UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed just went over how it will cut rates at the July 31st meeting and literally the next day core CPI surprised to the upside. This looks bad, but won’t have much of an impact on policy because the Fed follows core PCE the closest. Let’s go through the numbers. June core CPI was 0.3% monthly which beat estimates for 0.2% and May’s reading of 0.1%. Yearly prices were up 2.13% as you can see in the chart below.

That beat estimates for 2% and May’s reading of 2%. This was the highest core CPI since January. According to Oxford Economics, core PCE inflation will be 1.7% in June which is up from 1.6% in May. That’s not enough to change the Fed’s dovishness. The Fed can get away with lower rates because core PCE is almost always below core CPI. It’s certainly convenient the Fed picked the weaker one.

Details Of June CPI

Headline CPI fell from 1.8% to 1.66% which was the lowest reading since February. This is great for the consumer since weekly earnings growth only fell about 1 basis point in June. Therefore, real earnings growth increased. The weakness in headline CPI was catalyzed by energy as its prices fell 3.4%. Prices have been down all year except in April. Just like other aspects of this report, in energy, commodities inflation was much weaker than services inflation. Commodities prices fell 5.4% and services prices fell 0.7%. Food prices were up 1.9%. This inflation was driven by food away from home inflation which was 3.1%. That might be driven by the tight labor market which makes it tougher to find staff at decent wages.

Once again, in core inflation, price increases were much higher in services than commodities. Core commodities inflation was 0.2% and services excluding energy services inflation was 2.8%. The chart below shows how commodities inflation is nonexistent while services inflation is solidly positive.

In the commodities category, apparel and medical care commodities prices fell 1.3% and 1.5%. Tobacco and smoking products inflation was 4.6%.

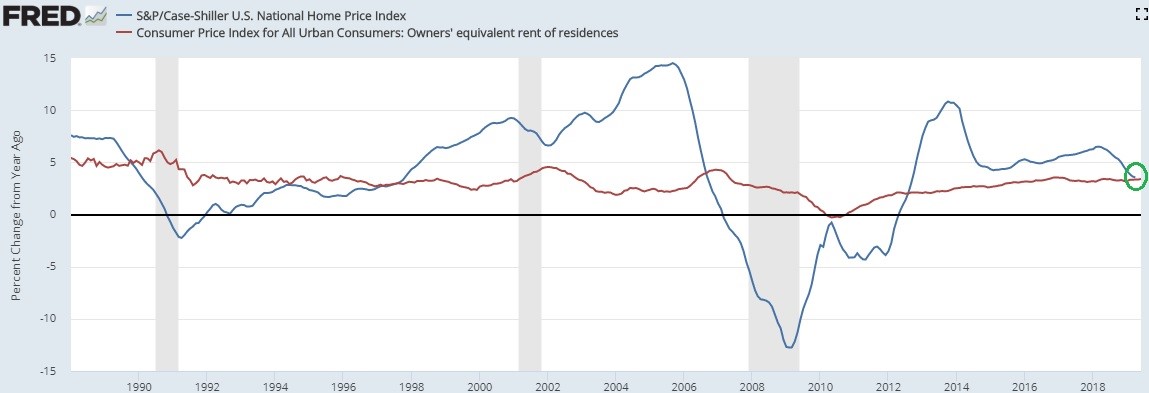

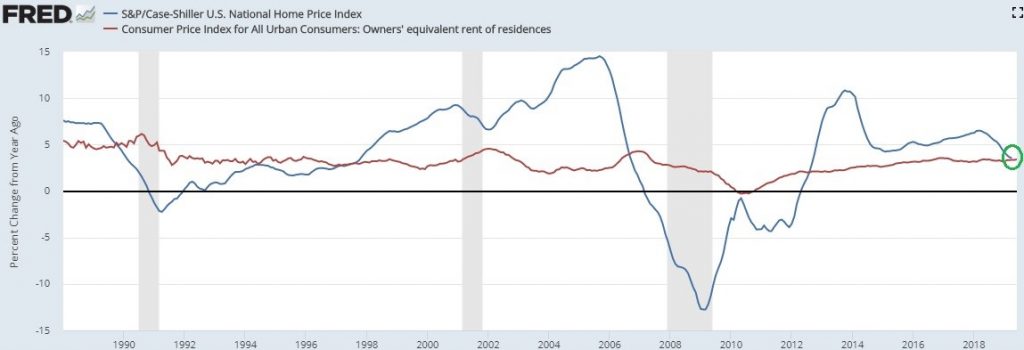

Core services inflation was driven by medical care and shelter which were 2.8% and 3.5%. Shelter inflation is the biggest category, so it has a huge impact on the headline and core result. Rent inflation was terribly high as it increased from 3.73% to 3.87% which was the highest reading since August 2017. That’s a big spike from 3.43% in January 2019. Somehow even though home price growth has been cratering, owners’ equivalent rent inflation was also up. It went up from 3.34% to 3.41% which is the highest reading since July 2018. Technically, we don’t have home price growth from June yet, but we can infer it will be low based on the most recent reports. The Case Shiller national home price index was up 3.55% yearly which is the weakest reading since September 2012. It’s still actually slightly above owners’ equivalent rent inflation, but the gap has closed.

Powell Doesn’t Believe In Phillips Curve

Powell basically announced the death of the Phillips curve when he stated, “The relationship between the slack in the economy or unemployment and inflation was a strong one 50 years ago … and has gone away.” The relatively tight labor market is generating wage growth for workers. Service inflation is elevated partially because services firms are labor intensive. Labor is just one component of their costs though. Plus, services is only 62.7% of CPI. Therefore, the labor market won’t tell you everything you need to know about inflation. It’s curious that the Fed is talking down inflation now that it is prepared to cut rates. It was talking up inflation when it was hiking rates. That’s while in both circumstances, core PCE was almost always below 2%.

The Fed isn’t reacting to inflation and the labor market like its mandate suggests. It has moved to try to extend the economic cycle. It is cutting rates while financial conditions are stable so it can extend the cycle. This is a preemptive move. It’s possible that conditions would be much tighter if the Fed hadn’t guided for cuts. The chart below proves the point that the Fed is looking at extending the cycle.

As you can see from the chart above, many more Fed members see downside risks to the economy than upside risks. If the Fed was looking at the labor market, it wouldn’t be cutting rates because initial jobless claims just hit a 3 month low.

In Every Instance Stocks Rallied

As you can see from the table below, the Fed has cut rates 17 times with the S&P 500 within 2% of its record high since 1980.

1 year after these rate cuts, the S&P 500 is up an average of 15%, with the worst gain being 3.2%. That’s right; every single time stocks rallied in the next year. That’s probably because cutting rates at/near a record high is a great example of insurance cuts. If a recession isn’t coming and the Fed is cutting rates, it makes sense that stocks rally. However, it’s too simplistic to claim the stock market being near its record high means a recession isn’t coming. Obviously, you can’t use stock prices being high to justify buying stocks. If there is further economic weakness, this pattern won’t be followed. Furthermore, the Fed is utilizing forward guidance more than ever, so rate cuts are already priced in.

Conclusion

The Fed just stated it would be cutting rates and core inflation increased above 2%. Luckily for the Fed, core PCE should be 1.7% in June. The Fed is trying to extend this cycle which is fine in the near term, but could be an issue in the long term. The Fed isn’t wrong about the cyclical slowdown, but it’s not listening to its mandate which is to keep the labor market strong. The market usually likes rate cuts near its record high, but the rate cuts are already priced in, making us wonder if there is further upside left. The market got to the party early and drank the Fed’s punch.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.