UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Q4 earnings season has been good for the most part. As of February 7th, 323 S&P 500 firms had reported earnings (The Earnings Scout). EPS growth was 4.94% with an average surprise of 4.67% and 72% of firms beating estimates. Utilities led the charge with 18.61% EPS growth. Keep in mind, only 7 firms (25%) in that sector reported results. Overall sales growth has been strong too as it was 3.71% with an average surprise of 1.35%; 67% of firms beat sales estimates which is 2% above the 3 year average.

Health care had the highest sales growth as it was 12.46%. The health insurance stocks have been rallying recently despite the rise in Bernie Sanders’ chances of winning the Democratic nomination. The logic is that if Bernie wins the nomination, Trump will win re-election. The IHF health insurance ETF is up 5.37% since the end of January. If the election isn’t an issue, investors can refocus back on these solid results. The sector had the 2nd best EPS growth as it was 16.4%.

FactSet shows that the blended estimate for Q4 EPS growth is 0.7% which would make this the first quarter with positive EPS growth since Q4 2018. This growth rate is above the estimate at the end of the year which was -1.7%. Tech is responsible for 63% of the increase. Earnings estimates for 2020 imply a recovery is coming.

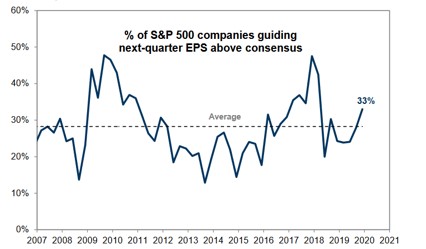

As you can see from the chart above, the percentage of S&P 500 firms providing guidance above next quarter estimates is 33% which is a few points above average. After the 3rd slowdown of this expansion, could we be on the precipice of a 3rd spike in the percentage of firms guiding above the consensus similar to 2010 and 2018? The situation might not be as great because there’s no tax cut and the economy isn’t coming out of a recession. However, a return to the long run average EPS growth rate seems possible.

The table below shows the latest EPS growth estimates for Q1, Q2, and Q3.

The table highlights how they are falling as they have in 33 of the past 36 quarters. It appears the estimate for Q1 EPS growth will head into earnings season lower than Q4 estimates did. 83 of the 323 firms that have reported earnings had their Q1 EPS estimates raised; their stocks are up 3.47% year to date. 183 firms had their EPS estimates lowered; they fell 0.73% year to date. Guidance matters.

10 Month High In Global PMI

If it wasn’t for the coronavirus overshadowing Q1 global GDP growth, the main talk would be about the global cyclical upturn. As you can see from the chart below, the global composite PMI hit a 10 month high as it rose from 51.6 to 52.2 which is the equivalent of about 2.75% GDP growth.

If the economy was in the state it was in a few months ago, during the heart of the slowdown, the negative catalyst that is the coronavirus would have looked even worse. Instead it will cover up good underlying trends.

Most of the PMI data was collected before the coronavirus outbreak which means it shows the direction the economy was trending in before the outbreak. Within the PMI, the new business index rose 0.4 to 52.3 which was the highest growth since March 2019 and the future output index rose 1.3 to 59.9. Business optimism hit a 9 month high. America, China, Europe, the UK, India, Brazil, and Russia all had solid growth. The employment index rose 0.2 to 51.1 which was the highest reading since July 2019.

Strong Consumer Confidence

The consumer is confident no matter what reading you look at. The consensus on U.S. GDP growth has fallen to 1.2% growth because of the coronavirus. The Atlanta Fed Nowcast, which just uses actual economic data not prognostications of how the virus will impact growth, shows GDP growth will be 2.7% and real PCE growth will be 2.9%. Obviously, GDP growth is driven by more than just the consumer, but if other parts of the economy are weak and the consumer is strong, it will drive growth higher. In that case, strong real PCE growth and weak GDP growth are incongruous.

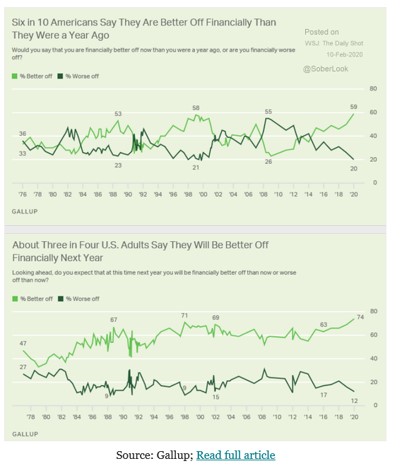

As you can see from the top chart below, 59% of consumers said they were better off financially than last year and only 20% were worse off. This is the best differential in history (going back to 1976).

Furthermore, 74% of Americans expect to be better off financially in the next year and only 12% expect to be worse off. This is great news for the economy and great news for Trump’s re-election odds which currently stand at 55%. One wonders how it’d be possible for so many Americans to be this comfortable in their finances, yet then vote for a candidate seeking an economic revolution like Bernie Sanders. Even if Trump isn’t wildly popular, you wouldn’t expect to see massive political change when consumers are happy. That being said, the latest Quinnipiac poll shows Sanders beating Trump in a head to head match up by 8 points.

Consumers Are Taking Out More Debt

The December consumer credit report showed that consumer debt rose $22.1 billion which rose from $11.8 billion and beat estimates for $15 billion. That was above the top end of the estimate range which was $16.5 billion. The annual growth rate increased from 3.4% to 6.3%. The growth came from revolving credit which is credit card debt.

Revolving credit debt was up 14% in December which was the highest growth since April 1998. The late Thanksgiving pushed spending from November to December. However, this was still a large leap which was likely catalyzed by high consumer confidence and the decline in income growth. Non-revolving credit growth which is auto loans and student loans (mortgage debt isn’t in this report) was 3.7%. In all of 2019, credit card debt growth was 4.2% and non-revolving debt growth was 4.8%.

Conclusion

If it wasn’t for the coronavirus, the dominant discussion on Wall Street would be on the cyclical turnaround. The global PMI hit a 10 month high. Consumers are very confident and should drive solid GDP growth even if the coronavirus catalyzes weakness in other parts of the economy. You would think Americans wouldn’t want a significant political change if the greatest percentage of consumers had an improved financial situation in the past year since 1976. That doesn’t jive with a Sanders win, but he is leading the latest head to head match up with Trump by 8 points.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.