UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Ever since the Dodd-Frank regulations were passed in 2010, the Fed has stress tested the largest banks to see if they have healthy capital ratios to lend even in a deeply recessionary environment. The stress tests also are qualitative to see if the proper internal controls are in place at the banks. This is the exact opposite of the period leading up to the financial crisis when the banks held toxic assets on their balance sheets that completely lost their value. Prior to the financial crisis of 2008 there were no stress tests; in fact, the banks were encouraged to lend more to subprime which increased the size of the housing bubble. There are now stress tests to prevent another crisis even though it’s unlikely for another housing bubble to occur since the banks and the regulators have understood the need for improved lending standards and do not want a repeat of 2008. It is also important to emphasize that just because housing is overvalued, and certain markets within the US are significantly overvalued (possibly in a bubble), doesn’t mean there is a housing bubble everywhere in the US. The definition of a bubble is an investment mania (think cryptocurrency or housing pre-2008) where the only objective is to sell at a higher price in a short period of time.

Is Another Bank Crisis Likely?

The 2018 annual stress tests occurred in June. In its February press release the Federal Reserve outlined the scenarios that the stress test is designed to test:

The stress tests run by the firms and the Board apply three scenarios: baseline, adverse, and severely adverse. For the 2018 cycle, the severely adverse scenario is characterized by a severe global recession in which the U.S. unemployment rate rises almost 6 percentage points to 10 percent, accompanied by a steepening Treasury yield curve.

The June stress tests were very stringent as the Fed wanted the banks to be able to still make loans if there is a 10% unemployment rate, a 7% decline in GDP, and a 65% decline in the stock market. Also, the banks were tested with having losses that were 7 times today’s losses. Being realistic, even if the banks could lend during such a contraction in the economy, they probably wouldn’t because few borrowers would qualify for loans and the banks would pull back to avoid heightened defaults. The premise of the stress tests is simply if the banks will be able to keep their doors open when a really bad recession occurs. In the June 2018 stress tests, 34 out of 35 banks passed with only Deutsche Bank’s US division failing. When banks pass, they can give back capital to shareholders. Morgan Stanley and Goldman Sachs had slight problems because they took big accounting losses at the end of 2017 to prepare for the tax cuts. This limited the capital they could return. State Street also received conditional approval for not properly assessing its counter party risk.

The negative of all these tests is that the banks sometimes aren’t able to lend as much as they would like. That prevents businesses and people from getting the capital they need to grow. Wells Fargo was ordered by the Fed to stop growing its lending until it fixed its internal operations. The regulators weren’t able to stop the violations the company made when it opened accounts without their customers’ knowledge, but the hope is it can at least prevent a meltdown of the financial system. The banks looked good to many analysts in 2007 even though shortly afterwards there was a crisis of confidence which caused a freeze in lending. The evidence of the success of these stress tests will only be seen when the banks are actually stressed in a recession. From the outside, it seems as though the banks are well capitalized.

Just One More Rate Hike?

Neel Kashkari, the President of the Federal Reserve Bank of Minneapolis, has a great policy of being open to dialogue and questions, particularly on Twitter. This openness is also demonstrated in his assessments of various policy prescriptions. The two salient points he made in an interview with Bloomberg may shape Fed policy in future cycles, which is why we must review them here.

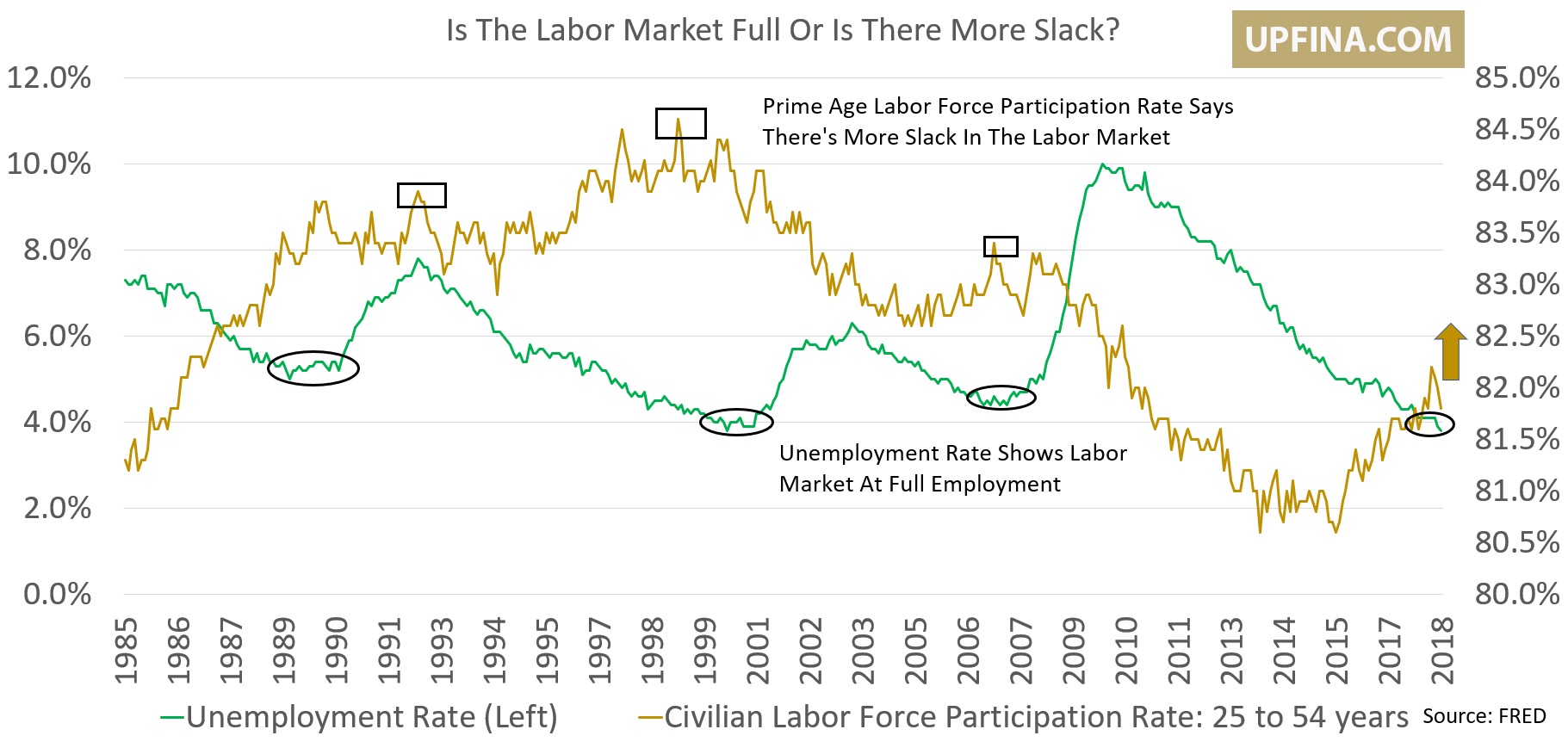

The first point he made is that the Fed raised its natural rate of unemployment too quickly following the 2008 financial crisis. This led the Fed to be consistently wrong on its unemployment forecasts this expansion as it has lowered them too gingerly. We mentioned in a previous post how the Fed’s forecasts for unemployment were too high; the natural rate and the forecasted rate have been similar. That is an assessment Neel believes is wrong. In the last recession, the full employment rate didn’t change. Most of the people who lost their job and couldn’t find one even for a few years didn’t become permanently detached from the labor market. They still wanted a job. That shows in the recent data since those people are now becoming employed. The solution to this perceived problem is to stop altering the natural unemployment rate based on cyclical changes; that’s a logical solution because long term rates shouldn’t change based on short term economic changes. The difficulty is figuring out what is a secular change and what is a cyclical change.

The second point made in the interview, which is critical of the Fed, is that the Fed shouldn’t hike rates past the neutral interest rate in this expansion. Instead of being contractionary, it should stay neutral. If the Fed has an accurate assessment of what the neutral is, this policy would extend the current expansion. The Fed usually hikes rates too far, which causes a recession. This point is great in theory, but it only works if inflation is low because the Fed needs to be contractionary to quell heated inflation. That’s the situation we have now as year over year core PCE is up 2%. Keep in mind, the Fed isn’t treating 2% inflation as the goal. It wants the long term average to be 2% as we mentioned previously. Since it has been below that rate for a majority of this expansion, the Fed would be fine with inflation staying slightly above 2%. If this view comes to fruition, the Fed won’t tighten too much and won’t push the economy into a recession unless inflation significantly accelerates using the core PCE metric. Another concept worth discussing is for the Fed to stop hiking rates when the yield curve is near an inversion to avoid a recession. In practice, this would mean potentially ending this cycle’s hikes after one more rate hike, unlike the current guidance which anticipates raising rates once more in 2018 and three more times in 2019.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.