easing cycle is estimated to have between 50% and 75% of the effect of a normal cutting cycle. That means it’s not good enough to help the economy should the slowdown deepen. The Fed can purchase asset backed securities to keep credit available to small businesses. If that’s combined with a temporary payroll tax cut or some other fiscal stimulus, the government could limit the number of small businesses that go bankrupt.

Refinances Increase

Whenever there is anxiety in markets, rates fall. This helps home buyers because housing affordability increases and mortgage owners because they can refinance at lower rates. That creates the awkward headlines where homebuyers benefit from geopolitical risk or in this case a global virus. Undoubtedly, the virus will prevent some people from buying because they won’t want to visit open houses. On the other hand, rates are at record lows and headed lower. The average 30 year fixed rate mortgage this week fell 16 basis points to 3.29%. Based on the currently low 30 year bond yield of 1.41%, the average fixed rate mortgage will fall to 2.9%.

The chart below shows the massive spike in the refinance index. In the week of February 28th, it was up 26% weekly after falling 1%. Its yearly growth was 226%. This is a stimulus for consumers. Spending will grow in the intermediate term after the virus passes as long as the labor market stays nearly full. The purchase applications index was up 10% yearly. Its days of double digit growth could be over as the coronavirus hits the housing market in the peak buying season.

Labor Market Doesn’t Signal Recession

The labor market signals there is no recession coming in the near term. We won’t call a recession until jobless claims spike. In the week of February 29th, claims fell 3,000 to 216,000. The February economic data appears to be showing only some signs of weakness. March will be much worse. Even so, we don’t see any spike in claims occurring yet.

The Challenger Job Cuts report also showed no sign of weakness. The number of cuts fell from 67,735 to 56,660. While that’s not a great reading, it’s an improvement from January. The data is supposed to be getting worse. Because the start of 2019 had a very big spike in the number of cut announcements, year to date announcements are actually down 4.2% from last year. This hasn’t been a great start to the year, but we don’t see weakness related to the coronavirus yet. The worst industry was tech which has had 24,078 cuts this year which was up from 2,111 last year.

The ADP report was very good as there were 183,000 private sector jobs created which was the 3rd highest in the past year. Small firms added 24,000 jobs. Very small firms added 8,000 jobs all of which were in services. So far, there is no sign of weakness in this group. Mid-sized firms created 26,000 jobs and large firms created 133,000 jobs. Good producing firms created 11,000 jobs and services created 172,000 jobs. Information lost 2,000 jobs which is bad because they pay the best. Leisure and hospitality created 44,000 jobs. You’d expect that total to go negative in March with the coronavirus wreaking havoc on travel. Education and healthcare created the most jobs again as it added 46,000. Professional and business added 38,000.

Coronavirus Impact On Labor Market

The pie chart below shows the breakdown of private sector employment by industry. Social consumption jobs and those impacted by supply chain disruptions will see a negative impact. That’s 39.2% of the labor market. We don’t think the healthcare industry will see job cuts. The demand for healthcare will increase.

Conclusion

The Fed has a few options to deal with the impact of the coronavirus once it reaches zero percent interest rates. The Fed likely won’t cut rates to negative and isn’t allowed to buy stocks or corporate bonds. With record low rates, refinancing activity has soared. The labor market was in fine shape in February. Weak data is coming next month. Many segments of the private sector which combined employ 39.2% of the labor market will be hit hard by the coronavirus.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.