UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

A zombie firm is a company that shouldn’t exist based on its business fundamentals (P&L), but does because of very easy credit conditions and low interest rates. Low interest rates help valuations and help some firms stay in business. The theory that central bank suppressed low rates have unintentionally created many zombies was combated by @ErnieTedesci on Twitter. He stated that demographics and some other factors are pushing down rates, increasing firms’ ages, and mitigating startup rates. There has been a slowdown in nominal growth in developed economies because of their slowing/declining population growth rates. These populations are also aging. Older people don’t create new companies as often as middle aged people. The wave of ‘boomer’ created start-ups is mostly over. It’s important to emphasize that while central banks do have an impact, it is not accurate to attribute all market responses on them, at least in the US. For instance, in places like Europe and Japan where there has been a higher level of central bank involvement with corporate equities and debt, this has contributed to the creation of zombie companies.

No Recession Coming

There are two great points as to why the U.S. economy won’t fall into a recession. The first is that global central banks are easing with the Fed. This could spur a global cyclical recover in 2020 if the rate cuts are effective. A ratcheted up trade war between the US and China would be a mitigating factor for a turnaround, but recognize that the trade war didn’t cause the slowdown. Specifically, the percentage of global central banks whose last rate change was a cut shifted from 38% to 82.4% in the past year. The Fed is about to cut rates for the 3rd straight time on October 30th as the futures market sees a 92.5% chance of a cut.

The second point is the U.S. economy is less cyclical as we have pointed out when discussing the employment gains in the healthcare sector. As you can see from the chart on the left, 19.1% of final domestic demand came from the cyclical sector in Q2 2019.

This percentage never recovered the losses made during the last recession and during the late 1980s. From the mid-1940s to the mid-1980s, the percentage was in between the low 20s and the high 20s.

As the chart on the right shows, real final domestic demand growth in Q2 for cyclicals was only 0.2%. The economy would be at a standstill if it wasn’t for the non-cyclicals which have a negative correlation with cyclicals. Non-cyclicals had yearly real final domestic demand growth of 2.2% which is near the cycle high. There can still be recessions, but there needs to be a big imbalance to cause one, which we don’t see.

Which Sectors Are Sensitive?

If you still think the economy is headed for a recession, or see a recovery in 2020, it’s valuable to see which industries will be the most and least affected. The chart below shows in green the industries driven by demographics and in red the industries driven by GDP.

The hotel industry has a 13.7% sensitivity value to a 1% change in GDP. Invest in this industry if you see a cyclical turnaround next year.

September Leading Indicators Index

The latest update in the leading indicators report from The Conference Board was poor. Monthly growth rate in August was revised from 0% to -0.2% and monthly growth in September was -0.2% which missed estimates for 0.1%. Missing estimates with an easier comparison is not good. The September leading index was helped by the stock market and the leading credit index. It was hurt by weakness in the manufacturing sector (the ISM PMI) and the interest rate spread (10 year yield minus Fed funds rate).

Even with this negativity, this report is probably consistent with an expansion slowdown and not a recession. The best visualization of this is seen in the chart below. It shows the ratio of leading to coincident indicators.

If the ratio stabilizes and falls slightly, it’s a slowdown. We saw this happen from 2011 to 2013 and from 2015 to 2017. This recent 12 month period looks very similar to those slowdowns and nothing like the last recession. On the other hand, yearly growth in the leading index was 0.4% which is just a tick higher than the expansion low of 0.3% in June 2016.

Not The Best Industrial Production Report

The September industrial production report missed estimates. It showed a further decline in both yearly manufacturing and industrial production growth. However, it wasn’t a disaster because of tough comparisons and the GM strike. September 2018 was the mini-cycle expansion peak. Comps will get much easier shortly.

Specifically, industrial production fell 0.4% monthly (estimates for -0.2%) and 14 basis points yearly. This was the first negative yearly growth in industrial production since November 2016. Last cycle’s trough was -4.1% in 2015. Next month the yearly comp will go from 5.4% to 4%.

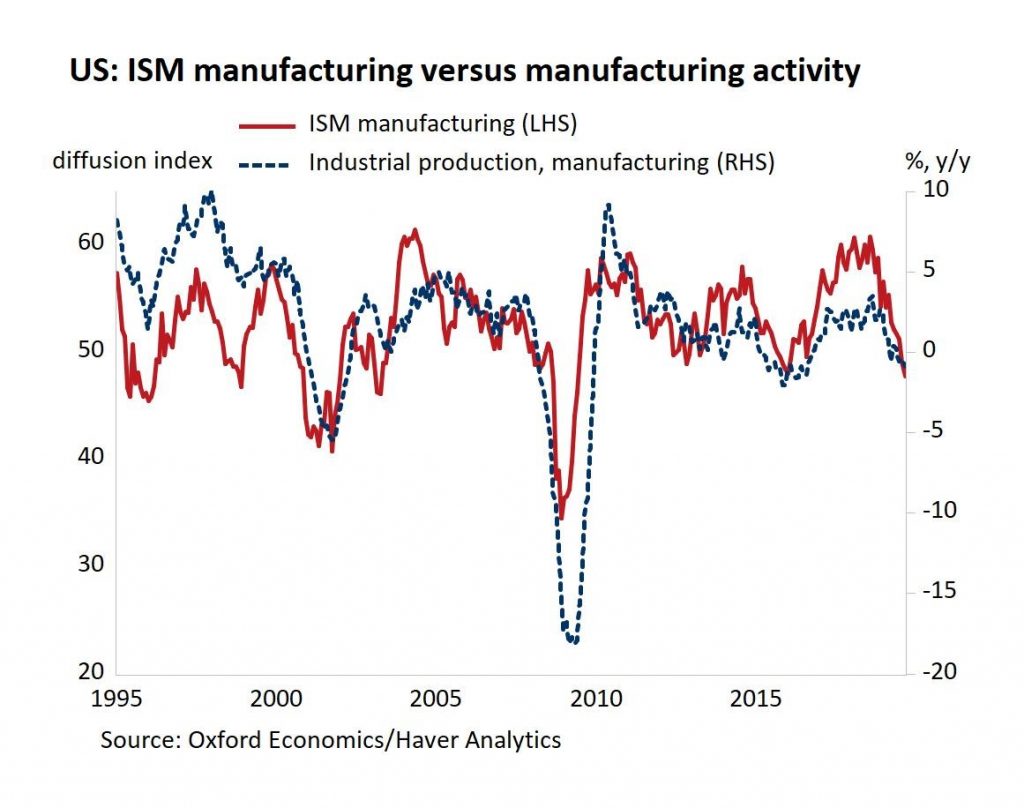

Manufacturing production was -0.5% monthly which missed estimates by 2 ticks. As you can see from the chart below, yearly growth was -82 basis points which is in line with the weakening ISM PMI.

The ISM PMI was way too optimistic in 2018. Yearly manufacturing production growth was the weakest since August 2016. In 2015, growth troughed at -2%. Next month’s comp will fall from 3.9% to 2.4%. The overall capacity to utilization rate fell from 77.9% to 77.5%.

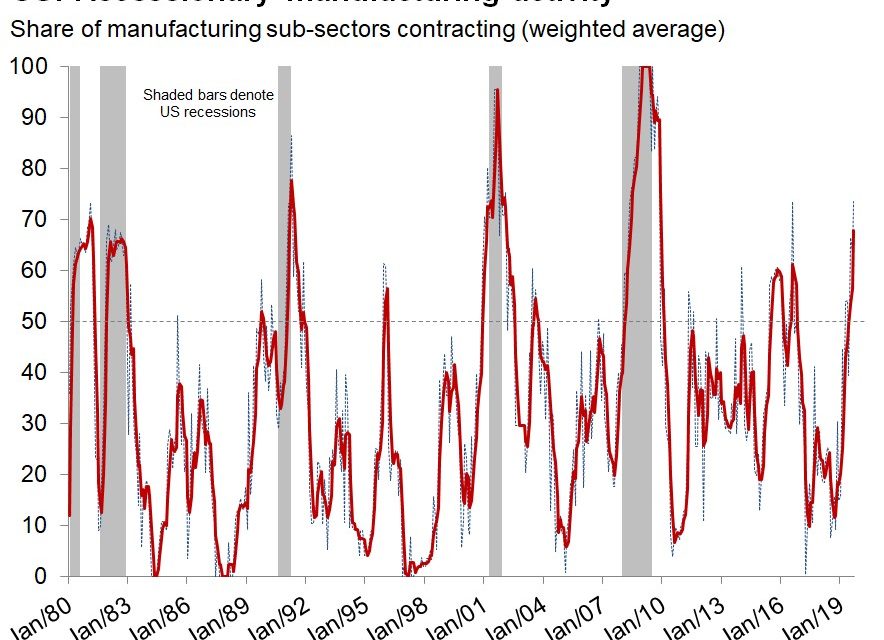

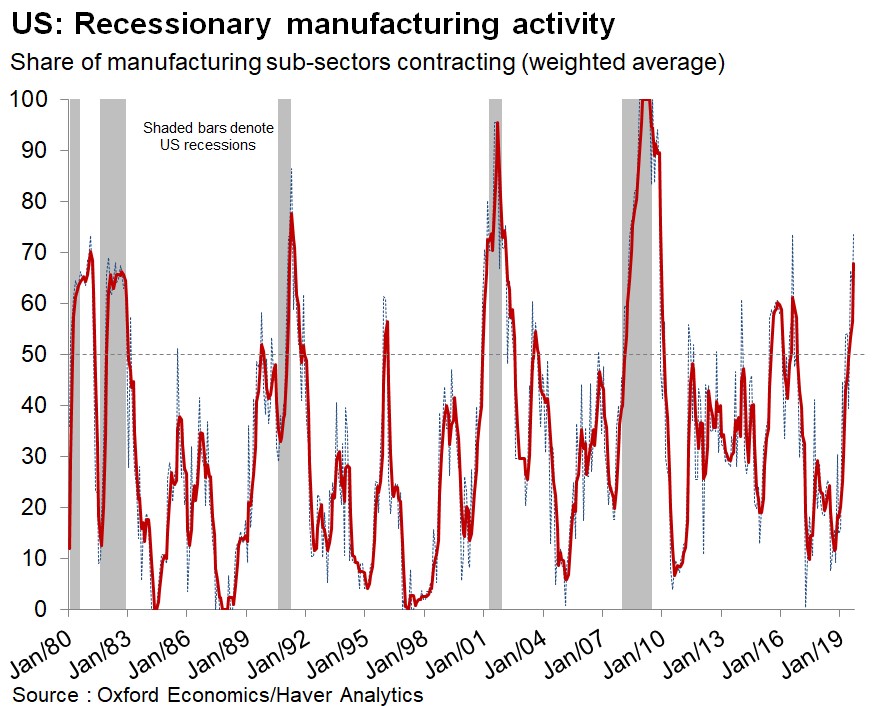

Monthly, industrial production and manufacturing growth would have been -0.2% without the GM strike which means estimates would have been largely met. Automotive products production fell 5% yearly which was the biggest decline of this expansion. This has been a broad based shallow industrial production slowdown. The chart below shows almost 75% of manufacturing sub-sectors were in contraction territory.

Industrial production isn’t cratering like the last slowdown because mining production was up 2.6% yearly. Last cycle it troughed at -12.4% in April 2016. Utilities production was up 1.4% monthly on warmer weather.

Conclusion

Zombies might not be caused by central banks artificially lowering interest rates. There might not be a recession soon because the economy is less cyclical and because global central banks are almost all cutting rates. Cuts are good for the global manufacturing PMI. The ratio of the leading to the coincident index is signaling this is a slowdown, not a recession. The industrial production report had weak growth because of the cyclical slowdown, the tough comparison, and the GM labor strike.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.