UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The Republican party is in a pickle if you were to look at a Gantt chart of its legislative agenda. If you don’t know what a Gantt chart is, it is a calendar which shows in what order you must complete tasks and their respective timing. The problem is that healthcare reform needs to be passed before tax reform because the money for tax cuts will come from the healthcare savings. Healthcare is tough to compromise on because the GOP has major philosophical disagreements within the party. With only 52 Senators, the GOP has very little wiggle room to get something passed. Healthcare reform can either create political momentum to raise the debt ceiling and cut taxes or it can delay both. It’s looking like the latter option is occurring.

To be clear, the healthcare plan doesn’t need to be passed for the debt ceiling to be raised, but it will be tough for compromise to be had on raising the debt ceiling if there’s ill will from the healthcare negotiations. The idea that the debt ceiling would be raised easily because the GOP controls all branches of government has been thrown out the window as nothing has been done for months. Besides the divide on philosophical grounds, the Congress and President have low approval ratings, making it doubly hard to accomplish anything.

Before we get into the specifics of the debt ceiling debate, let’s look at the healthcare situation, because it will alter the speed at which the debt ceiling issue will be resolved. As was mentioned the GOP only has 52 senators which poses a problem because it’s tough to get a majority; it’s also impossible to get 60 votes which is what some parts of the plan need to be passed. The GOP is trying to pass the bill under a budget reconciliation which only needs 50 votes instead of the usual 60. The recent news is that many parts of the plan don’t fit under reconciliation, making the odds of it passing change from low to impossible because no Democrat will support it. In what is called the parliamentarian, changes such as defunding Planned Parenthood, restrictions on tax credits used for insurance plans that cover abortion, two market stabilization provisions which grant money to insurance companies, the lockout provision which prevents consumers from buying healthcare insurance for 6 months to stop people from only getting health insurance when they’re sick, and state specific provisions are deemed to need 60 votes because they can’t be passed via reconciliation. That’s a deadly blow to healthcare reform, making the issue even tougher for the GOP. It’s the equivalent of a student getting a zero on his final exam after he was already failing by a couple points.

This depiction shows the dire state of the GOP agenda. If you are unfamiliar with the debt ceiling, it is a limit to the amount the government can spend over the amount it receives. It’s supposed to prevent the government from running out of control deficits. The problem is that by the time the debt ceiling is about to be hit, the money has been spent already, so it comes down to whether the government wants to follow through on its obligations. In a game of chicken, politicians attempt to use the debt ceiling to negotiate compromise. It has lately been used by fiscal conservatives to get spending cuts. The problem with the game of chicken is if they push too hard, problems arise from the risk of government not paying its bills and the conservatives get the political blame. The most notable example of blowback was when S&P downgraded the U.S. from AAA to AA+. As you can see from the chart below, the downgrade didn’t cost the government in terms of its borrowing rate, but it’s not something the Congress wants to repeat.

If the debt ceiling was to be improved, it should focus on future spending so a real discussion can be had instead of this game of chicken. Secondly, it should be debt as a percentage of GDP or debt as a percentage of GDP per capita (a more reliable measure), not on a nominal basis. The debt increasing isn’t inherently a problem because of inflation. The key is to have it grow at or below the rate the economy is increasing at. The Democrats want to abolish the debt ceiling and the GOP wants to have a balanced budget amendment, meaning nothing will be changed as per usual in Washington.

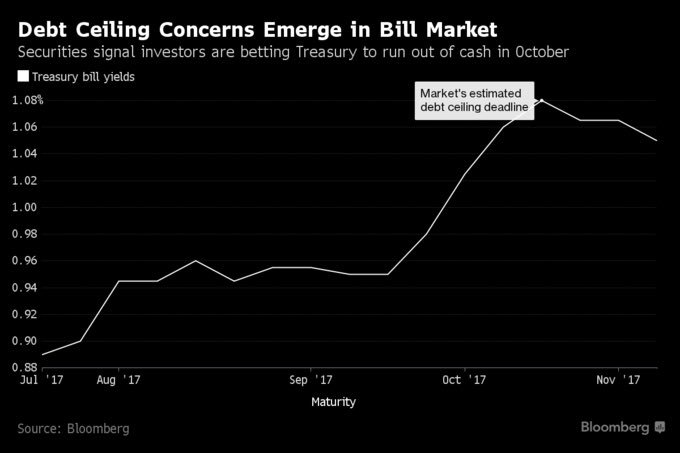

Getting into the specifics of the way the bond market is handling this issue, the chart below shows treasury yields for various maturity dates. As you can see, there’s a big spike in October, which represents the premium paid for the risk of the debt ceiling causing complications. The peak in yields is October 26th which tells us that is the day the market expects the government to hit the debt ceiling without being able to take anymore extraordinary actions. That’s when the government will start prioritizing what it spends money on. To reiterate, the government has already agreed to spend this money so it is reneging on its duties by not making the payments. The debt ceiling will eventually be raised. If it’s raised after the deadline, the money owed will be paid, making this a temporary delay for some.

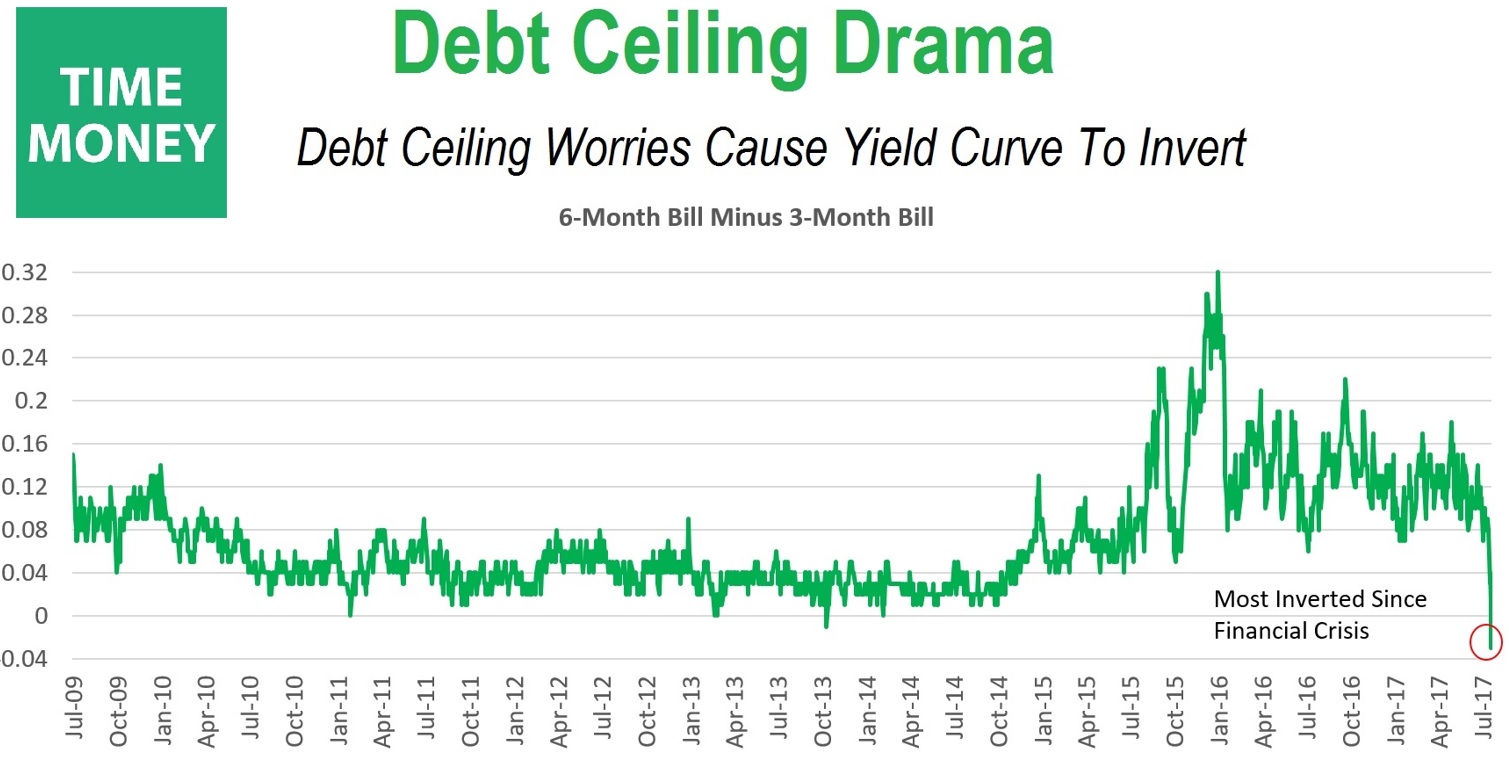

The chart below gives you a clearer picture of the debt market. The yield curve has inverted on the short end meaning longer maturity bonds have lower yields than shorter maturity bonds. The 3-month bill has a higher yield than the 6-month bill for the first time since the financial crisis because 6 months from now is past the debt ceiling deadline, while 3 months is before the deadline. This will change in August as nearer term maturity bills will likely invert.

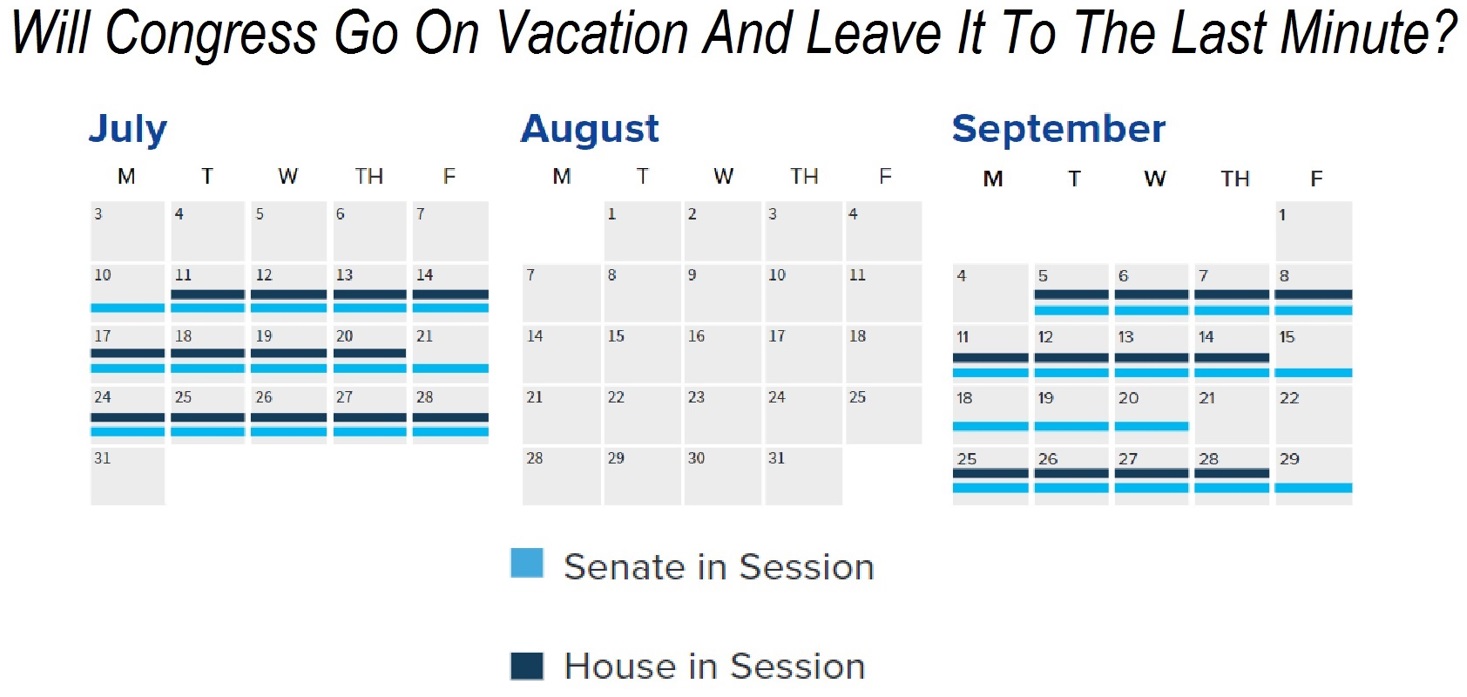

The calendar below shows that Congress goes on vacation in August meaning the debt ceiling will be left to the last minute to be raised. President Trump wants the Senate to stay in Washington to get the healthcare bill passed. Either way the Congress will likely not be working on passing the debt ceiling this summer, postponing the discussing of the issue till last minute.

Conclusion

If the debt ceiling isn’t passed in the next few weeks there will be a flight to safety trade as treasuries and the dollar will be bought and stocks will be sold. This is ironic because traders would be betting on America because America is having problems. It shows how no one really believes America will default. Problems with the debt ceiling might be a negative signal that the tax reform won’t be passed in 2018. That would be a big hit to the economy as small business optimism, including spending and hiring, has relied on tax cuts and regulation cuts.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.