UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

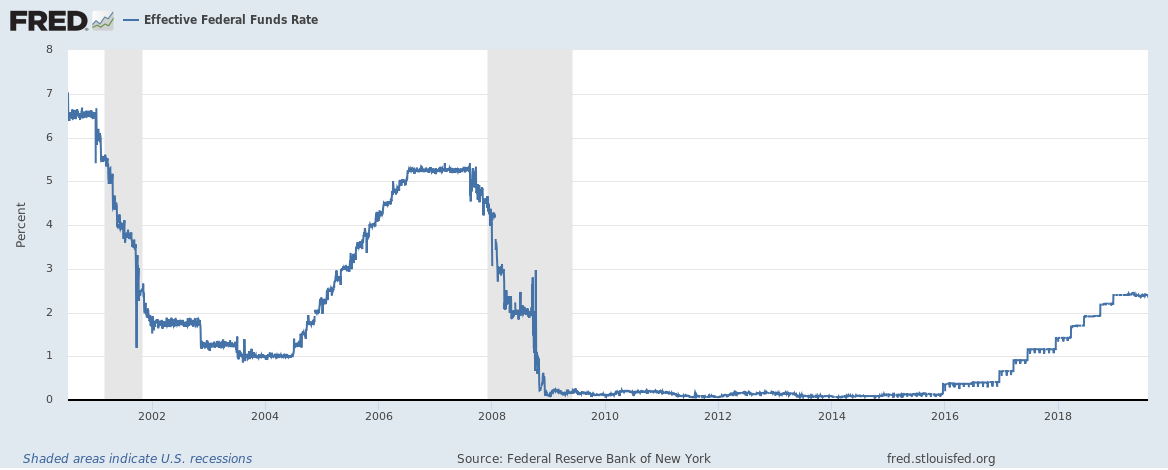

For those who are new to following monetary policy, the fact that the Fed cut rates 25 basis points on July 31st, doesn’t make the meeting dovish even though the act of cutting rates is dovish. Firstly, there was about a 20% chance of a 50 basis point cut heading into the meeting, so the blended expectation was for rates to be a bit lower than they turned out. More importantly, the Fed gave hawkish guidance. We knew the Fed was going to cut rates, but we didn’t know how many more rate cuts it would guide for in the rest of the year.

Fed Moves Hawkishly

At face value, the Fed didn’t guide for any more rate cuts which is against expectations for 2 more cuts in 2019. That moved the Fed funds futures market to expect fewer cuts. The odds of at least 3 total cuts in 2019 was 56.1% as of July 25th. After the Fed’s hawkish guidance, that fell to 39.6% as the most prominent option became 2 total cuts instead of 3. (Those odds have since switched bad to expecting more cuts). Unsurprisingly, this sent stocks lower. The S&P 500 fell 1.09%.

The chart below shows under Powell, the Dow has fallen 9 of 12 Fed meeting days. That’s because the Fed was hawkish until the end of December 2018.

This July 2019 cut actually had hawkish guidance. Technically, the Dow fell 334 points on Wednesday, but the point of the chart is the same.

Since the Fed funds futures market expects fewer cuts, the near term bond market sold off, meaning yields rose. The long term bond market rallied which flattened the curve. At one point on Wednesday, the difference between the 10 year yield and 2 year yield was 14 basis points. Its cycle low is 10 basis points which was reached in December. It’s ironic because Powell declared victory on policy this year by stating, “Increasing policy support has kept the economy on track and kept the outlook favorable.” In the Fed’s victory declaration it has gotten closer to a full yield curve inversion which implies a recession is coming in the next 1-2 years.

2 Fed Members Vote For No Cut

Before we get into the Powell’s press conference and the Fed’s statement, it’s notable that 2 Fed members voted to keep rates the same instead of cutting them. It’s not a surprise those two were Esther George and Eric Rosengren. The graphic below reviews where each Fed member stands on the dove to hawk scale. The names in bold mean the member can vote on policy in 2019. The fact that some members voted against the cut is hawkish.

Midcycle Adjustment

Every Fed meeting has a term or phrase that defines the meeting. Previous important phrases were autopilot and patience. The key term from Powell’s press conference was ‘midcycle adjustment’. That’s an interesting choice because the cycle is already the longest since the 1800s. The term mid-cycle doesn’t necessarily connote the exact middle. There have been a few mid-cycle slowdowns in this expansion. The one from 2011-2012 was far from the middle of the expansion.

The point with calling it a midcycle adjustment is that the rate cut doesn’t mean the floodgates are open for more cuts. This isn’t supposed to be the start of a new cut cycle. This was the first cut in 3,878 days which is the longest streak since 1954, but the Fed doesn’t want to open Pandora’s box for more cuts necessarily. The Fed may not be able to put the genie back in the bottle. Interestingly, this was the S&P 500’s third worst performance during a rate cut in a expansion since 1990. The 2 worse days were the March 2001 cut and the December 2007 cut which were both right before recessions.

Specifically, Powell stated, “We’re thinking of it essentially as a midcycle adjustment to policy. That refers back to other times when the FOMC has cut rates in the middle of a cycle and I’m contrasting it there with the beginning of a lengthy cutting cycle.” This isn’t the start of a new cut cycle because the Fed isn’t cutting rates because the economy is weak. The labor market and consumer are still strong. The Fed is cutting because of low inflation, global weakness, and trade tensions.

The Fed’s Statement

The Fed added a new line to its statement where it wrote, “In light of the implications of global developments for the economic outlook as well as muted inflation pressures,” it will cut rates. We knew the Fed would cut rates for those reasons along with trade tensions, but the market had priced in that cut being the start of an easing cycle. If financial conditions start to tighten, that cut might not be enough. It’s worth noting the Fed plans to end its QT program in August which is 2 months before it stated it would. It’s weird to see a shrinking balance sheet and rate cuts because one is hawkish, and one is dovish. It’s not clear what place the balance sheet will have in setting policy in the future.

Consumers See Rate Cuts

Prior to the Fed’s July decision, consumers were starting to anticipate lower rates. As you can see from the chart below, the net percentage of consumers expecting lower interest rates hit its highest level since 2012. This is from the very optimistic July Conference Board consumer confidence index.

Global Central Banks Are Cutting

The list below shows the latest actions from the largest central banks.

Obviously, you can switch the latest action from the U.S. Fed to a rate cut to 2.25%. As you can see, 70% of the major central banks are easing. That makes sense because the global economy has had a relatively weak year. The US economy has been one of the best performers. The fact that even the Fed cut rates shows how bad it has gotten. It’s possible this combined monetary stimulus turns the global economy around next year, but not immediately.

Conclusion

The Fed went with a hawkish cut. Even still, the market sees more cuts in 2019. If Fed members give hawkish statements in August, the 2 year yield will increase which could invert the 10 year 2 year yield curve. That would portend a recession in mid 2020 or early 2021.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.