UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

2020’s recession was/is weird. The current economy is unlike any other recovery we have seen. The housing market is exploding. It has caused the homebuilder ETF to rise 118.6% since the bottom in March which is better than the cloud computing index which is up 79.3%. Similarly, lumber prices are at a record high. They have never risen this far above their 50 week moving average going back to 1986. This housing market is much different from the bubble in the 2000s because demand has come so quickly.

There was a rush to buy houses after rates plummeted and the worst of COVID-19 was over. Sales of ‘ready to occupy’ homes fell 24% yearly, while sales of homes ‘not started construction’ were up 34% in July. We are way past buying homes for sale as people are purchasing homes before they are constructed. The spike in lumber prices is occurring as demand causes more starts. Toll Brothers reported, “Our third quarter net signed contracts were our highest third quarter ever in both units and dollars, and our contracts per community, at 8.5, were the highest third quarter in fifteen years. This strength has continued into August.” Urban areas are doing the worst as people are leaving cities.

Anyone who objectively followed the housing market in the past cycle knew it wouldn’t crash because high qualified borrows took out loans. There wasn’t excess supply built in the last expansion, so new supply is now needed. We have record low rates and millennials who are ready to purchase. Older people are also buying 2nd homes. As you can see from the chart above, there was a V shaped recovery in new and existing single family home sales.

In July, there were 901,000 new homes sold which was up from 791,000 and above the consensus of 774,000. The highest estimate was 800,000. This was the highest monthly sales since 998,000 in December 2006. The median new home price was $330,600 which is 7% yearly growth. Sales were up 36% from last year. There is a 4 month supply.

Sales were up 59% in the Midwest and down 23% in the Northeast. The Northeast is a small single family housing market because it is an old part of the country, it’s population dense, and because people are leaving (New York). To be clear, we aren’t saying New York City is dying because of COVID-19. We’re referring to the long term trend of people leaving the state. That being said, NYC was weak for Toll Brothers this past quarter.

Worry About Renters

While new homes sold explode, many people are still in forbearance. As you can see from the chart below, loans in forbearance fell from about 8.5% in May to 7.2% as of August 16th. The situation is gradually improving. This situation is going to resolve itself over the next few months just like small business closures and temporary job cuts.

There is a fork in the road. Either houses will be foreclosed and jobs/small businesses will be permanently shutdown or loans will be paid back again, people will go back to work, and small businesses will reopen. The end result for housing should be positive because homeowners are well qualified. The main variable is COVID-19. The 7 day average of new deaths per day has fallen to 965 which is the lowest since July 26th. If continues to steadily fall, people should return to normal activities. That’s important for small businesses and the labor market.

Instead of worrying about homeowners in forbearance who will mostly come out of it, the real worry should be about renters. They don’t have equity to lean on and are likely to have less savings. They are the most financially vulnerable.

Consumer Confidence Plummets

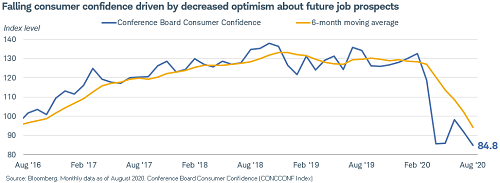

In August, consumer confidence fell to a 6 year low as it got lower than the worst readings of the recession. This metric makes it look like the economy never left the recession. It was weak mainly because of the decline in unemployment benefits. This is a case of what would have happened if there never was a stimulus or if it was smaller. This decline in confidence might help motivate Congress to act on a stimulus in September.

The real kicker would be a weak August jobs report. The Conference Board consumer confidence index fell from 91.7 (revised down 0.9) to 84.8 which missed estimates for 93 and the lowest estimate which was 88. Interestingly, RedBook same store sales growth in the week of August 22nd rose from -2.8% to 0.6%. However, the Conference Board index’s cutoff date was August 14th, so that’s not the same time frame.

The present situation index fell from 95.9 to 84.2 and the expectations index fell from 88.9 to 85.2. As you can see from the chart above, expectations for the labor market weakened. Those saying business conditions are good fell from 17.5% to 16.4% and those saying conditions are bad rose from 38.9% to 43.6%. Those saying jobs are plentiful fell from 22.3% to 21.5% and those saying jobs are hard to get rose from 20.1% to 25.2%.

SPAC Crazy

A SPAC is an investment vehicle where a blank check company acquires a private business (reverse merger), allowing the business to become a public company without going through the arduous filing process. As you can see from the chart below, $30 billion was raised via SPACs in 2020 (updated as of August 20th). That’s the most ever and well over the peak in 2007 prior to the financial crisis. This spike in money raised is a sign of a speculative bubble. Many companies with weak fundamentals have been going public this way.

Conclusion

The housing market is doing really well. It’s causing homebuilder stocks to outperform the red-hot software stocks. Single family home sales are the highest since 2006. There never was a bust in housing this cycle. The worst issue is loans in forbearance. That should resolve itself as COVID-19 deaths fall and the economy returns to normal. Another spike in cases and deaths would change that. Renters are mostly in worse shape than buyers in forbearance as homeowners are well qualified. Consumer confidence fell in August because the $600 in weekly federal jobless benefits went away. In early August, we didn’t know if any money was coming to help unemployed people. By September, many people will be getting $300 weekly checks. SPACS are hugely popular as we are in the late stage of this bull run even though the economic recovery is in its infancy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.