UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

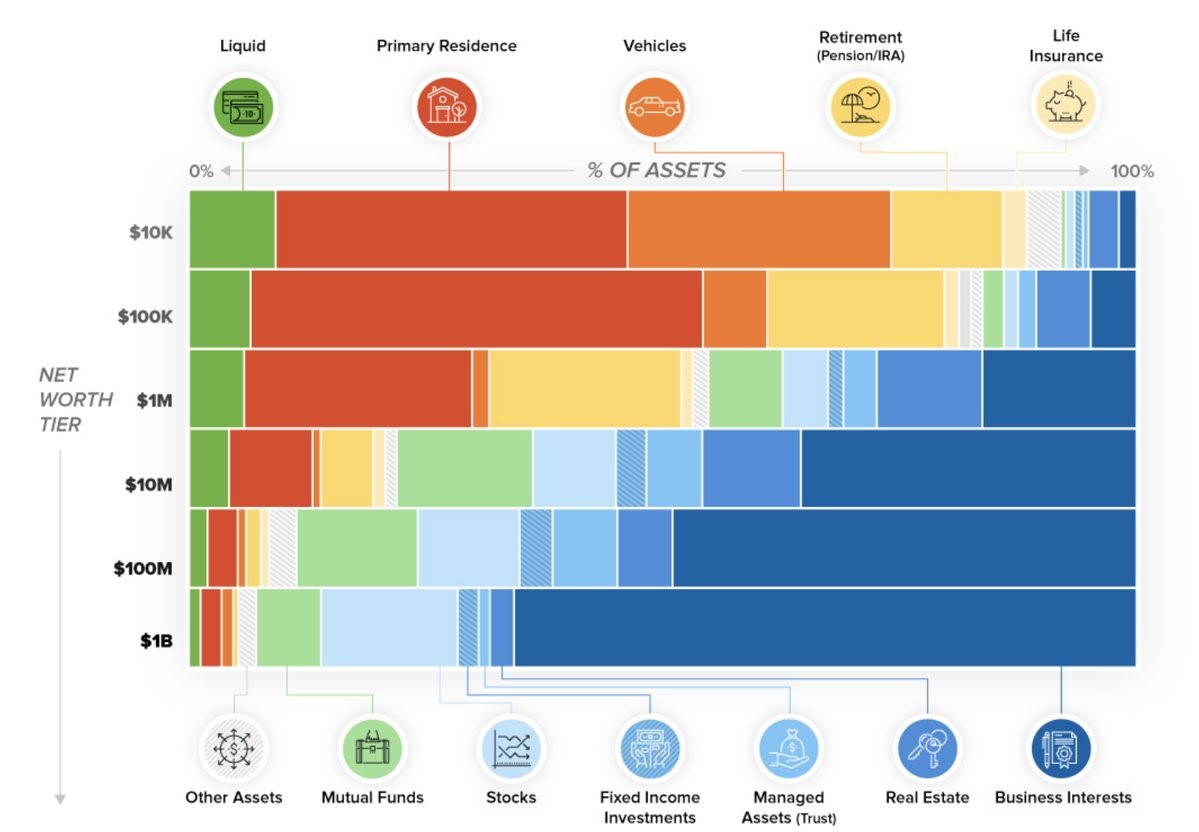

In this article, we’ll extend the conversation about savings that we began in a previous article. As you can see from the chart below, even though the Fed funds rate has been raised 5 times in this business cycle, the national interest rate on non-jumbo deposits, which are less than $100,000, has barely budged.

This has occurred because when the Fed funds rate was near zero the banks had interest rates too high by having them above zero. The banks decided they’d lose deposits and customers if they charged to have money in a savings account. The Fed funds rate increasing helps their net interest margins because it increases the difference between lending rates and borrowing rates, but at the same time the flattening yield curve hurts them because banks typically make long term loans and borrow in the short term.

There are some who have the thesis that people save more money to make up for the low interest rates. That’s difficult to justify because the savings rate has been in decline for the past few decades along with interest rates. In the past two years, the savings rate has declined to near record lows while the interest rate on savings accounts is near zero. Lower interest rates make it cheaper to borrow and lever up. If interest rates were to increase in the next few years, there would be a seismic shift in consumer’s spending habits as they’d borrow less.

Higher Income Saves More

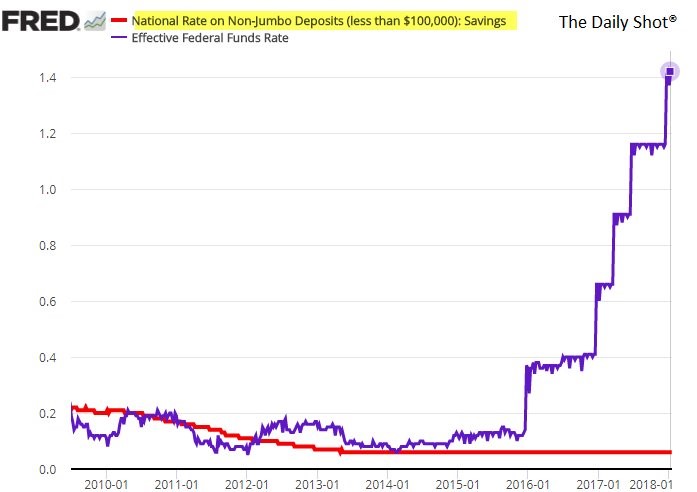

The chart below shows the savings rates of each income class.

The top 1% have almost always saved the most, usually above 30% of their income. The next 9% save less, but still usually save above 10% of their income. The bottom 90% barely save at all as the percentage is always below 10%. It’s interesting to think about if the rich are well off because they save money, or they save money because they have so much of it. It certainly helps to have extra money as it shows from this chart, but it’s still possible to create a good life and save money if you are in the bottom 90%. The key is to budget wisely and make sure you spend your time correctly. If you want evidence of the importance of budgeting and wise financial planning, check the news for all the celebrities who have gone broke.

Life Cycle Of Net Worth

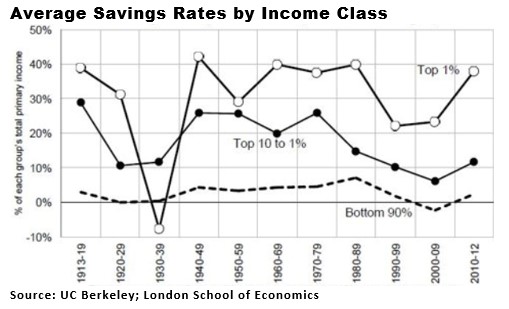

Transitioning from income to wealth, the table below shows the net worth of each household by age.

The net worth increases over time because of the earnings life cycle. As people get older, they make more money and their savings compound. If the person owns a home, they probably will pay it off in their 50s or 60s, making living expenses diminish. This further increases their wealth. Households under 35 need to deal with children, who are extremely expensive, while working with a relatively low salary because of a lack of experience. Sometimes one adult needs to stop working to take care of the children when they are young. This all breaks down to the median net worth barely getting above the flat line.

Breakdown Of Assets By Net Worth

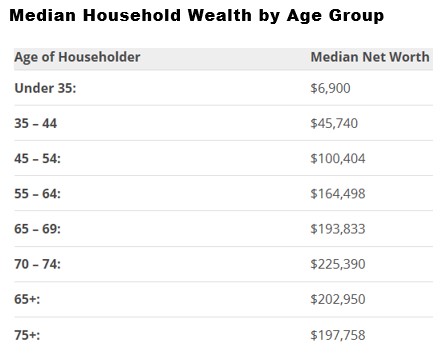

Now that we looked at the savings rate by income and the median net worth by age, let’s review the breakdown of assets by net worth tier.

Those with a net worth of $10,000 are mostly people in their late teens and early 20s. Even though a vehicle is much cheaper than a primary residence, the vehicle is almost as large because many of these people don’t have a house yet. The people with a house and a $10,000 net worth must have just purchased it and have little equity built up. The $100,000 tier is the median net worth of those ages 45-54. The primary residence and pension/IRA grow significantly because these people can afford a house and have some savings.

Decisions On Which House & Car You Buy Come Down To Values

Smart budgeteers will try to limit their spending on a vehicle and save as much as possible in their 401k, making sure to max out their contribution when the employer matches contributions. When you have money to help pay for your child’s college or retire a couple years early, you won’t remember what kind of car you drove in your 20s and 30s. That being said, some view a car as their most beloved possession like others cherish a guitar or fine wine. In that case, you need to decide what you’re willing to give up spending money on to make that purchase a reality. We’re not trying to live your life for you, like some financial advice articles try to do. Just make sure to go into any big purchase with your ‘eyes wide open’ knowing what you have gotten into.

This same value structure exits with home buying, making it a touchy subject for some people. A house is a better investment than a depreciating asset like most cars and consumer goods. However, unless you made your decision to buy a house based on its investment appeal, which is unlikely, your house might not appreciate like stocks can. Other factors like the location of the house and equity valuations affect expected returns, but that’s a general rule. The final point is that you can’t live in your equity investments. There might not be houses available to rent in your area, making the decision to buy more necessary.

Upper Net Worth Categories

The next tier is the top 10%, as you need a net worth of about $1.2 million to be in the top 10%. This category sees a big increase in mutual fund ownership, business interests, and real estate. The billionaires club has most of its investments in business interests. One aspect to keep in mind when you read about what the rich are doing with their money is to avoid copying exactly what they are doing because they have vastly different goals and risk tolerance. You may think this an obvious point, but some investors mimic exactly what Warren Buffett does and they’re not billionaires. The decisions Buffett makes are a source of information, not something to copy 100% of the time.

Conclusion

The greatest financial advice is to avoid making emotional spending and investment decisions. The goal is to make disciplined decisions, so you can have fun in your life in a responsible manner. It’s not fun to reach the normal retirement age with no savings. In case you’re interested here’s the #1 Risk Free Investment (no, this is not a sales pitch).

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.