UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Leisure travel has increased significantly above pre-pandemic levels. However, business travel is only about half way to two thirds back. That’s why the chart below shows TSA throughput is almost back to normal. If business travel was back to normal, we’d see flying well above any point in history. There are already complaints of unruly passengers which is probably related to the increase in demand. Many people want to get back the trips they missed. It makes sense to wait until next year to avoid the intense crowds. It’s like going to the store for toilet paper in March 2020. It’s a stressful activity for everyone.

Besides business travel not being back to normal, international travel is still limited. We imagine a lot of people are going on domestic trips instead of international ones, meaning eliminating all restrictions and hesitancies won’t be 100% additive to travel. The summer of 2022 will probably be huge for international travel. It’s no surprise businesses haven’t returned to normal traveling since workers aren’t even fully back in offices.

The 10 city average of office occupancy increased 0.6% in the week of July 16th to 32.1%. The highest reading was in Austin which rose 1.6% to 50.3%. At the very least, offices should get back to two thirds full by the end of August. Companies are bringing back workers who have been vaccinated. As of June 21st, 54% of Americans had at least 1 shot. The vaccination rate skews older. Most people 70 years old or older aren’t working. We still have further to go for everyone to get back.

Shipping & Supply Chain Issues Going Away

Sometimes economic projections are very easy because of certain innate laws. For example, the price of lumber has crashed as fast as it has risen. Whenever a commodity spikes in price, demand falls and supply rises. Lumber couldn’t stay at its peak for long. Lumber will never be a long term investment.

The same rules apply to shipping and the supply chain. The supply chain will normalize in the next few months as demand relaxes and capacity rises. We are now seeing the early indicators of normalization. The normalization process will get going almost as quickly as lumber prices crashed. As you can see from the chart below, trucking rates just started falling. This includes flatbed rates, van rates, and average equipment rates. It seems like this small decline is finally the start of normalization due to the timing of the crash in commodity prices.

The craziest supply chain issues are peaking. As you can see from the chart below, the supplier deliveries z score reading peaked at the highest level ever, going back to the 1950s. Just like all other examples, the z score will fall very quickly following its peak; within a few months it will be near zero. Another issue will crop up in a few years, but we are not likely to see such supply chain stress as we are seeing now for a while. Companies will learn from this situation.

Older Workers Aren’t Coming Back

The pandemic caused older people to retire early. They were the hardest hit by the pandemic and are the least tech savvy. Of course, there are plenty of 65+ year olds who can use technology, but in general they didn’t grow up with it; they don’t know how to use it as well as millennials and zoomers.

As you can see from the chart above, over 1.2 million workers retired early during to the pandemic. The share of retired workers has been increasing for awhile because the population is aging. We’ve seen more 65+ workers than ever, but that hasn’t overcome the tidal wave of retirees. The US is in better demographic shape than other countries like China, Spain, Italy, and Japan. It will be interesting to see their retirement data during the pandemic because they were already struggling to pay for older people’s benefits and growing their economies. America has seen more teenagers working following the start of the pandemic.

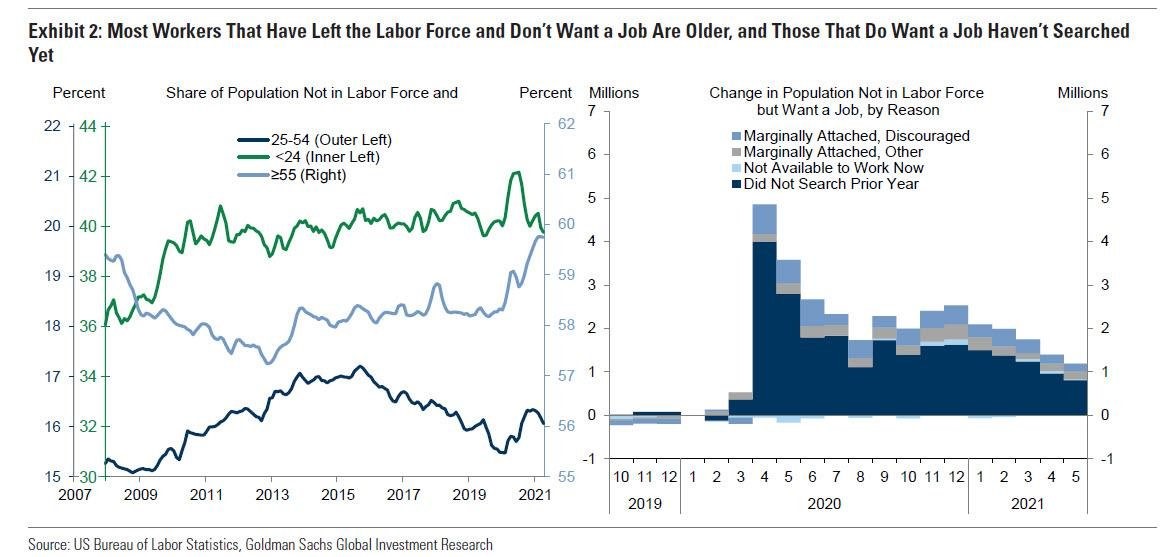

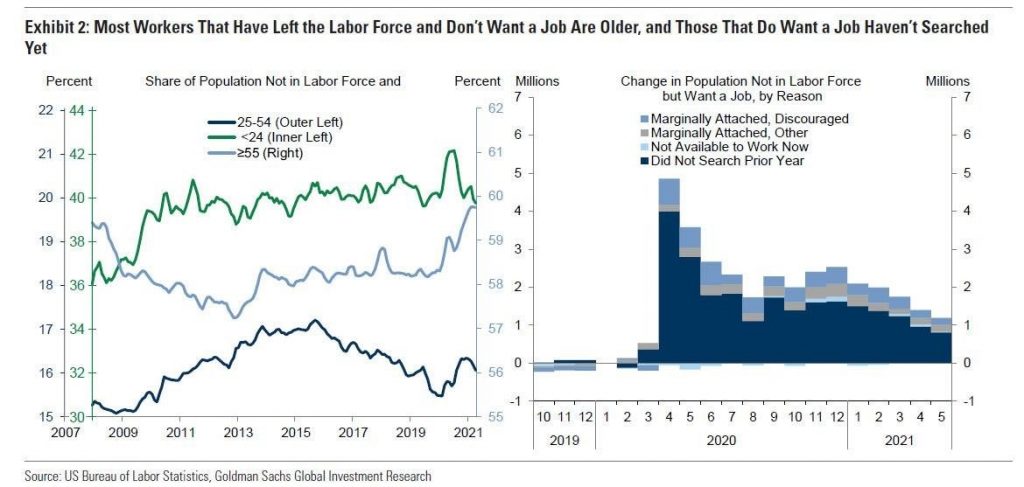

As you can see from the chart on the left, the share of 55 and over people not in the labor force has spiked to the highest level in over a decade. They aren’t coming back. Someone who was 63 at the onset of the pandemic and retired 2 years early isn’t coming back to the labor market at 64.5 years old later this year. As we mentioned, younger people are working more. The percentage of people under 24 not in the labor force is near a decade low. Keep in mind, that this is a tri-axis chart. That doesn’t mean it’s a chart crime though. Just pay attention to each axis. The green line is actually signaling a lower percentage than the light blue one.

The chart on the right shows the reasons why people aren’t in the labor force, but want a job. Most people simply haven’t searched for one in the past year. That’s likely because of health concerns, child care concerns, or worries about the state of their industry. This data point will normalize by the end of the year. Most of the stragglers still out of the labor market that want a job will be back working soon.

Conclusion

The TSA checkpoint data shows air travel is almost back to normal. Domestic leisure travel increased significantly. International and business travel aren’t close to normal. The supply chain issues and the spike in commodity prices are going to be gone within a few months. This is businesses and consumers responding to incentives. Nothing lowers commodity prices like higher prices. Boomers retired early during the pandemic. They aren’t going back to work after it ends. Instead, young people are taking their place in the labor market (not the same jobs of course). America can handle this shift. It will be interesting to see how this impacts Italy, Spain, China, and Japan because they have worse demographics.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.