UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Financial security and stability have immense value just like any product or service. It can become a product as is the case with insurance. It’s clear financial stability has value, but how do we pay for it outside of insurance? The two most prominent ways we pay are through delayed gratification and research. It’s work to be financial secure, but it is an extremely worthy cause because it helps maintain your sanity and health. It’s important to connect mental health with your personal finances because it is impacted by your financial decisions.

For example, if you buy an expensive car with your retirement savings, you get a car, but you also get fear over whether you can retire at the age you want. Essentially, you trade peace of mind for a fancy toy. No matter how you try to push away the fear of not having enough money by claiming you are living in the moment, you will always have a nagging stress in the back of your head. Knowing that you and your family will be financially secure no matter what should be worth more than a fancy car or boat. Put your values first when making big purchases.

Haves & Have Nots

The work part of the process of being financially secure is budgeting and investing properly. Deciding whether to waste all your savings on something that gives you temporary instant gratification is about values, while budgeting is about the details of how much you should be saving and investing. It’s work to figure out where you can save money in your budget to meet your saving goals.

Those who budget correctly and those who don’t is a contrast between the haves and the have nots. Credit cards shows this stark contrast vividly. If you use credit cards correctly, you can gain financial flexibility, and perks for using the card. Credit cards can have a positive impact on your financial wellbeing. Building credit can help you make a big purchase like a house or a car at favorable interest rates. If you use credit cards incorrectly, they can destroy you financially because their interest rates are so high. The people who pay the excessive interest rates are essentially paying for the benefits responsible users get.

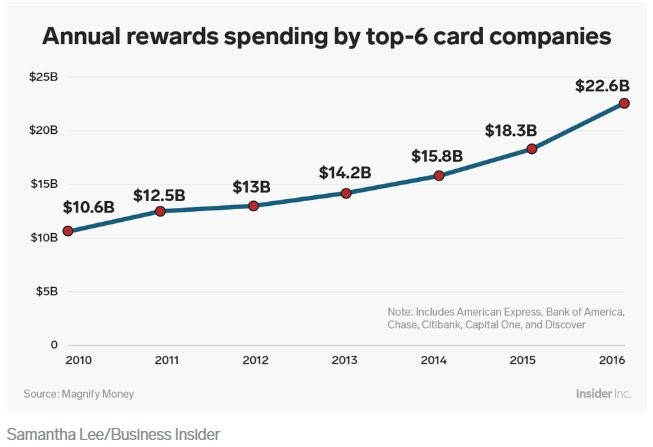

The chart below from Magnify Money shows the annual rewards given to users from the top 6 credit card companies.

Rewards more than doubled from 2010 to 2016. More rewards were given out to keep customers and customers have become very savvy with getting the most rewards as possible. The programs have been working too well for these firms as these rewards are eating into their profits forcing some to cut them. To someone with credit card debt, it looks like financially secure people are running up the score as they get bonuses for acting responsibly. Some people on the extreme end of the bonus earnings ledger open many cards to get bonuses (we’re talking about dozens of cards).

The money is going from irresponsible people to responsible people. As you can see from the table below, interest income, cash advance fees, and penalty fees make up a large portion of credit card firms’ profits.

To be clear, credit card companies also earn between 2.4% and 2.9% in interchange fees from merchants. It’s a great business to be in because credit card firms have a high moat as only a few are accepted everywhere. Credit card companies have had great historical stock appreciation as the world goes from paper to plastic and shifts to online purchases where cash can’t be used.

Investing Requires Risk

We have done many of more in-depth articles on investing, especially for those who consider themselves to be passive investors, but let’s just quickly look at CD returns versus equity returns. The chart below shows stocks are up 16.47% per year in this bull market and it hasn’t even been one of the best bull markets.

The best run was in the 1980s where stocks were up 26.65%. According to the “rule of 72”, which tells you how long it takes to double your money, it only took 2.7 years to double your money in the 1980s bull run. In this bull run, it took 4.4 years to double your money.

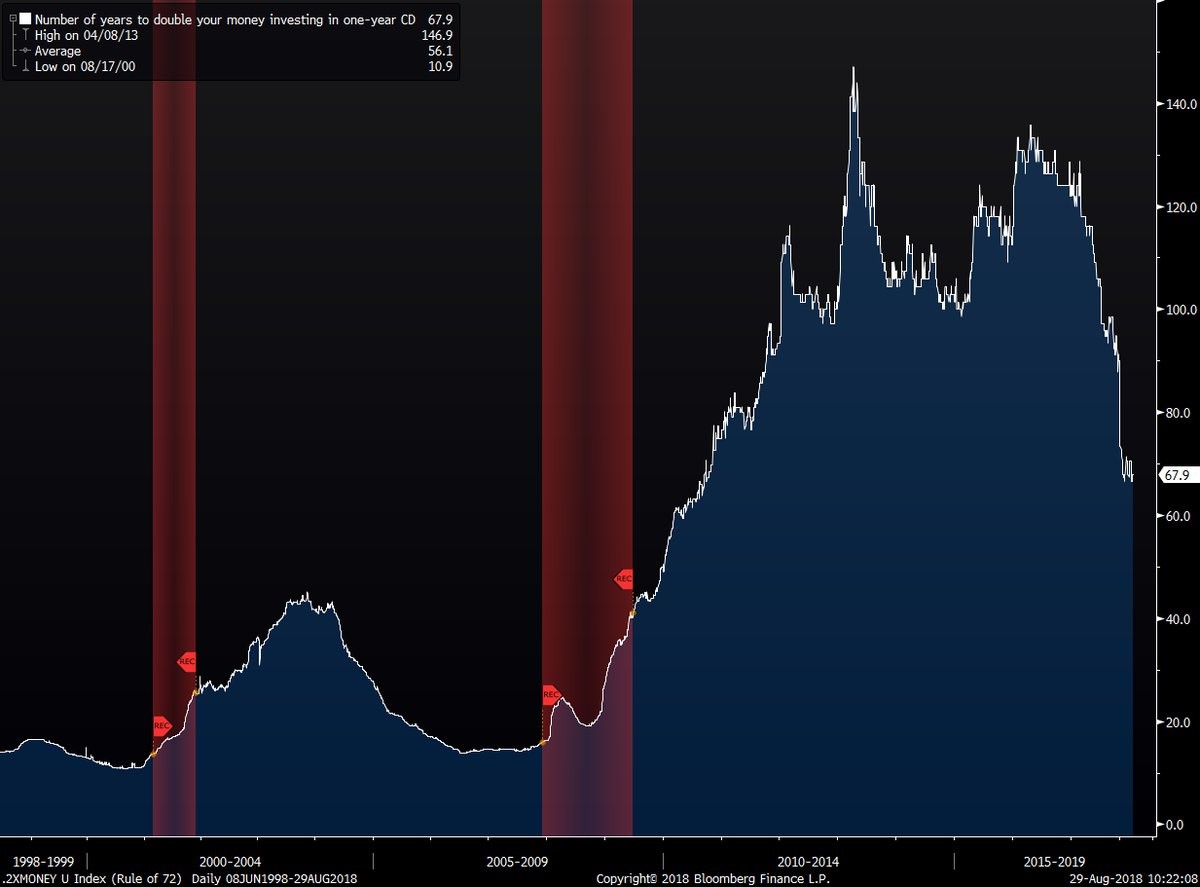

The chart below shows how long it took to double your money with a 1 year CD which pays the national average.

In 2013 it took 147 years to double your money which means stock returns did it about 33 times faster. With the latest increase in yields, it takes 68 years to double your money. As you can see, not taking risk has had a big opportunity cost. Not taking risk when you should be taking risk can cancel out all the gains you make by spending less than you earn. To be clear, if you need the money in the short term, it’s worth foregoing gains to secure the money. Secondly, there are bear markets, so the money won’t always double that quickly.

New Default Rate

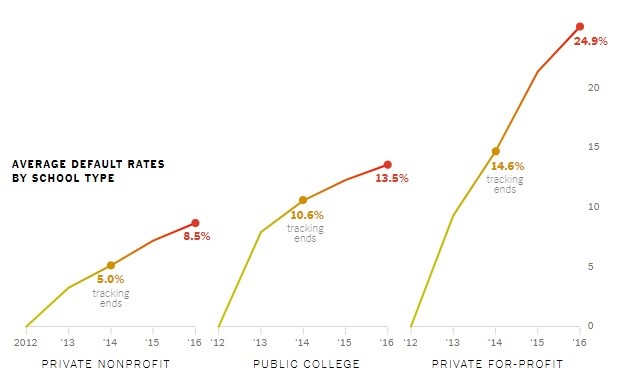

Only go to college if you have a plan for how you will get a job after graduation. Go to a private non-profit school or a public college. Don’t go to a private for-profit school unless it is the only option and works for your needs. As you can see from the chart below, the default rate on private for-profit loans is an astronomical 24.9% which almost doubles that of public colleges and almost triples that of private non-profit colleges.

The tracking period shows the default rate when the government studies it and the final red dot shows where it ends after the government stops following it. If you default after the government stops following your loan, it’s no less financially devastating.

Conclusion

Budget properly or you will end up paying for responsible credit card users’ rewards. You could literally be paying high interest rates to send your neighbors on a free vacation. Not taking any risk when investing could have a massive opportunity cost. Some believe you should only swing at the perfect pitch, but if the perfect pitch doesn’t come for years, then its necessary to exemplify patience but also be open to new investment opportunities. One investment that may not be great is going to a private for-profit college, which has a very good chance of being a devastating decision. Invest in yourself, but don’t take out impossible to pay back loans to do so.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.