UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Fed policy is starting to become a hot topic amongst investors because of the spike in inflation. There would be even more calls for an end to QE and a rate hike if the April jobs report had met expectations. Even still, reports like the Philly Fed manufacturing prices reading show there is some pressure on the Fed to move hawkishly. The good news for the Fed is the 10 year yield is only at 1.61%. There is nothing destabilizing about the 10 year yield being at the same level it was at in 2012.

The Fed’s biggest worry besides its main goals of keeping employment high and inflation moderate is probably the decline in the dollar. The dollar index is at $89.85 which is very close to a 6.5 year low. Higher rates and tapering QE would strengthen the dollar. Ending bond buying would lower demand for treasuries directly. However, hawkish policy would suppress long term rates because it would mitigate inflation and economic growth.

As you should know, the Fed has members who disagree with each other. On the hawkish side we have Dallas Fed President Kaplan and on the dovish side we have Atlanta Fed President Bostic. Kaplan argues the Fed should stop its $120 billion per month in bond buying. He said, “Maybe taking the foot gently off the accelerator would be the wise thing to do here.” Bostic disagreed. He said, “If we see that substantial, significant progress towards our goals, I’m going to be advocating for us moving policy – now, we are not there right now.” Bostic mentioned that the economy is still lacking 8 million jobs and inflation hasn’t been at 2% sustainably.

We believe the Fed won’t raise rates in 2021 or 2022. We also think the Fed will announce slow QE tapering at the end of this year. In December 2021, the Fed could say it plans to lower bond buying to $60 billion per month starting in March 2022 and completely end the program by the end of 2022. The Fed won’t be selling off its assets this time.

The April Fed Minutes stated, “A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goal, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.” The Fed will discuss those plans at the next 2-3 meetings before coming up with a solution.

There is no pressure on the Fed to act in June. At the Fed’s Jackson Hole symposium, we should hear a complete overview of how the Fed plans to end QE without specific monthly targets given. The Fed has been very open about its process in the past few months. It’s much less stressful and easier to warn the market of future normalization plans than it was to cut rates and buy assets in March 2020.

Employment Rate Actually Falling?

The labor market improved in April, but not at the rate anyone expected. We expect job creation to be above April’s level in May, but full labor market normalization will be reached later than we expected heading into the April report. It’s likely that by sometime next spring, the economy will be near full employment. That could be in line with the timeline for the beginning of tapering.

The Dallas Fed’s real-time population survey doesn’t encourage as much optimism about the labor market as the jobless claims reports suggest we should have. As you can see from the chart below, the real-time population survey shows the prime age labor participation rate fell from 71.8% to 71.1%. Furthermore, the unemployment rate rose 1 tenth to 7.2%. We shall see how correct this is in less than 2 weeks when the May labor report comes out.

Extremely Strong May Flash PMI

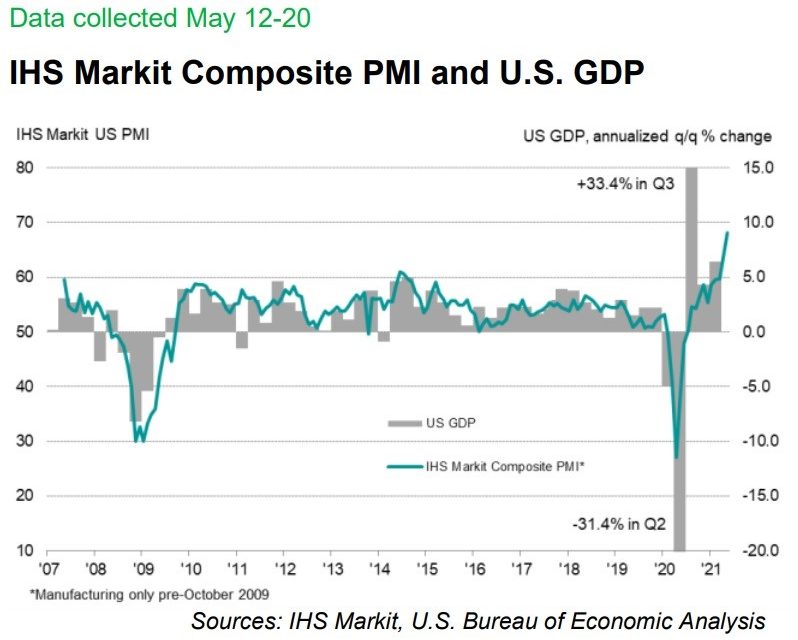

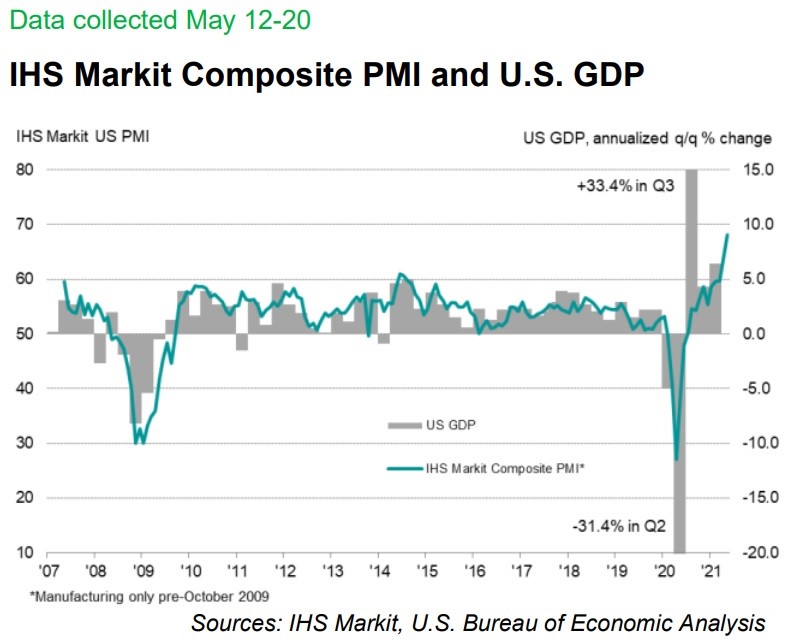

The May Markit PMI for the first half of the month was extremely strong. Remember, the Markit PMI improved in April which was different from the ISM PMI. Specifically, the May flash output PMI rose from 63.5 to 68.1 which was a record high. As you can see below, this is consistent with around 6% quarter over quarter GDP growth. The survey started in 2007. It doesn’t have as long of a track record as the ISM reading.

Both services and manufacturing hit a record high. The service index rose from 64.7 to 70.1 and the manufacturing index rose from 60.5 to 61.5. With the pandemic nearly over, it makes sense that the service sector is seeing a spike. The 7 day average of new COVID-19 cases fell to 25,318 on Sunday which is the lowest reading since June 2020. There are way more tests now than then. Undoubtedly, the pandemic is more contained it has ever been since its initial spurt in March/April.

To be clear, this is only the flash PMI. However, it’s unlikely that the index will be weak in the final reading given the momentum the economy has. Of course, this report also showed record high inflation in both sectors (since October 2009). We have gotten so used to high inflation that any reading that is the highest in a couple decades gets met with a yawn. Everyone has moved on to the next few months when inflation should mellow out on a monthly basis. The market will only be shocked if inflation stays high through next year.

Conclusion

The Fed isn’t even thinking about raising rates. Some members are open to discussing tapering QE. The next step will be official FOMC statements on a potential policy change. Then, the Fed will tell us its plan. Finally, sometime in 2022, the Fed will execute on this plan. It will be interesting to see if a dovish June meeting causes the dollar index to fall into the mid-80s. It’s interesting to compare this cautiousness with the roaring nature of the May Markit flash PMI reading. The composite index hit a record high and inflation hit a record high. This signals the economy has momentum. Let’s see what this means for the May jobs report since the real-time population survey oddly showed prime age employment weakening slightly.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.