UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Now that the pandemic is within weeks of ending in the US and many of the innovation stocks have corrected sharply, it seems like the economy and markets are more normal than they had been in the prior 15 months. The market is never truly normal because there are always countervailing trends that will cause asset prices to be severely different in the following few years. However, the last 15 months have been much more unusual than normal dislocations.

Despite the global pandemic, shutdowns, and reopenings, the craziest factors were Fed policy and record-breaking retail investor participation in the market. The Fed had never bought corporate bonds; free addicting stock trading apps that encourage everyone to follow hot stocks were never this popular. We haven’t mentioned how addicting the apps are prior to this. You can argue that having a clunky UI is a feature because it discourages over-trading and checking your stocks multiple times per day.

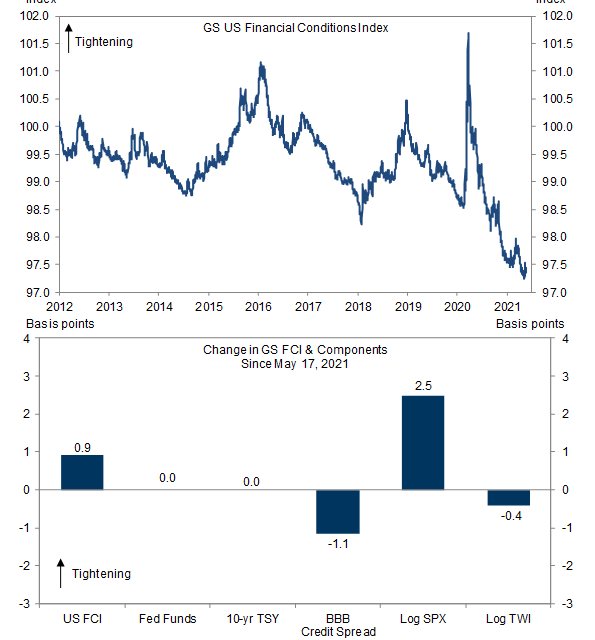

While the market is adjusting to the post-pandemic world, the Fed still has recession-type policy in place. Many critics believe the Fed should pull back since markets have recovered and the pandemic is close to done. On the other side, the Fed believes it must maintain extreme policies ($120 billion QE per month & 0% Fed funds rate) until the labor market reaches full employment. It’s tough to determine the Fed’s impact on markets. You can’t say the Fed caused x% of the stock market’s increase last year. However, we can say for sure the Fed has strongly impacted the financial conditions index.

As you can see from the chart above, the financial conditions index is near its 10 year low. This implies conditions will probably tighten within the next few quarters which would be in line with the Fed ending QE and potentially hiking rates thereafter. Some investors believe that as the Fed turns more hawkish, stocks will be a sell. That’s dramatically incorrect. The Fed has already gotten more hawkish in the past 6 months.

The Fed is always giving open mouth guidance. When the Fed tapers QE, investors won’t be fighting the Fed. They will simply have slightly less support which won’t matter because the pandemic will be over and the labor market will be nearly full. We are at least 3-4 years away from risk investors fighting the Fed. In the past 15 years, the Fed has usually been on equity investors’ side. This is nothing like the 1970s & 1980s when investors really had to fight the Fed.

Shorting Is Rare Again

Easy financial conditions have made it tougher to short stocks. Some say when the tide goes out, you see who is swimming naked. Others say we are in the golden age of financial fraud. The market makes it easier for the weakest companies to survive. Even if you ignore fraud, weak business models are helped by strong markets.

As you can see from the chart below, the median S&P 500 stock has just a 1.5% short interest as a percentage of its market cap. This is the same as the bottom earlier in the year and in the early 2000s. That being said, it hasn’t been a bad few months for short sellers.

The worst companies don’t make it to the S&P 500. The SPACs and the money losing tech stocks have crashed. Short sellers likely moved their attention to the innovation companies and away from S&P 500 firms. That would have been the smart choice because the S&P 500 has barely fallen in this so called ‘correction.’

Investors are wondering if this low short interested in the median S&P 500 stock portends bad news for the overall market. We don’t think that’s the case. This is more about short sellers covering their bases in an unpredictable market. There is another category of stocks beyond money losing growth stocks that short sellers could focus on. These are meme stocks that have had short squeezes. These stocks, which are popular among retail investors, have very little fundamental bull case. We’ve seen stocks like this do well in the past, but not to this magnitude and for this long. Plus, there has never been this broad of a rally. There have been isolated short squeezes, but this time the category consists of many stocks.

The interesting phenomena here is that when these stocks spike, they bring down the rest of the market. Their rise causes hedge funds to de-gross. They cover their shorts and sell their longs. When meme stocks explode and real profitable businesses fall, it makes the market look unrealistic.

The Oil Glut Is About To Be Gone

The inventory glut in the oil market has been slowly going away in the past few months even as supply has been increasing. That’s because demand has been increasing quicker. Supply isn’t up more because it takes a while to increase, oil is only in the mid-60s, and energy companies know there is still a glut.

As you can see from the chart on the left, inventories should be almost back to where they were to start 2020 at the end of this year. It’s amazing how smooth and predictable the decline has been so far. The chart on the right shows the forward curve implies a lower future Brent price. This is surprising because demand is set to really increase once the pandemic is over in Brazil and India (could take more than 6 months).

Conclusion

The Fed has made financial conditions easy. Be careful of when they tighten in the next year. The Fed is still largely on the side of long investors. The S&P 500 has done well, but growth stocks have corrected sharply. Recently, the meme stocks started rallying again. The sweet spot for short sellers has been innovation stocks. Shorting retail favorite meme stocks has been a disaster. The oil market has been steadily working through its inventory glut. The market should be in balance soon. Brent oil probably will do better than the forward curve projects.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.