UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Congress finally passed a stimulus. The stimulus checks are $600 per person. They are going out to those who make less than $75,000 per year and couples who make less than $150,000. Dependents will be getting $600 as well which is actually $100 more than the first stimulus. The checks shrink the more money people make. People who make $100,000 per year or more won’t get anything.

Mnuchin is promising these checks will go out as early as next week. Therefore, we could see a boost in spending in December after all. However, they won’t come in time to be used for Christmas gifts. Many people will use the checks for basic necessities anyway. For some people, their last thought is buying gifts. They are in survival mode. Cynics will say these stimulus checks will go into people’s Robinhood trading accounts. Some people are even forming strategies around story stocks, anticipating a pop when the checks go out. Buying a high flyer is not what people should do with their money, but it’s up to them.

Unemployment Benefits

These checks won’t save people, but unemployment benefits well help a lot. For gig workers, there will be a $100 boost in weekly unemployment checks which is better than the $0 given last time. For everyone else, the benefits are $300 per week for 11 weeks, but they might not start immediately. States’ unemployment computer systems are terrible. This spring Florida had people waiting outside on long lines to apply for benefits which could have spread the virus further. Many state governments are living in the 20th century.

The $300 in benefits in addition to the regular ones add up to about 85% of typical incomes (without the $300, it’s 50%). PUA and PEUC benefits will also be extended 11 weeks. The expiration of 14 million people on benefits would have decimated the economy. This negative consequence is partially why Congress actually passed a stimulus. Generally, Congress needs a major motivator to compromise. As a clarification, PUEC benefits can continue past March 14th (the 11 weeks) to April 5th if the individual hasn’t reached the max. That probably won’t be many people.

Other Items

Besides the checks and the benefits, there are $284 billion in PPP loans. The problem here seems to be actually getting small businesses the money opposed to having it available. That transmission process hasn’t worked. It’s going through banks, but we’ve heard many small businesses say they haven’t gotten loans. Many are worried about paying them back because they have no business. Getting a loan that only turns into a grant if it goes to certain costs is a problem when business is shut down (for example, indoor dining in NYC).

There is $82 billion in help for schools and $27 billion for transit. School employment has taken a hit as less workers are necessary for e-learning. There is $25 billion in rental money to avoid evictions. There is also $13 billion to help the hungry. There will be $10 billion for childcare and money for vaccine distribution. Obviously, it would have been better to allocate money for vaccine deliveries before they started. There is also legislation against surprise billing. The GOP’s liability shield and the Dem’s money for state and local governments weren’t in this bill.

Fed Allows Banks To Do Buybacks

The Fed announced late last week that it is allowing the major banks to do buybacks. It is still capping dividends. Some mistakenly think this means the Fed is pulling back on its dovish stance. That is very wrong. One has nothing to do with the other. The banks simply have built key capital ratios and loss absorption capacity even while setting aside $100 billion in loan loss reserves.

The banks did what they were supposed to, so the Fed is letting them return capital to shareholders which boosted their stocks on Monday. This doesn’t mean the Fed thinks the economy will have a smooth recovery next year. The Fed would be letting loose if it lowered requirements banks needed to meet. This situation is the case of the Fed following its previous rules. By assuming the Fed is turning hawkish, you are looking way too deeply into this decision. It’s great news the banks are in good shape.

Some on Twitter challenge us on this, but they aren’t looking at the banks’ results. Secondly, if there was going to be a banking crisis, it would have happened in the worst part of this recession. Finally, the bubble in speculative tech stocks has little to do with the banks. If the high-flying stocks take a dip, the banks will be okay. Quite frankly, bank stocks would probably rally as money would rotate into value stocks if the economy is improving.

Best Run Since 1999

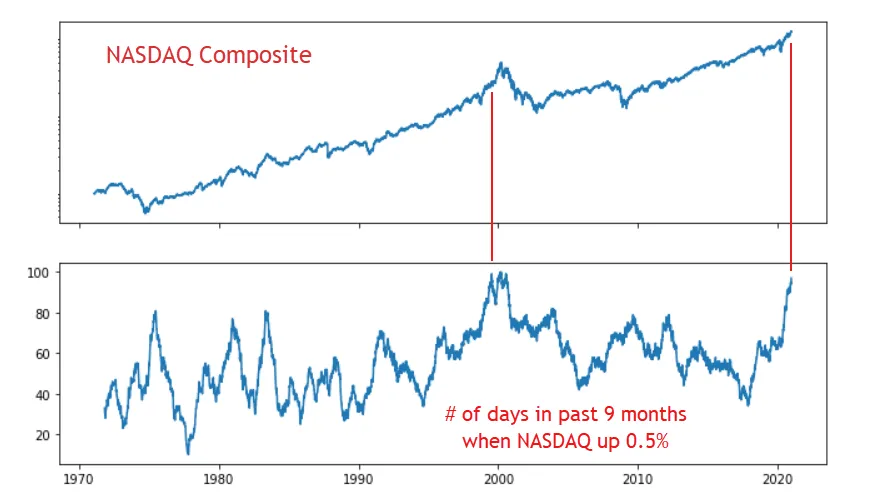

Speaking of the speculation in tech stocks, the Nasdaq has been on a historic run. As you can see from the chart below, the Nasdaq Composite has increased more than 0.5% in a day 97 times in the past 9 months. This non-stop rally has only been matched by the rally in the 2nd half of 1999. That was a few months before the peak in March 2000. This should not be taken lightly as the Nasdaq subsequently crashed 78% causing retail investors to be completely wiped out.

Conclusion

Congress finally passed a fiscal stimulus. It’s just enough to allow people to survive until the economy starts to reopen. Obviously, this won’t bring the 8 million people newly impoverished out of poverty, but it will prevent more people from joining the ranks. The Fed didn’t let banks buy back shares because it is becoming hawkish. It did so because they are in good shape. The rally in tech stocks has been non-stop. This speculation will end like it did in 2000. Be cautious!

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.