UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

President Trump made a bold official promise of 4% GDP growth per year:

“To get the economy back on track, President Trump has outlined a bold plan to create 25 million new American jobs in the next decade and return to 4 percent annual economic growth,” reads the White House website.

However, despite the promise, in the near term, the economy looks to be barely growing at all. This article shouldn’t be construed as criticism of the president as it will have no bias towards or against him. It’s an analysis of what drives economies and how the recent economy looks as well as a discussion of whether 4% growth is in fact attainable.

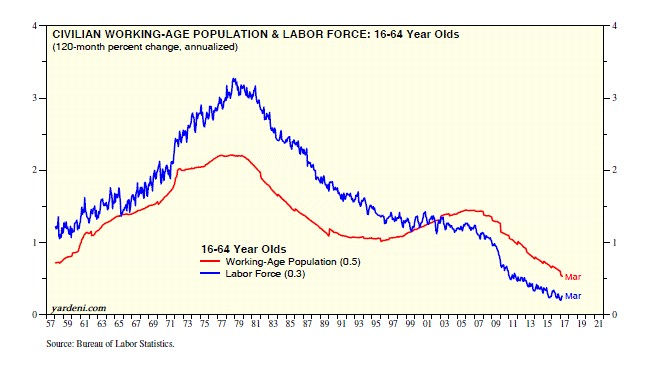

The biggest hurdle to GDP growth is the slowdown in the labor force growth rate. Much has been made about the decline in the labor force participation rate which has been driving the growth in the labor force lower, but the bigger trend is the slowing growth in the working age population. Both are driven by the aging of the population of the United States. The aging of the population puts stress on government programs as older Americans take in more than they produce, in addition to living longer than in past generations.

The chart below shows the population trend of the working age demographic in the United States as well as those in the labor force.

An aging population hurts productivity growth as an older workforce may be less efficient. In addition, purchasing habits change, therefore reducing demand for certain sectors of the economy. For instance, elderly people living on a fixed income budget are less likely to purchase a home or a car.

President Trump’s goal is to cut regulations to boost productivity growth, as he has stipulated on multiple occasions. While it is the correct approach as certain regulations may hinder new business formation, this may be easier said than done.

The chart below shows potential GDP growth as computed by the Congressional Budget Office.

Trump is hoping regulation cuts will change the downward trend GDP is in. It’s worth noting that productivity growth is a long run driver of economic growth and credit growth is the short run driver. This makes it tough for Trump to get a meaningful boost in productivity growth within the next four years. Productivity growth will come from increased domestic fixed investment, but if demand is weak in the short term, it could delay any benefits from regulatory cuts.

One final point on regulations is that they are enacted in a cyclical manner. When the economy is coming out of a recession there is usually a push for more regulations as the people want to prevent another crisis from occurring. Regulations cannot outlaw recessions, which makes it a fruitless task. Usually the next bubble in the economy won’t be the same as the last one anyway because investors and credit issuers feel burned from past mistakes. This is exemplified by how it took until 2015 for the Nasdaq index to reach the record high it set in 2000. It’s also shown in how mortgage debt hasn’t reached the prior cycle’s high. When the economy is at the end of the growth cycle, regulations are relaxed as people forget about the prior recession. Policy makers see signs of deceleration in growth and act to cut regulations to boost growth. When the economy falls into a recession, the regulation cuts are blamed even though the real cause is unsustainable credit expansion.

The near-term outlook of economic growth is weak. Trump’s first quarter as president having below 1% growth is not a step towards 4% growth, although quarter one (Q1) economic growth has little to do with his policies. The debate over what Q1 growth will be is centered on the difference between ‘soft’ survey data and ‘hard’ economic reports. After the election, businesses and consumers became more optimistic about the economy because of the increased likelihood of tax cuts, regulation cuts, and infrastructure stimulus. This is what drove the increase in sentiment surveys and the increase in the stock market which is the ultimate arbiter for the consensus on where the economy is headed.

The real economic data has been weak which shows that although small business CEOs are optimistic about the future, they aren’t investing in new plants and equipment. This weak hard data will mean the economy will grow slowly in Q1 as sentiment has no role in the GDP report. The difference in hard and soft data is played out in the two Fed models which predict economic growth.

Currently the Atlanta Fed’s model sees Q1 growth being 0.6% while the NY Fed’s model sees 2.8% growth. Clearly the Atlanta Fed’s model uses more hard data in its projections. It’s important to note that these models are not official projections by the Fed. If they were official, the Fed would have a tough time coming up with policy since they are diverging.

In an ironic twist of fate, the NY Fed actually did an analysis which proves that small business sentiment is useless in predicting economic growth. This nullifies the NY Fed model’s forecast.

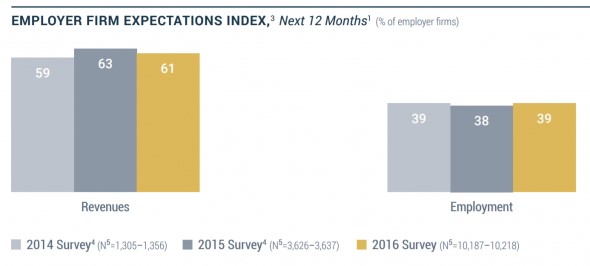

The charts below are from the NY Fed’s analysis. As you can see in the charts below, the small business employer expectations for revenues and employment are consistently positive. Anyone who starts a small business must be positive because it’s a significant risk.

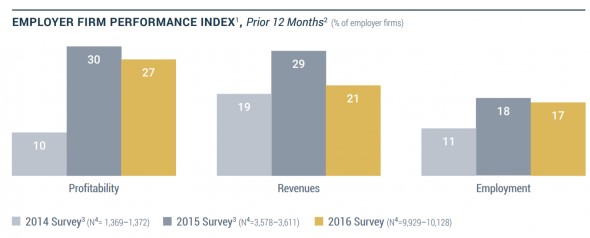

The charts below show the results of how businesses performed in terms of revenues, profits, and employment. Reality is bumpy while the projections are consistently positive. This shows small business sentiment is meaningless. The NY Fed proved that the Atlanta Fed’s 0.6% GDP forecast for Q1 is more likely to occur than its own model which projects 2.8% growth.

As was mentioned, short-term growth is driven by the credit cycle. The chart below shows U.S. consumer credit card debt is about to reach the 2008 peak. It shows that the credit cycle is near its end. If the credit cycle ends in Trump’s term, no amount of an increase in productivity growth will be able to mask it. The economy will fall into a recession if credit card debt falls like it did in 2008 and 2009.

Conclusion

Population growth is a negative long term factor which will hinder Trump’s GDP growth goals. Credit growth is a negative near term factor which will inhibit growth and possibly cause a recession. If the economy is weak, Trump’s deregulation efforts won’t increase domestic fixed investment which is what drives productivity growth.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.