UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

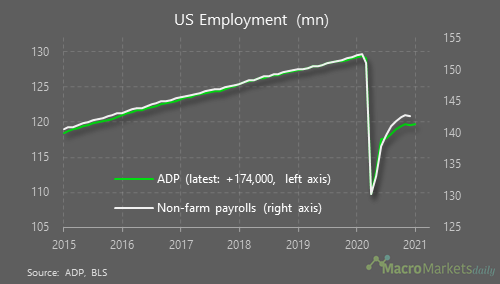

The economy is no longer quickly gaining jobs like it was at the beginning of the expansion, but that’s okay because we recognize this is a COVID-19 related slowdown which will end as hospitalizations and cases plummet. We might see sharp improvements in the labor market as early as March. The current weakness is just biding time before the 2nd step of this recovery. The goal is simply to avoid sharp job losses.

With that framework in mind, the January ADP report was very strong. It showed 174,000 jobs were added which was above last month’s 78,000 decline in private sector jobs. Any increase this month is a major win. The top forecaster for the ADP report, Continuum, predicted an 85,000 decline. The BLS consensus is for 50,000 overall jobs added and 35,000 private sector jobs added. We’ve been saying it could be above or below zero.

As you can see from the chart below, the ADP report has been too negative which implies the BLS report could be solid this Friday. The worse the report is, the more likely a large stimulus will be passed. The longer the delay before one passes, the more likely the money will go into reopening industries like restaurants.

Specifically, 51,000 jobs were created by small firms; 84,000 were created by medium firms; and 39,000 were created by large firms. The goods producing sector added 19,000 jobs and services created 156,000 jobs. The strongest industry was education & health with 54,000 jobs added and the weakest industry was inflation which lost 2,000 jobs. This type of report would be good late in the cycle when the unemployment rate is low. Instead, it’s good now because COVID-19 had a severe impact on the economy. We think results will be better soon because the 7 day average of new cases per day is down 45% from the peak on January 11th and hospitalizations are down 31% from the peak on January 6th.

As an aside, this January BLS reading will be seasonally adjusted. Technically, the economy will lose millions of jobs, but it will come up as slightly negative or positive because it’s a seasonally weak month. Losing almost 3 million jobs would come up as even after the seasonal adjustment.

America Has A Relatively Strong Service Sector

The Markit services PMI had a sharp jump in January from 54.8 to 58.3 which beat estimates for 57.5. The chart below shows America’s PMI was far stronger than other countries. That’s probably related to the fact that America is one of the leaders in vaccine distribution. As of Wednesday, 10.7% of the country was vaccinated. 13.4% of Alaska has been given 1 shot and 4.3% has been given 2 shots. That has led to the 7 day average of new cases falling from 704 to 144 in about 2 months. The January Markit composite PMI rose to 58.7 from 55.3 which gave us the highest private sector output expansion since March 2015.

Unlike the manufacturing report, the ISM services PMI rose 1 point to 58.7 which is consistent with 3.4% GDP growth. This was the highest PMI in almost 2 years. The business activity/production index actually fell 6 tenths to 59.9, but the new orders index rose 3.2 points to 61.8. There was a massive 6.5 point jump in the employment index as it rose to 55.2 which means it is in expansion. Remember, we’re expecting either a small loss or a small gain in jobs created. This indicator is a little bit more optimistic. The prices index fell 2 tenths to 64.2 which is more tepid than the manufacturing index.

Within the report an accommodation and food services firm stated, “Many of our restaurant locations remain completely shut down to on-site dining. We remain optimistic about business trends beyond April/May 2021. [We] have a very challenging few months to go.” They see the spring as an inflection point which makes perfect sense because more vaccinations should be out by then. Furthermore, more people can eat outside in the spring than the winter if that’s still necessary.

Defense Never Falls

Recently, the defense industry has been out of favor in the market because of fears of budget cuts by a Democratic Congress and because investors are more focused on hot growth companies than steady defense contractors. Historically, defense stocks have been winners. Even when America isn’t going to war, it’s always spending more money on defense. Furthermore, the battle lines are different now as they have expanded to space and the internet.

As you can see from the chart above, rolling 10 year total annualized returns of the defense industry have never gone negative and have usually been in the double digits since the early 1970s. Current 10 year returns look good, but defense stocks are cheap and many have had bad returns in the past year. Lockheed Martin is down 22.84% and Northrop Grumman is down 16.88% in the past year. Northrop Grumman trades at 12.74 times 2021 EPS estimates and Lockheed Martin trades at 12.62 times 2021 EPS estimates. Those are relatively cheap multiples for such an expensive market.

According to FactSet, the S&P 500 trades at forward PE ratio of about 22 which is nearly the highest in the past 10 years. These aren’t recommendations. We’re just saying an industry that has historically done well has a relatively low multiple.

Conclusion

We were expecting no job creation and the ADP report delivered a solid result. The most accurate forecaster actually expected job losses, so this report was a big win. Both the Markit and the ISM service sector PMIs were very strong. The defense sector has never delivered 10 year annualized returns that were negative since 1973 which is almost 50 years. Even though long term returns are currently still good, in the past year, the industry has taken a dive as it hasn’t fully recovered the losses incurred during the March 2020 bear market.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.