UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

In theory, if the labor market gets to full employment in the next few quarters and there isn’t an immediate recession, the economy will be limited by the working age population growth. Everyone who could come off the sidelines and into the labor market already will have done so. There isn’t an exact level we can point to where full employment will be reached, but the peak in the prime age labor force participation rate in 1999 gives us a big clue as to how full the labor market can get.

As you can see in the chart below, if this occurs, America will be in relatively great shape.

Interestingly, even though America is a developed economy and China and Russia are emerging markets, America is the one with the highest expected working age population growth. China is developing because of its low GDP per capita, but its population will actually peak somewhere between 2030 and 2035. America has great long term demographics.

This supports the notion of heavily weighting American stocks in your long term portfolio. If you live in America, critics will scream going overweight America is home country bias. Forgetting about this bias, it is bad for diversification if you heavily invest in the country you get your paycheck from. The good news is American large caps have a high percentage of their sales coming from international markets. Therefore, you’ll never be completely ‘all in’ on America unless you put all your money in a small cap ETF.

Paycheck To Paycheck

Despite the doom and gloom in the media which states American consumers are highly indebted and aren’t seeing their personal balance sheets improve, the percentage of people living paycheck to paycheck is declining. Even the personal finance horror stories can be vanquished by a strong labor market which has provided plentiful jobs and accelerating real wage growth. As you can see from the bottom chart below, the percentage of people who agree or strongly agree with the statement that they live paycheck to paycheck has recently fallen sharply to 37.8%.

The bad news is that there are still about the same amount of people living paycheck to paycheck as those who aren’t doing so. To be clear, when someone doesn’t live paycheck to paycheck it doesn’t mean they don’t rely on their income to live. It simply means they have savings to survive if something goes wrong.

Obviously, no one wants to get caught living paycheck to paycheck. The problem is it becomes a black hole. If you get into credit card debt, making enough money to service the debt becomes difficult and saving extra money is impossible. There is also lifestyle creep. People start out spending as much as they earn. As their income increases, their spending habits get more lavish.

It’s prudent to have 3-6 months of expenses saved for in a low interest savings account, since it will relieve a lot of stress if you lose your job or get a pay cut. People think the good times will live forever when the economy is strong, but unfortunately the labor market is highly cyclical.

3 Great Charts For Consumers

During the last recession, consumers learned the hard way that taking out too much leverage can be catastrophic. The leverage consumers took out last cycle might end up being a record that lasts for decades. As you can see from the top chart below, the ratio of debt to disposable income for consumers has fallen steadily during this expansion.

Usually, the cycle ends when leverage gets too high, but in this case it hasn’t increased. That explains why this expansion is a few months away from being the longest since the 1800s. The chart also shows the net worth to disposable income ratio is very high because asset prices have soared. Bears use this peak as a signal that stocks are overvalued, but ultimately stock prices are determined based on firms’ future cash flows not how high their value gets in relation to disposable income.

The middle chart shows total household debt payments as a share of disposable income have fallen. That’s because housing debt growth has been limited this cycle and because interest rates are low. Consumers are in great shape. The 3rd chart shows the catalyst for the decline in debt payments is mortgages. Only qualified buyers are getting loans unlike last cycle. Consumer debt payments have increased because of auto loans and credit cards.

Credit Card Rate Spikes

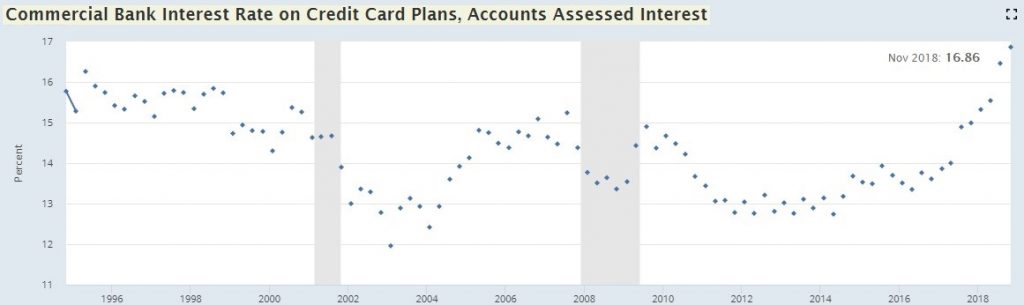

Credit card interest rates are spiking. As the chart below shows, they are the highest in decades.

The spike in rates isn’t caused by a huge spike in defaults or a major spike in overall interest rates. To be clear, this increase in rates isn’t good for consumers. It just doesn’t mean a recession is coming.

BLS Preview

The February BLS report is expected to show 178,000 jobs created. It should be a strong report because the jobless claims in the week of the BLS survey were very low. The ADP private sector payrolls report gives us a sneak peak into how strong the February BLS report will be. The ADP report showed there were 183,000 private sector jobs created. It should be another solid month for the labor market.

Small firms added 12,000 jobs, mid-sized firms added 95,000 jobs, and large firms added 77,000 jobs. The bears are highlighting the 8,000 decline from very small firms. That’s a mistake. This report was fine. Service providing firms added 139,000 jobs as they were led by the professional and business industry which added 49,000 jobs. The goods producing sector added 44,000 jobs as it was led by construction which added 25,000. The chart below shows the leisure and hospitality industry only added 4,000 jobs which was the lowest number since September 2017. Let’s see if the BLS report shows similar weakness.

Conclusion

America’s demographics are solid. The consumer is in great shape relatively speaking because its leverage has declined. The bad news is just as many people say they are living paycheck to paycheck as those saying they aren’t even though the labor market has little slack and is generating accelerating real wage growth. The ADP report was promising despite the weakness from very small businesses and the leisure and hospitality industry.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.