UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

One of the biggest questions in the past few weeks is how much business is going to change in the long run. The potential trend could be more companies having remote workers. We’ve mentioned that the calls for everything to be different are likely over-exaggerated. Specifically, the call for permanently high unemployment has always been wrong. There are also trends that were already in place which are accelerating to fill needs. Online shopping has been growing as a percentage of retail for decades. More shopping being done online in the next few years isn’t because of COVID-19. We just saw a temporary rapid acceleration in growth.

Similarly, online work has increased with the explosion of technology tools. There will always be in person work. The exaggeration that work for everyone is going to suddenly change is aimed to gain attention. The chart above has a headline saying 74% of companies plan to shift to remote work, but the details show only an incremental shift once COVID-19 is over. The chart shows the percentage of workers who are newly working remote that will remain remote (it’s not the percentage of all workers). 26% stated all the workers working remotely will come back and only 6% said 50% or more will remain working remotely. This isn’t a massive societal shift. Most people will go back to work on site. Some of the companies that had workers working remotely realized it was doable. It saves time and money. Technology was advanced to meet firms’ needs as demand skyrocketed.

Guidance Changes

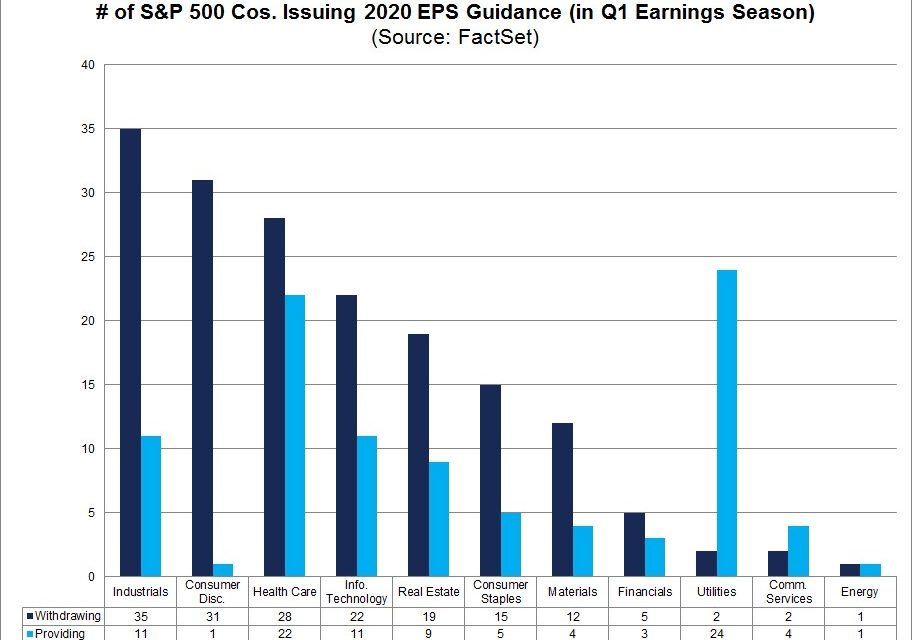

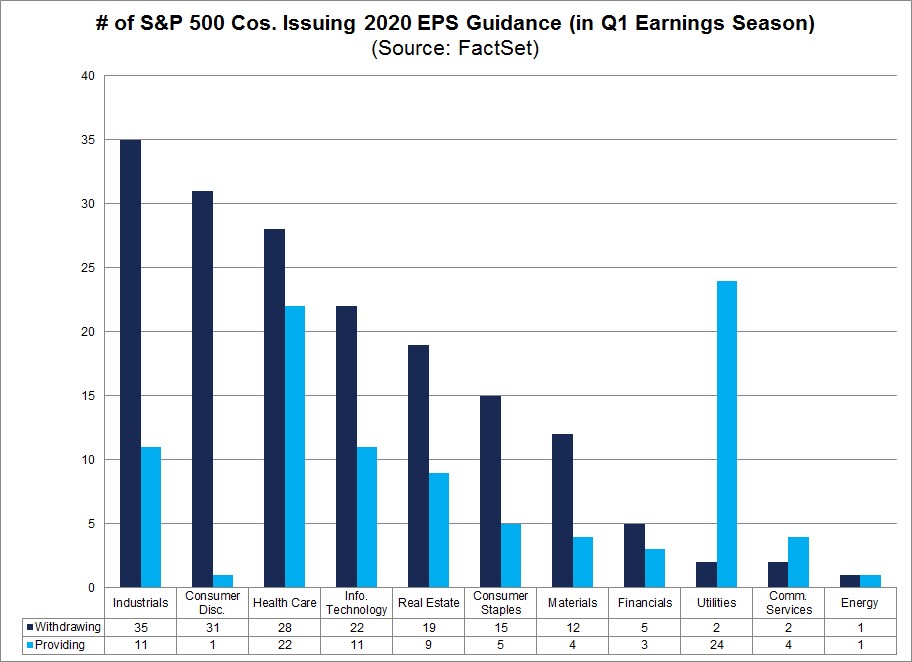

This quarter’s earnings season was mostly weak, but next quarter will be worse. The theme of this quarter was a lack of guidance. Out of the 474 firms that reported Q1 results, 276 commented on EPS guidance. 172 withdrew guidance and 95 gave it. Of the 95 that gave it, 42 lowered it, 40, kept in the same, 9 raised it, and 4 initiated it. Raising guidance was a rare threshold few companies reached.

The chart below shows the sector breakdown of those who gave and withdrew guidance.

The worst was consumer discretionary where 31 withdrew it and 1 gave it. The best was the utilities where 2 withdrew it and 24 provided it. The utilities mostly avoided the pain of this recession. When stocks are crashing, you can buy safe companies like utilities at a modest discount or cyclicals at major discount. The biggest winners in this rally have been the stocks that initially sold off, but actually do well in this environment. That’s a short term strategy, but it has worked for a few months now.

On the positive side, many firms gave updates on how their business started to rebound in April. That’s why the stock market didn’t crash at the sight of weak numbers, with worse ones coming. Q2 will have the worst numbers of the recession, but there will be better guidance. Since earnings estimates are what matters, you can argue Q2 earnings season will be a positive catalyst for stocks. It all depends on what is priced in. Obviously, that makes it tough because that’s an open-ended question with no scientific solution. There have been investors calling for the end of this rally in stocks ever since the bottom.

Sector Weighting

Valuations and the 2nd wave of COVID-19 are the main concerns. As we’ve mentioned, one of the key drivers of this rally has been the increases in tech stocks which dominate the indexes. When the COVID-19 crisis ends, will the companies that exploded because of it, decline? The bulls see no end in sight for the cloud stocks. They see this year as a launching pad for secular growth.

On the other hand, the idea that every SaaS company will be a winner is foolhardy, just like the idea that every energy company being a loser is a mistake. The smartest stock pickers take advantage of situations with indiscriminate selling or buying. Buying a stock just because of its industry could be a mistake. The odds of it failing increase when you’re just chasing momentum. You don’t want to be left with bad fundamentals when the momentum ends. Then you won’t be able to hold during weakness as your conviction will be low.

The table below shows the recent changes to the weighting of each industry group. It gives a lot more detail than typical sector analysis.

By breaking this down, you can really see the changes within tech. As you can see, software and services had 9% share of the S&P 500’s market cap 10 years ago and 12% one year ago. It’s now at 15%, making it the largest by far. Energy has been the best sector off the low in March, but it hasn’t impacted the market much as it has a 3% share. Energy had an 11% share 10 years ago which was near its height. Even if you ignore the peaks, energy is at a low point. It has never been this bad for the sector.

The right side shows software and services has a 24 PE, which isn’t that high when you consider its growth and high margins. Retailing looks dramatically different with and without Amazon. As of May 5th, with Amazon it had a 5.5% year to date gain and a 28 PE. Without the firm, it is down 11.4% and has a 17 PE multiple. Even though tech has had a good run, hardware and equipment firms have been weak as this industry has a 7% share which is down from 8% 10 years ago and 22% 20 years ago.

Conclusion

Most of the workforce isn’t going to shift to remote work when this crisis is over. Q2 earnings season will be terrible, but many firms will bring back guidance which would be a huge positive. Software has taken huge share of the S&P 500, while energy has lost share. You can look at it like the S&P 500 is keeping the winners or that it’s ignoring cyclical opportunities. If you disagree with the weighting, there’s an equal weight index.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.