UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The June ADP report beat estimates and estimates for private sector job creation in the BLS reading. Let’s see if that matters. We expect it to be relevant because all signs point to a solid BLS reading. For now, we just have the ADP report. It showed there were 692,000 private sector jobs were added which was down from 886,000 and beat estimates for 550,000. According to the BLS, in May, there were 492,000 private sector jobs added; expectations are for 555,000 jobs added in June. As you can tell, the May ADP reading was too optimistic.

Job creation was almost evenly distributed between the 3 sizes of companies (small, mid, large). The goods producing sector added 68,000 jobs, with construction adding 47,000 jobs. The service proving industry produced 624,000 jobs with the leisure and hospitality industry adding 332,000 jobs. Demand for labor within this industry is extremely high. All the jobs lost during the recession should be back very soon. The limiting factor is the supply of labor, not demand. Air travel is above where it was before the pandemic. This industry might even create more jobs in July than it did in June.

2nd place was education & health which added 123,000 jobs. This fall, most remote learning will transition back to the classroom.

Companies need to hire workers as quickly as possible to keep up with demand. Remember, consumers have trillions left to spend. The chart above shows the share of job postings that indicate an urgent need for workers increased from 2.3% on May 14th to 2.5% on June 28th. This is important because even though there have been record job openings, the unemployment rate is still elevated. The more desperate companies are to hire workers, the more they will pay them. With the extra unemployment benefits going away, there is no reason for people stay on the sidelines. This summer will have a ton of job creation.

As we mentioned, most indicators are showing the next few labor reports will be great. One of these is the survey which asks consumers whether they think jobs are “hard to get” or “plentiful.” In June, the percentage of consumers saying jobs are “hard to get” fell from 11.6% to 10.9%. This is about as low as it was at the bottom in the last expansion. Unless this survey is wrong, the labor market should be full soon. The percentage saying jobs are “plentiful” rose from 48.5% to 54.4% which is a new record high. We assume that all these people saying jobs are plentiful have one. Since the net percentage of these readings is better than before the pandemic, wage growth should be strong this summer.

Rent Inflation To Spike

Consumers are going to need all the wage increases they can get because rent inflation is set to be high this summer. The CDC’s eviction moratorium expires on July 31st which means in August rents should increase. The size of the increases should be large because we skipped the 2020 increases.

As you can see from the chart below, primary & owners’ equivalent rent CPI comps will get weaker as the months go on. These two CPI metrics combine to make up 40% of core CPI. It won’t be hard for these metrics to increase from their cycle low. The rental price increases recent apartment movers have experienced imply the CPI metrics will spike in the next few months. This chart has dual axes, so don’t get confused into thinking these CPI metrics will rise to 5.25%. However, even rising above 4% will have a very large impact on core CPI.

Investor Sentiment Is Too High

In the week of June 30th, the money manager exposure index spiked from 70.86 to 91.72 which is very bullish. The Q2 average was 81.22. It was a great quarter for stocks. On social media, tons of investors are bragging about their quarterly returns. Small trader speculative call buying volume is nearly at a record high.

The ARKK innovation ETF rose 31.56% from May 13th to June 29th. That’s more than a year’s worth of gains in 6 weeks. This week, the percentage of bulls in the AAII investor sentiment survey spiked from 40.4% to 48.6% which is way above the average of 38%. We are nearing extreme optimism. If stocks rise in the next 2 weeks, we could trigger a strong sell signal.

As you can see from the chart above, as the bull run has continued since 2009, individual investor expectations have grown. Now they are unrealistic. In 2014 investors expected 8.9% real returns per year which is reasonable. That’s about 10% nominal returns per year. In 2021, these investors expected 13% real returns which is about 15% nominal returns per year. That is highly unlikely to be sustained. Such returns can last a few years, but not over a few decades. If the S&P 500 fell 30% in the next 2 years, expectations for returns would plummet. It’s entirely possible that stocks have will have weak intermediate term returns. This optimism is a bearish signal.

Stocks Are More Expensive

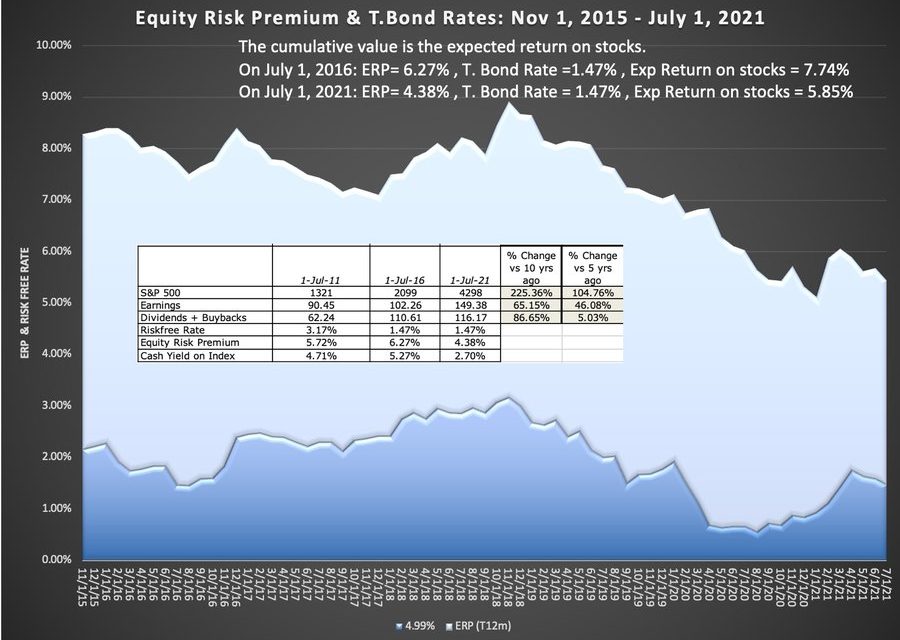

Investors say the stock market should be more expensive than usual because yields are low. However, the chart below shows the cash yield on the S&P 500 has fallen from 5.27% to 2.7% in the past 5 years even though the 10 year yield stayed exactly the same. The equity risk premium fell from 6.27% to 4.38%. Plenty of great companies’ stocks trade at above a 25 PE ratio.

Conclusion

Many indicators suggest the labor market is stronger now than it was before the pandemic which is why we think this summer will have very strong BLS reports. Rent inflation will be high this summer and fall. Individual investors are way too optimistic about future returns. We need a correction to sort this out. Valuations are much higher than they were 5 years ago even though the risk free rate is exactly the same. It’s unlikely that we get more multiple expansion in the next 5 years. However, stocks should still provide positive returns due to earnings growth.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.