UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Bank of America fund manager survey asked managers what level the 10 year yield would need to hit to cause a 10% decline in stocks. Of course, a 10% correction isn’t a ‘level of reckoning. That’s a very dramatic description for a correction. As you can see, 43% think a 2% 10 year yield would cause a 10% correction. An additional 20% believe the 10 year yield rising to 2.25% would cause a correction.

Investors are following the Nasdaq’s correlation with the 10 year yield. They believe growth stocks will fall if the 10 year yield hits a certain level. The S&P 500 is near a record high while the 10 year yield is at 1.67%. The overall index has been unaffected, but there has been a big factor rotation under the surface. The 10 year yield is very likely to rise to around 2% based on the coming spike in economic growth and inflation. Plus, expectations for higher long run government spending have moved up. However, markets aren’t straight forward. We don’t know how correlations will look in the next few months. We only know that they aren’t stagnant.

Rate Hikes Expected

In the past few months, expectations for rate hikes have increased dramatically. This is in line with the Fed funds futures market. However, we don’t see the Fed hiking rates soon if it stays true to its average inflation targeting. Even if core PCE inflation in 2021 makes up for the past 2 years of low inflation, that would need to be sustained in 2022 for there to be hikes. 2022 will have very tough comps (assuming 2021 inflation is strong). The Fed could get away with not hiking rates this year or next year.

As we have been discussing, this difference between what the Fed has said and what the market is pricing could cause issues this summer. That’s because the Fed still has coverage to be dovish now that the pandemic is still inhibiting economic growth. The labor participation rate is still much lower than it should be. It will lose that coverage in a few months when the pandemic is fully under control.

Where Will The Money Go?

We are within 1-2 weeks of seeing where the stimulus money will go. 90 million stimulus checks have gone out so far. We don’t have access to up to the minute spending data. We have been saying the money will go to the real economy. That means it will be spent at restaurants, on clothes, and on vacations. Of course, someone can save the money for a few weeks/months and then spend it on those things later on when the economy is back to normal.

As you can see, those making less than $30,000 per year plan to spend 47% of the stimulus check. For this group, saving the money quickly becomes spending it because they are struggling to get by. It’s no surprise those making more money have a higher propensity to save and invest. We could already be seeing the stimulus’ impact on the stock market now. Those who got the money may have already invested it.

Tax Hikes Coming?

It appears the Biden administration doesn’t adhere to the more extreme versions of modern monetary theory. It plans to raise taxes to pay for the stimulus. Some economists don’t believe that’s necessary. Others say raising taxes next year would be too soon because the pandemic recession just ended. We disagree with that notion because in 2022 the economy should largely be back to normal.

The Bloomberg screengrab below shows the outline for the proposal.

It’s in the works now which means it will probably be many months before it passes. It won’t affect 2021 taxes, but it will impact markets this year. As you can see, the corporate tax rate could increase 7 points to 28%. The income tax on those earning more than $400,000 will increase. Finally, the capital gains tax on those with over $1 million in income will increase. There probably will be a long term shift away from corporate profits and towards the working class. There is strong political will to help the middle class and poor at the expense of corporations. This will lower margins and compress valuations. This plan probably won’t do that much damage, but it could easily be the first of many.

Energy Hasn’t Been Great

Energy has had great 12 month returns, but that was following its worst decline in about 100 years. The decline was based on the fundamentals, but a cyclical macro swing came in the sector’s favor. The energy sector has had a brutal past 5 years. As you can see from the chart below, the S&P 500 energy sector has had a negative ROIC minus WACC rate for all but 3 quarters in the past 5 years. Keep in mind, the best energy companies are in the S&P 500. Most of the small and mid-caps have done even worse. One thing is certain: the recent bottom won’t be surpassed for a while. It’s not clear if the sector will get its ROIC above its WACC in the next upcycle.

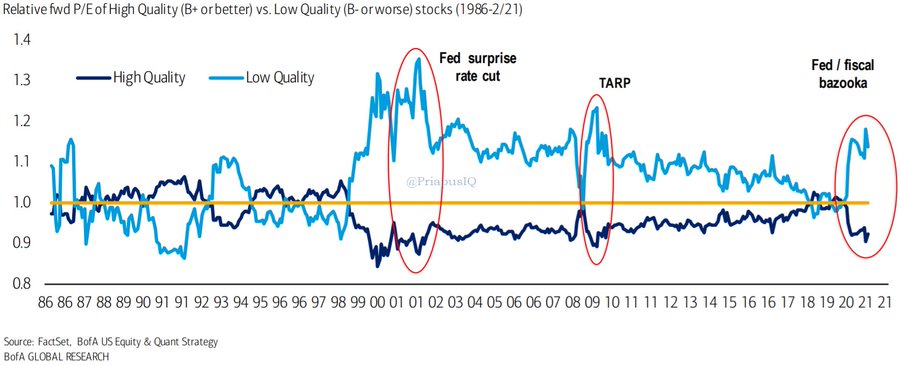

Low Quality Might Be Done

The chart below ascribes all the increases in low quality stocks to monetary policy which may or may not be correct. If you think that’s true, the rally in low quality stocks is probably mostly over. While the Fed might not hike rates soon, it will likely end QE next year. The market will probably price that in ahead of time (later this year). The fiscal stimulus is going out now, but the future might not be as bright if a tax hike passes. That would be the first tax hike since 1993.

Conclusion

The 10 year yield hitting 2% might not cause a correction because correlations aren’t stationary. The Fed’s average inflation targeting implies it won’t hike rates anytime soon. Polls show around half of the stimulus checks won’t be spent. We think most will be spent. The stock market will be less popular for retail traders this summer when other entertainment options are available. Biden plans to raise taxes on the rich. That will hurt equities. Energy businesses have been horrible for almost all of the past 5 years. However, 2021 won’t be as bad as 2020. The rally in low-quality stocks might end after the Fed announces it will start to unwind QE and Biden hikes taxes. That news might come in the 2nd half of this year.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.