UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

In this article, we’ll review some of the recent comments made by NY Fed President Bill Dudley in his interview on CNBC with Steve Liesman. In this discussion, we’ll touch upon the problems with the broken window theory. The reason this discussion is being brought about is because of the two major hurricanes which hit in September 2017. Hurricane Harvey brought flooding to the Houston area and Hurricane Irma affected Florida with the usual hurricane related problems: strong wind, a lot of rain, and storm surge.

NY Federal Reserve President Believes In Broken Window Theory?

In the interview, Bill Dudley approached describing the broken window theory, but didn’t do so explicitly. Determining if Dudley said anything incorrectly lies in your interpretation of what he said. He used ‘Fed speak’ to make what he said ambiguous enough to leave it up to interpretation. In response to the economic effect of the two storms he said.

“Those effects tend to be pretty transitory. The long-run effect of these disasters unfortunately is it actually lifts economic activity because you have to rebuild all the things that have been damaged by the storms.”

The key term to decipher is what he means by economic activity. If he means GDP, then he is correct. When a hurricane hits, the area goes into a standstill. There is no consumer spending or travel. Then when the area needs to be rebuilt, there is a burst in spending which boosts GDP. There’s nuance to this statement because if you look at the weakness and the strength of activity there’s not much of an effect. But if you only look at the part after the storm, then there’s a boost.

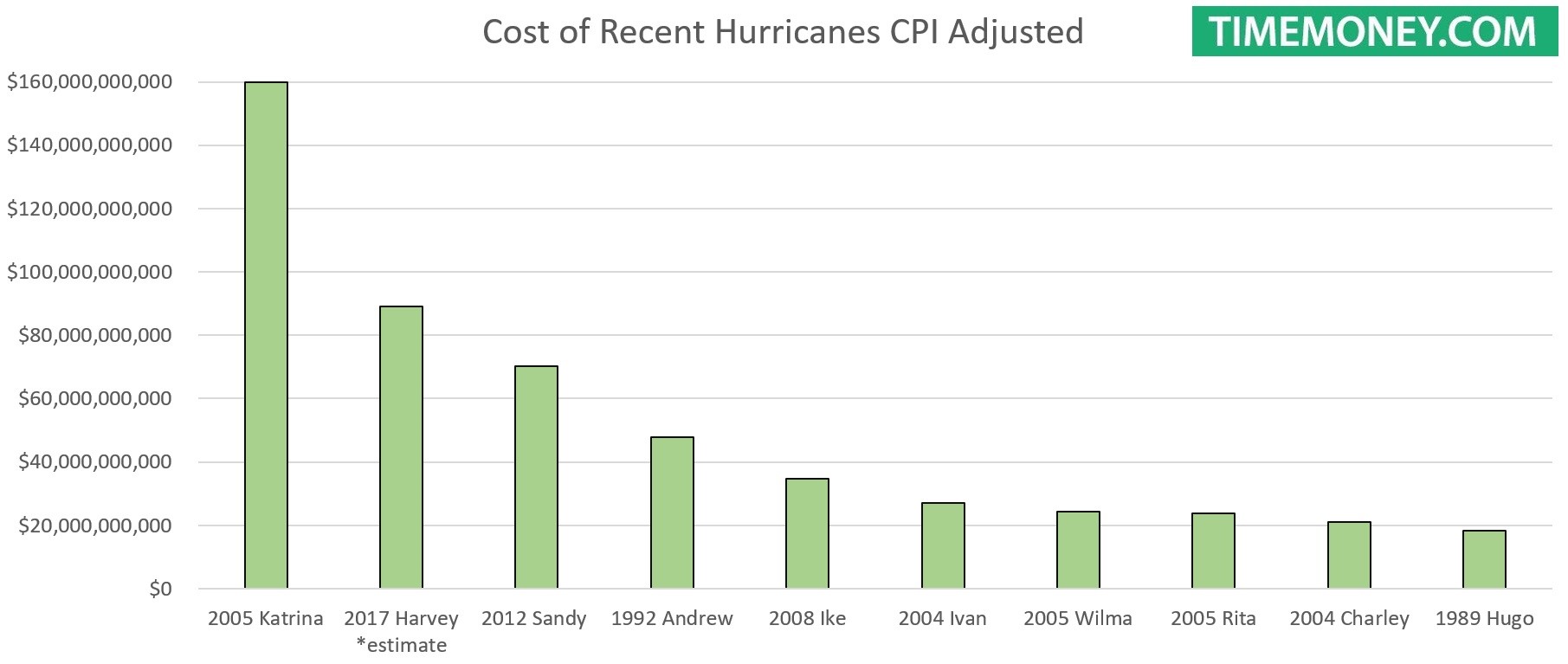

The chart shows an estimate of the cost of recent hurricanes adjusted for CPI.

Hurricane Harvey is the second costliest. Hurricane Irma can’t be accurately estimated yet, but when you add up Harvey and Irma, the cost will come close to or exceed that of Katrina. The effect on GDP growth is determined by the size of the storm and where it hits. Hurricane Sandy impacted the NYC area which is the biggest city in America. That’s why the costs are high even though it made landfall as a tropical storm. Hurricane Harvey impacted the 4th largest city in the United States, Houston, which has about 2.3 million people. The greater Houston area has 6.5 million people. Hurricane Irma impacted the Tampa Bay area which has 3 million people and the Miami area which has 5 million people.

Let’s look at the GDP before and after hurricane Sandy. Hurricane Sandy hit in October 2012 which is in Q4. 2012 Q3 nominal GDP growth was 4.11%, Q4 nominal GDP growth was 3.24%, and Q1 2013 GDP growth was 3.14%. The real GDP growth (which excludes inflation) in Q3 2012 was 2.39%, in Q4 it was 1.28%, and in Q1 2013 was 1.31%. As you can see, there wasn’t a big impact even though the greater NYC area has about 20 million people and the city shut down for a few days. One of the reasons the GDP growth wasn’t impacted heavily was because the hurricane was in early Q4. That meant the rebuilding period and the devastation period both were in Q4, canceling each other out. This won’t occur in Q3 2017 because hurricane Harvey was about 4 weeks later in the quarter and hurricane Irma was about 5 weeks later in the quarter. That means the devastation will have a greater impact on the growth results as it will be separated from the rebuilding efforts which should boost Q4 GDP. That’s why Goldman Sachs shaved 0.8% off its Q3 GDP forecast, cutting it from 2.8% to 2.0%.

Broken Window Theory: Are You Better Off?

Getting back to the statement made by Dudley, the other way to interpret it, which goes along with the broken window theory, focuses on the point where he says unfortunately it lifts activity. The theory behind this is that devastation is bad, but unfortunately it boosts the economy. That’s the definition of the broken window theory. Economist Frederic Bastiat described this fallacy by saying that those who see the increased spending on repairing a broken window are missing the entire effect. The spending to repair a broken window takes money from disposable income which could have been used to buy something else. Repairing a broken window is maintenance spending which doesn’t improve growth because it doesn’t improve productivity; it would have occurred anyway. The only thing a broken window does is it makes the maintenance spending occur earlier, lowering the use life of the window. Maintenance spending on infrastructure keeps the economy going, but doesn’t provide a boost. An example of infrastructure spending which boosted productivity is the transcontinental railroad. That improved the ability to move goods quickly.

While the hurricane will temporarily hurt GDP growth in Q3 and then help it in Q4, that’s not the best way to measure the effect on the economy. The wealth effect for the people living in the area is negative. The insurance companies take the loss on insured property and the people take the loss on property which isn’t insured. 85% of the homes in Houston weren’t insured for flooding; about 40,000 homes were destroyed by the flood and storm surge. The people who took the loss on their property will need to dip into their savings to find a place to live and a way to get to work. That nets out the effect to GDP, but it is exclusively a negative to the standard of living for those affected. In summary, the effect isn’t devastating to GDP growth, but GDP isn’t an accurate depiction of the economic effect of the storm.

The final point we’ll look at is Bill Dudley’s mention that the effect is transitory. Firstly, if your wealth is damaged because your house was destroyed and you don’t have insurance, then the effects are not temporary. Secondly, the Fed calls almost every economic change transitory. When you use a word to describe everything, it means nothing. Technically, almost every single economic change can be called transitory because the business cycle means there will always be strength and weakness coming. However, we shouldn’t minimize every trend change just because it isn’t permanent. Using many government officials’ hero’s words, John Maynard Keynes said “in the long run, we are all dead.”

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.