UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Picking an active manager to invest with is difficult because it’s tough to determine which manager’s investing process is sustainable. If you are a small investor, you won’t get to meet with the manager. You don’t have much of a basis to make up your mind. Many people who aren’t in the investing field think if a manager outperforms for 10 years, that’s good enough. However, cyclical swings mean it isn’t good enough.

The best managers in the past 5-10 years have taken the most risk on growth stocks, but that might be wrong in the next decade. Managers get to pocket the fees along the way, so if they lose money and underperform in the future, it affects them less than it does you. Some even believe they are brilliant just because of the cycle. Beware of thinking you are extremely smart just because of performance. It can change in a heartbeat.

The other aspects of funds that make them tough to invest in is that when these hot funds get a massive influx of capital it’s tougher to execute the same winning strategies. Furthermore, people copy their process, so their alpha is whittled away. It takes a lot of mental flexibility to be a great manager over decades. You don’t know if a manger has what it takes to change when the cycle changes which is why it’s probably better to go with an index fund if you don’t want to manage your own money.

As you can see from the chart above, in the 1970s, 1980s, and 1990s, the funds that outperformed in the current decade didn’t outperform in the following one. It’s tough to maintain great performance. Obviously, it’s not the end of the world to moderately underperform after years of big wins. The problem is when the cycle ends, these mangers underperform in down markets. The bigger winners become the biggest losers. Years of opportunity cost is incurred by big losses. That’s why it’s so important to avoid losing money.

Winning Attributes

Some investors are now claiming that the worst thing you can do is miss out on a big winner because the winner can gain 10x, while you can only lose what you have. That’s flawed logic. It’s the logic you see in bull markets where 10x winners are common. Your money is all you have. You only have one shot to make money. If you lose it all chasing performance, the game is over. Missing out on a big winner is hard, but there’s always another day for you to find a new one. The key is staying alive financially to invest another day.

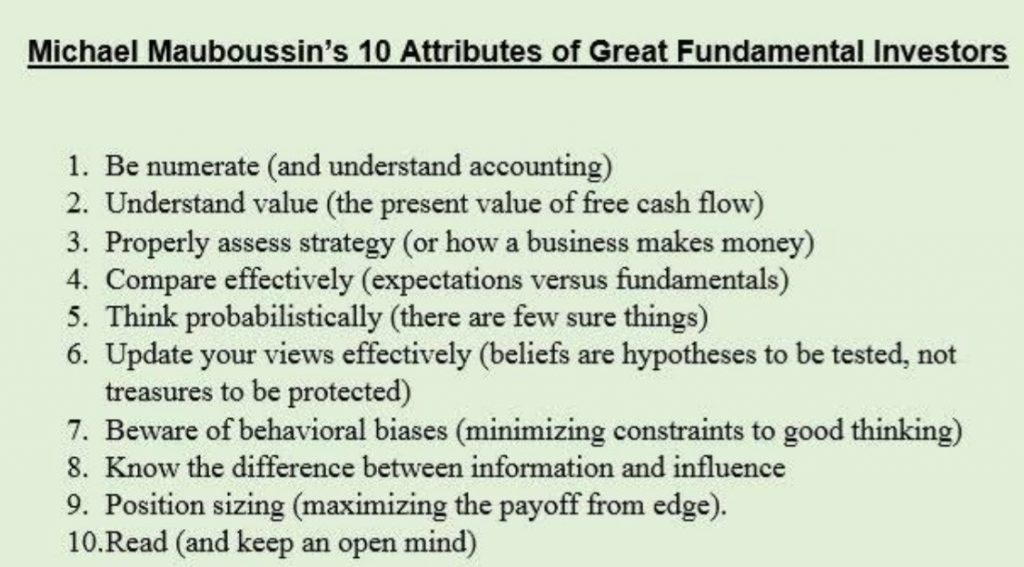

We touched on a few of the 10 attributes that make investors great seen in the image below. Number 9 is very important.

If you have a position that you are highly confident in because of deep due diligence, it makes sense to increase your sizing. Investing is all about knowing when to pick your spots. Not only do you need to have good analysis, you need to know how good it is. You need to properly understand your level of certainty and the potential payoff.

This goes hand in hand with thinking probabilistically which is the 5th attribute listed. We mentioned earlier how precious your money is. You don’t want to lose it. That’s why large position sizes probably should be rare. However, it doesn’t take too many homeruns to have great performance in your lifetime.

Concentrated investing is much different than having a diversified group of 30 stocks. It heightens all your emotions. It increases your positive and negative tendencies and biases. Keep an open mind, but also have enough conviction to stay with the trade. Essentially, you need to only be open to good arguments which is quite difficult because it’s not always obvious which ones are good.

Changes To PE Multiple

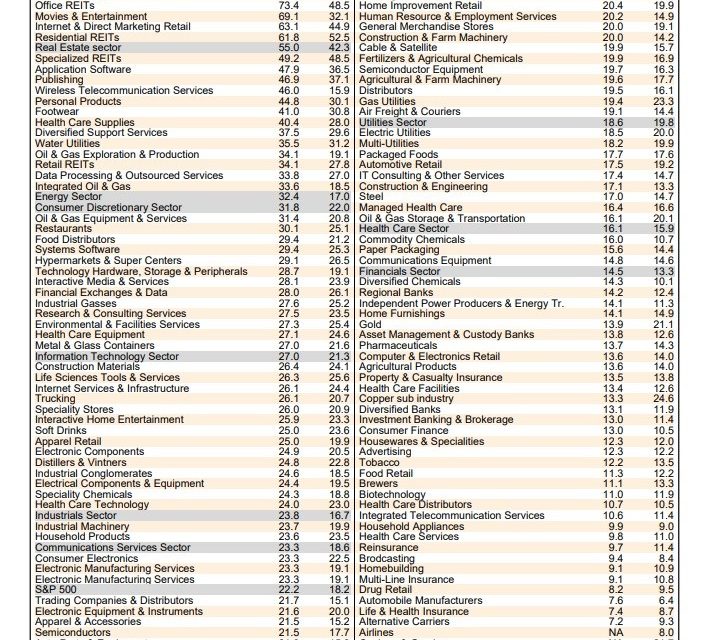

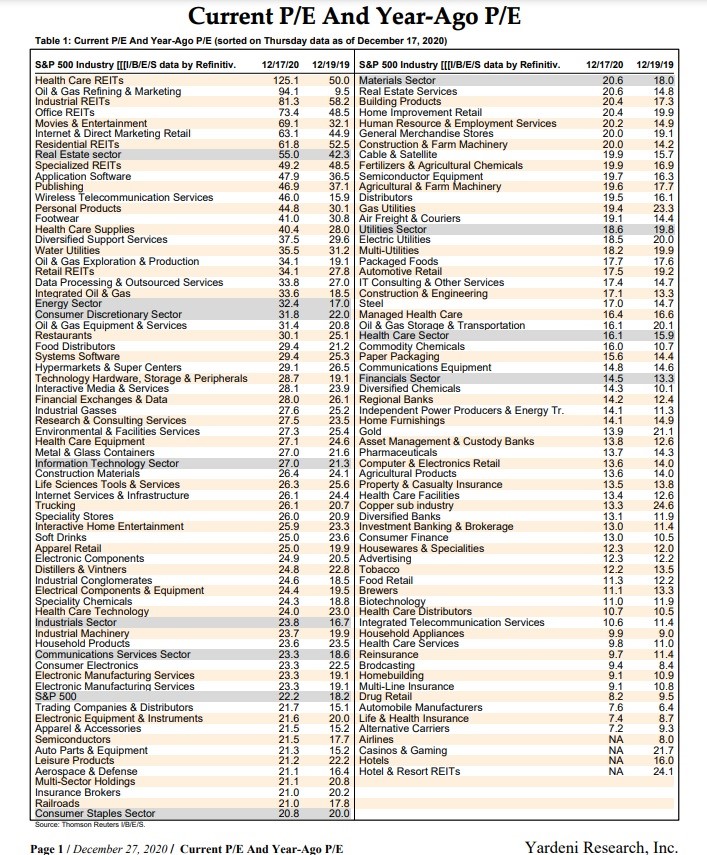

The table below shows a detailed look at the changes to PE multiples in each industry in the past year.

The S&P 500 now has a 22.2 PE ratio which is quite high. Strong earnings are coming in 2021, but the acceleration may have already been priced in. In the past few years, we’ve actually seen stocks do well when earnings were poor and vice versa. Here’s something to consider. Q2 EPS growth is already expected to be 37.58%. Is that a high bar? If the market expects such growth, we need to avoid big negative revisions in the meantime for stocks to do well. It’s quite common for low growth stocks to trade at a 30 PE ratio. This is certainly an expensive market.

EPS Estimates

The stock market is hot and earnings revisions are strong. As you can see from the chart on the left, global earnings revisions are about as strong as they were in late 2017/early 2018. The stock market peaked in January 2018. In fact, with the emerging markets rally in the past few months, this group has just gotten back to that peak. As you can see from the chart on the right, 2021 and 2022 earnings estimates have rebounded in the past few months. Usually, estimates fall. They only rise after recessions when estimates fall too much. That’s what we are seeing now.

In the S&P 500, 2021 EPS growth is expected to be 22.1% and sales growth is expected to be 7.9%. The consensus for energy sales growth is 15.2% which is the highest out of all the sectors. We don’t have one for EPS growth because energy lost money in 2020. The top 2 sectors for EPS growth estimates are the industrials and consumer discretionary. The consensus calls for 78% and 58.9% EPS growth. Tech and healthcare are below the market at 14.5% and 10.7%. These are sectors to avoid in a cyclical upturn.

Conclusion

The best performing managers in the 2010s probably will struggle in the 2020s. That’s the nature of the game. Great investors know when to make big bets because they have a good grasp of probabilities, understand their biases, and are open to changing their mind when they hear good arguments. The S&P 500 is expensive. Good earnings are coming, but that doesn’t mean stocks will do well. Sector estimates imply analysts see a cyclical upturn in the economy in 2021.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.