UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

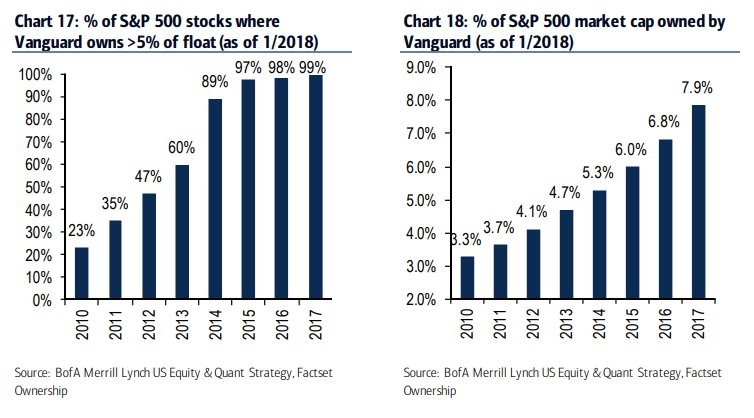

There is a lot of speculation about what the rise of passive investing will do to the economy and the stock market. In theory, if everyone invested passively, then public companies would have less incentive to improve their businesses. This is far from reality as of 2018. As you can see in the chart below, Vanguard owns 7.9% of the S&P 500 market cap. Vanguard has 18% market share in the ETF business.

Source: Twitter

If the ownership of index funds rose to a point where it affected the market, smart investors would use research to pick the best stocks. It would be easier to beat the market if active investors have to compete with index buyers. If outperformance by active investors continued in this scenario, money would flow out of index funds and into active strategies. Investors are always chasing performance; they are willing to try any strategy which has done well over a few years. Even investors who have conducted significant due diligence on the befits of passive investing will try something else if it does better.

The fear of those who think the stock market is in a bubble is that passive investors are buying stocks without regards to valuations when they blindly buy the index. We don’t think passive investing is responsible for excess valuations because this would presume that active investors stop buying individual stocks because they are expensive. Investing is an emotional experience which is why many people chase the best stocks even though they get more expensive when the price goes up. To be clear, every stock that goes up isn’t necessarily getting more expensive because there could be positive catalysts which make the business more valuable, but if you just chase price, then you will be buying many stocks which are just going up on paper without improvements to the business which justify the price increase.

Psychological Failure Of Passive Investing

The worst part of passive investing is that people don’t actually do it. In the correction in February, there were ETF outflows. The average person owns passive investments for 18 months. That’s a recipe for underperformance. If investors held onto their positions until they needed the money, volatility in the market would decline. The psychological failure when it comes to selling out of a passively managed funds instead of letting it ride until the money is needed stems from the human desire for control. If you are wondering how to fix this, we address the problem in What To Do In A Selloff?.

People feel they need to react to a selloff in stocks as part of the fight of flight mentality. When stocks decline, it is a negative stimulus which invokes pain. That means, they either engage with the issue or run away from it. In this case, fighting would be buying more stocks and running away would be selling stocks. Passive investors shouldn’t be reacting to movements in the market aside from fundamental long-term trend changes. At most, when there is a severe selloff, investors should consider buying stocks. Doing nothing in the face of a problem is quite difficult which is why passive investing doesn’t work for a lot of people.

Catch 22: Do You Know Too Much Or Not Enough?

One of the biggest problems with this strategy is actually knowing too much and having an opinion. Obviously, watching every tick of your portfolio is an emotionally disastrous way to live life unless you are a day trader. However, on a less intensive note, if you read about how stocks and the economy will do, you will naturally formulate an opinion. If you then go check your portfolio, you will certainly find that it doesn’t match perfectly with what you read. Essentially, your investments aren’t in what you think will do well. It’s emotionally draining to have a prediction go right, only to find you lost out on gains or lost money because you didn’t follow your research. You need to trust the process of your investing strategy. It’s not about feeling good about a decision. It’s about objectively making the correct choice based on math. You’re taking the reason out of managing your money.

It’s a catch 22 for passive investors because if you don’t know much about the market, you might panic at the first sign of trouble. If you know a lot about the markets, you may want to try to beat the market yourself in the middle of acting on a passive strategy because you can’t handle going against your own research.

2 Helpful Tips To Deal With Portfolio Stress

Being aware of these mental challenges can help you avoid falling into the passive traps. Besides this, we have 2 tips which can help you with these problems. The first is to stress test your portfolio. You can look at the max drawdowns in each investment vehicle and look at the correlations among the assets you own. The easiest way to see how much you can lose is to look at how your portfolio would have held up during the 2008 financial crisis. It’s better to do nothing than sell during a crisis. The best action would be to buy the absolute bottom, but that’s impossible. Buying the dip can be draining because if the market keeps falling afterwards, it could encourage you to sell out completely.

The second solution is to have a small portfolio where you manage your money. You can invest 1-5% of your funds in a trading account. This can distract you from checking your main portfolio and worrying if your positioning matches your opinions. Since this portfolio is so small, you might trade less emotionally. It’s fulfilling to know that when some of your investments are going wrong, your bigger portfolio is still doing well in an uncorrelated fashion. This can help you avoid selling near bottoms in your trading account.

Life Event

Even if you buy and hold your passive investments, you can still ruin your performance if you don’t actively prepare for life events where you will need the money. If you have the money invested passively, follow your plan until the end, rather than trying to sell out of risk assets when they increase before you need the money. It’s tough to be ruthlessly passive and follow a strategy, but if you get nervous and sell too early for no reason, you might lose out on gains.

Conclusion

In this article, we discussed how to deal with passive investments. It’s actually very difficult to buy and do nothing. Investment advisers often become shrinks trying to get clients to avoid making emotional decisions. When you invest passively, you don’t have that emotional crutch, so you might be more likely to make a dumb decision. If you’re investing in asset classes in a diversified manner, it’s best to avoid worrying about price action. You’re not trying to time the market, so don’t do it! With that said, it’s still important to understand that the economy and markets move in cycles. Even as a passive investor being proactive in your decision making and portfolio allocations when cycles may be beginning or ending can position you for less downside and potentially more upside over the long-term. Being a passive investor does not give you permission to be clueless about your investments or not understand the economy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.