UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Despite the relatively low jobless claims in March, the ADP report showed private sector job creation was only 129,000 which missed estimates for 165,000. It was below the low end of the estimate range which was 150,000. It’s interesting that the February reading was revised higher to 197,000 from 183,000. That just increases the massive difference with the BLS report which initially stated there were only 20,000 total jobs created and 25,000 private sector jobs created. The February BLS report was a one off on the negative side and the January report was a one off on the positive side. Friday’s March report could break the tie. We will figure out if job growth is truly slowing.

Weak ADP Report

The ADP report showed only 6,000 jobs were created by small businesses, 63,000 were created by midsized firms, and 60,000 by large firms. The chart below shows very small businesses with 1-19 employees lost 9,000 jobs which was worse than last month and the worst reading in at least 5 years. Last month we said it wasn’t a big issue. This month we say it’s worth watching closely because it could be the start of a slowdown.

Overall, goods producing firms lost 6,000 jobs and service providing firms added 135,000 jobs. That goes along with the decline in the Markit manufacturing PMI. The weakest industry was construction which lost 6,000 jobs. The strongest was education and healthcare which added 56,000 jobs. It’s interesting to note that most macro analysts still follow the manufacturing sector even though it has shrunk as a percentage of the economy. That might be because it is more sensitive to changes in the economy. The sector can be a signal of an incoming change of either weakness or strength. While education and healthcare employ more people than construction, it’s not volatile category. It won’t be the first category to signal a phase change in the economy.

ISM & Markit Services PMIs Fall

The manufacturing ISM PMI improved, while the Markit PMI fell. Services was somewhat of a role reversal although both fell. The Markit services PMI fell from 56 to 55.3 which beat estimates for 54.8 and the high end of the consensus range which was 55.1. Even though the PMI beat estimates, service sector optimism fell to a 15 month low and overall private sector optimism fell to the lowest level since September 2016. Even with this decline in optimism, Q1’s service sector output growth was the highest since Q2 2018.

The first quarter Markit reports as a whole are consistent with 2.5% annualized GDP growth which is above the Atlanta Fed Nowcast’s projection for 2.1% growth. March had the 3rd straight month of outstanding service sector business growth with the backlog accumulation the joint strongest since November 2014. Overall, the Markit reading showed modest sequential weakness and a decline in optimism, but still showed solid business activity growth in the service sector which outperformed manufacturing.

The non-manufacturing ISM PMI fell much more, but was actually consistent with higher GDP growth because it had been much more optimistic than reality. As you can see from the chart below, the PMI fell from the highest reading since August 2005 as it was 59.7 to the lowest reading since July 2017 as it is now 56.1. That missed estimates for 58 and the low end of the consensus range which was 56.5. The 6 month average PMI was exactly the same as it was last year. During recessions, the average yearly decline is 12.2%.

Business activity fell from 64.7 to 57.4. New orders fell from 65.2 to 59. This report is consistent with 2.6% GDP growth. That would be solid growth, but we must consider how optimistic the ISM had been. For example, if the biggest bull on Wall Street suddenly moved close to the consensus, you’d wonder what changed.

Even though there was a sharp decline in the ISM PMI, the quotes aren’t negative. For example, a firm that manages companies and provides support services stated, “There is a sense of relief in our industry with the temporary reprieve of the additional tariffs. As of now, we feel this will help us maintain competitive prices and steady margins over the next quarter.” The end of the trade war could help boost growth in Q2.

Massive Increase In Refinancing

The MBA mortgage applications index in the week of March 29th was very strong mostly because of the growth in refinancing due to the drop in interest rates. The composite index increased 18.6% on top 8.9% growth in the prior week. Weekly purchase index growth was 3% on top of 6% growth. The spring selling season is in solid shape. The purchase index is near its cycle high. The refinance index increased 39% on top of 12% growth. As you can see from the bottom chart below, the 5 month decline in 30 year interest rates was the largest since 2010. (Rates increased 2 basis points in the week of April 4th to 4.08%.)

Worst Economic Surprises Since Financial Crisis

As the chart below shows, America, emerging markets, and the G10 nations have seen their economic growth trajectory turn south.

The indexes for the G10 and U.S. are at post-recession lows. The data in relationship to its one year average isn’t the same as its yearly growth. The rate of change of growth has been terrible, but yearly growth isn’t as weak as the last slowdown. The good news to counter such a bad reading is the global services PMI increased from 53.3 to 53.7 in March which was the best reading since last November. It’s not 100% clear if the global slowdown expanded from manufacturing to services. Markit’s reports don’t indicate it has.

Weak Durable Goods Orders Growth

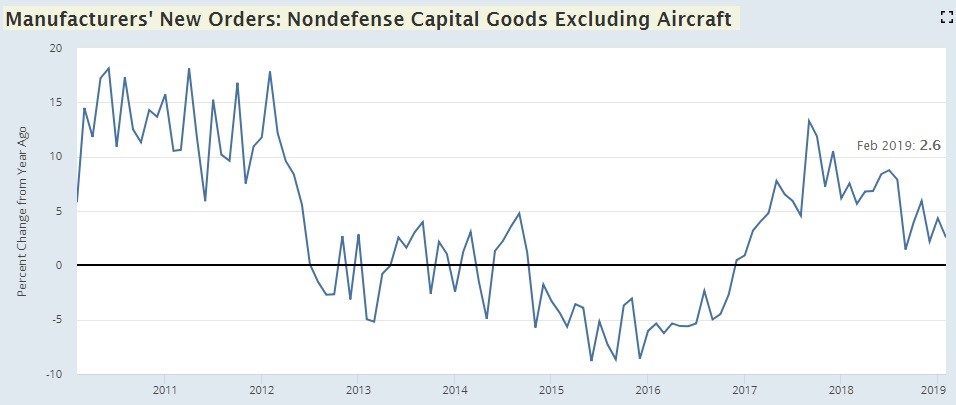

One of the most disconcerting American economic reports this week was February’s durable goods reading. Core capital goods orders fell 0.1% which missed estimates for 0.2% growth. Non-defense capital goods orders excluding aircrafts had 2.6% yearly growth which was down from 4.3% growth in January. As you can see in the chart below, the acceleration that started in 2017 looks to be ending. Looking at the headline results, new durable goods orders fell 1.6% monthly because of the volatile aircraft orders. There was a 4.8% decline in transportation equipment and a 31.1% decline in non-defense aircraft orders.

Conclusion

The ADP report missed estimates, but it was significantly higher than the February BLS reading, so it doesn’t have predictive value. Let’s see if the labor market’s growth slowed. Markit suggests the service sector is stronger than manufacturing. The Markit services PMI fell in America, but rose globally. The delayed durable goods orders report signals manufacturing activity was weak in February. That’s consistent with the March ISM and Markit manufacturing PMI declines.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.