UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 6 minutes

What Is Financial Literacy

There are two main different types of financial literacy. There is literacy in terms of investing and literacy in terms of budgeting. This article will review tips on both aspects, which can help you live a fulfilling life. The overarching theme of this advice is to think for yourself. If you don’t think for yourself, you can’t live an optimal life because the herd will often steer you in the wrong direction. Thinking for yourself takes a lot of work. You must train your brain to think logically. The exciting part of this is the most difficult part is putting in effort. Once you apply a rigor to your decision-making, the answers will be clear.

How To Invest In Stocks

When analyzing individual stocks, you need to understand that when firms put out presentations and press releases, their goal is to spin everything in a positive light. For example, when iPhone sales growth diminished, Apple started to direct investors’ attention to the services business which is the money it makes from the App Store and iTunes. In the case of Netflix, the company focuses on subscriber growth and tells investors to ignore the negative free cash flow. Fracking firms invented their own accounting term called EBITDAX. It is a new term which excludes exploration costs from earnings. It’s a spin off from the more traditional EBITDA (earnings before interest, taxes, depreciation, and amortization).

As an investor, you must be a detective, doing your best to ‘poke holes’ in the thesis of why the stock is a buy. The more you like a stock, the more you should read up on what can go wrong to avoid falling in love with the stock. You can read bearish articles/comments on Seeking Alpha or talk to people who are betting against the stock. If you know what can go wrong, you can foresee weakness which can prevent large losses. The best advice for being a good investor is remaining disciplined which means avoiding violating your principles on how you judge a business model. For example, don’t buy stock in a company with weak fundamentals just because its stock price is going up.

Passive Investing: Stock Market Basics

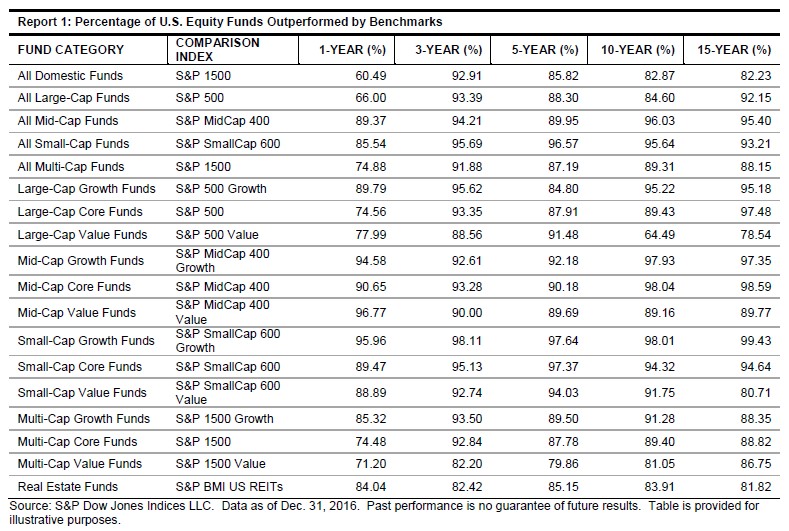

Passive investing occurs when you invest in mutual funds or ETFs as opposed to actively picking stocks yourself. When handing your money off to mutual funds, remember that mutual funds’ main goal is to get more assets under management, so they can collect fees. They are marketing vehicles to collect money. Investing is secondary to the success of the fund which is an agency risk. As you can see, the reason why investors are leaving mutual funds is because they believe most funds have underperformed their benchmark. The chart shows in the past 15 years 99.43% of small-cap growth funds underperformed the S&P Small Cap 600 Growth Index.

There’s been a sea change in the way personal financial advisors do business. They now focus on helping the client achieve life goals. While that sounds good, outperforming the market and making profitable investments would do that. It’s easier for advisors to help you meet the goal to buy a 2nd home because that achievement doesn’t have a performance benchmark.

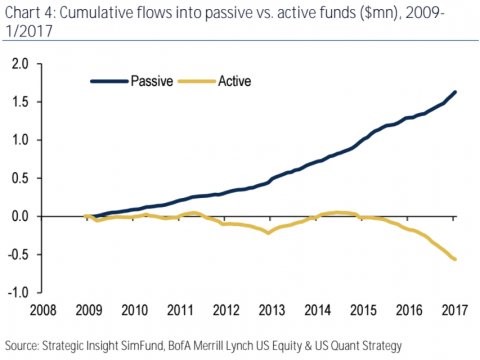

The perceived underperformance combined with the high fees mutual funds charge is causing a huge sea change in investment flows out of active management and into ETFs. While mutual fund managers are more concerned with getting money than making money, at least they are taking care of your money. Now investors have decided to have no one manage their money. Only 10% of trades in the market come from stock pickers (active investors). 60% of trades are from quants or passive investors which is double the amount from 10 years ago.

As was mentioned at the onset, it’s best to avoid following the herd. Proponents of ETFs hail its diversification as a key component to a successful portfolio, but unfortunately the major flaw of ETF investing is that you are buying both the good and the bad companies. Many might wonder why ETFs may pick “bad” companies. They don’t do it on purpose. There are many rules that ETFs have to live by which often times restricts them from purchasing the best companies, and requires them to settle for others. That’s not the type of diversification that you want. Many ETFs sell companies that decrease in value and buy companies that increase in value – in other words the opposite of what a value conscious investor should be doing. The goal is to buy low, sell high. This misallocation of capital can be taken advantage of by being an active investor, avoiding ETFs outright and buying good stocks yourself. With ETF investing growing in popularity, there is more research available online, than ever before. Of course, this requires a some effort on your part. There’s no free lunch here.

Mutual fund fees are also coming down as you can see from the chart below. They are trying to do more with less as investors aren’t as excited by fancy annual meetings as they were in the past. They want performance with low fees. That’s what the industry will attempt to deliver. In the event of a correction caused by the herd leaving ETFs and going into cash at the first sign of trouble, these fund managers will use their experience to pick the best stocks among the rubble.

Financial Planning

The best advice when making a personal budget is to stop buying expensive things to impress people. There will always be someone with a bigger house than you or a nicer car. You won’t be happy trying to keep up with the Joneses and your budget will suffer. Live your life for yourself and no one else. It will be more satisfying and less stressful.

The second part of meeting financial goals is to make more money. Start a side gig like we outlined in: 10 Fast & Easy Ways to Make Money Today.

Another way to make more money is to attempt to find better pay by switching jobs. Who knows, you might get lucky. When you find a new job, you can ask for a competing raise before you leave your current one.

As you can see from the chart below, job switchers saw a 4.2% increase in wages from February to April 2017 which is higher than the 3.5% growth the overall labor market saw.

The final piece of advice is to spend money to improve your health. This doesn’t mean buying supplements. It means spending money to buy fresh fruits and vegetables and spending time cooking instead of eating out. It also means exercising. The time and money you spend exercising pales in comparison to the money you’ll save on healthcare costs in the long run.

As you can see from the chart below, health care spending is rising at an exponential rate. It’s cheaper to avoid the hospital entirely by taking care of your body.

Conclusion

The takeaway from this article isn’t to blindly pick a mutual fund and throw all your retirement money into it. Instead you should research and be proactive in your investments. Following the herd into ETFs isn’t a great idea especially if these “passive” investors sell at the first sign of trouble. It makes sense to buy stocks when investors are panicking, but few can do that. This is why people pay others to manage their money.

Secondly, you should always be on the lookout to find a new job because it can increase your salary. Looking after your health will save you significant costs in the long-term and bring you more happiness. At the end of the day, don’t worry about impressing people with things you cannot afford.

Is this in your portfolio? You may want to reconsider some of these common investments. Here is the list of Best Investments (and not so great ones).

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.