UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed once again met expectations by not changing rates and not changing its asset purchase program (QE). The Fed noted the recent economic slowdown in its new statement seen in the image below. The Fed stated, “The pace of the recovery in economic activity & employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic.”

It also mentioned how the progress on vaccines would impact the trajectory of the recovery. That’s about it for the changes to this statement. Since the last meeting, millions more people have been vaccinated, the stimulus passed, and the data has gotten worse. The next change will be when the reopening commences this spring. We think the fact that the Fed hasn’t reacted to the latest speculation in stocks implies it will never react to it. The Fed doesn’t want to risk hurting the recovery just to clamp down on retail speculation.

Powell’s Presser

Powell’s press conference was slightly more interesting than the bland statement. Powell said, “The economy is a long way from our monetary policy and inflation goals, and it’s likely to take some time for substantial further progress to be achieved. He added, policy will stay “highly accommodative as the recovery progresses.” A lot of progress is needed, but it might not take that much time because there will be rapid improvement after the reopening. Is 6 months a long time? It’s not. However, Powell is saying it will take a long time because he wants to show the market he is as dovish as possible.

When asked about tapering QE, Powell stated, “In terms of tapering, it’s just premature. We just created the guidance. We said we wanted to see substantial further progress toward our goals before we modify our asset purchase guidance. It’s just too early to be talking about dates. We should be focused on progress that we need to see.” It would be completely unexpected and bad policy to even talk about tapering before the vaccine ends the virus. In the next 1-2 meetings that should change. A lot can happen in a few months because vaccination distribution is occurring rapidly. In the past week, 1.21 million doses per day were administered.

As we mentioned, the Fed is not likely going to try to clamp down on speculation. When it eventually raises rates, it might hurt speculation, but that won’t be the Fed’s intention. When asked about the recent speculation in the stock market, Powell said, “If you look at what’s really driving asset prices really in the last couple of months, it isn’t monetary policy. It’s expectations about the vaccines, it’s also fiscal policy. Those are the news items that have been driving asset … values in recent months.”

That’s partially true. Of course, he isn’t going to comment on the recent short squeezes. For a Fed chair, a few short squeezes largely don’t matter as much as they do to investors. Does the price of GameStop going up 10X or crashing 50%, get more people vaccines or employ more people? No, it doesn’t do much. By the way, he’s right about Fed policy not causing speculation. Retail investors have been stuck inside with extra stimulus cash. Low rates aren’t making them play the market. Easy access to trading with time & cash to burn are causing speculation.

Indeed Job Postings Fully Recover

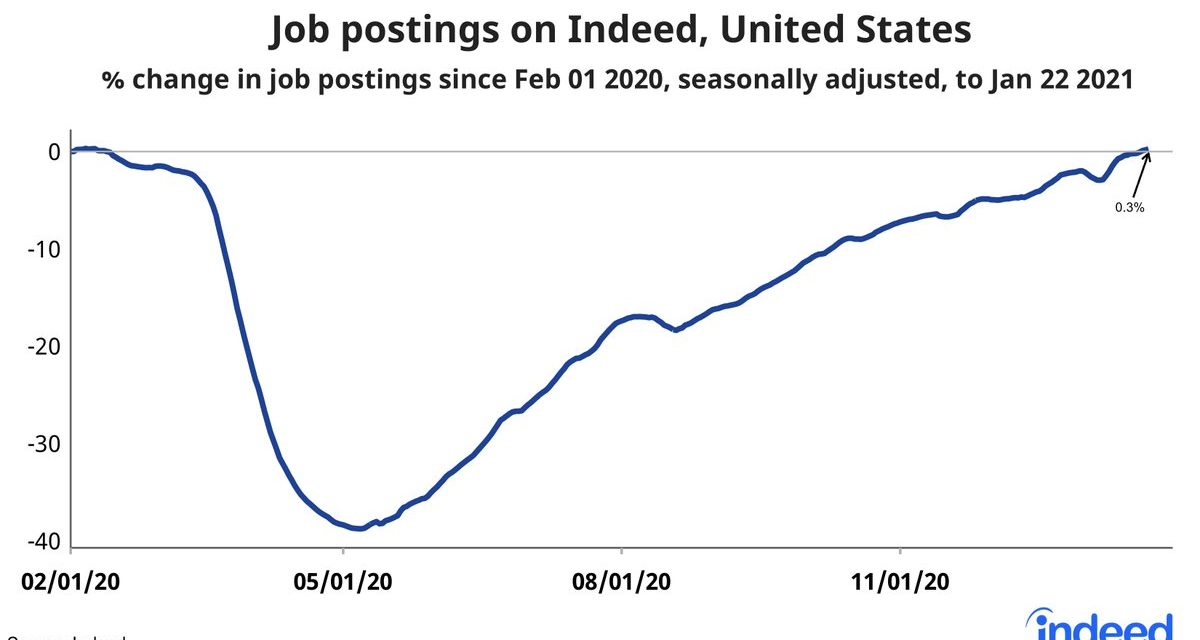

As you can see from the chart below, Indeed job postings have gotten back to the peak before the pandemic on a seasonally adjusted basis.

Let’s look at how some of the sectors did. The best performing one since last February was loading and stocking which had a 29.3% increase in openings. The best performing sector since September 30th is pharmacy which is up 18.4%. The worst performing since last February was hospitality & tourism which is down 40%. The worst performing since the end of September was beauty & wellness which is down 4.2%. Urban Honolulu has been hit the hardest as its job postings are down 23.4% since last February.

Durable Goods Orders

December durable goods orders were up 0.2% monthly and core capital goods orders were up 0.6%. The chart below makes it look like the economy has fully recovered. In certain areas it has recovered. Of course, durable goods for the home have been very strong; some of that demand has been pulled forward meaning future demand will be weak. You don’t need to buy a new washing machine every year. Shipments were up 1.4% and core shipments were up 0.5%.

On a yearly basis, core capital goods orders were up 8.4% and core capital goods shipments were up 6.6%. Since last February, total orders are down just 4 tenths. Transportation is down 1.2% because of the Boeing issues. Core capital goods excluding aircrafts are up 8%. Computers and electronics are up 9.7%. Shipments are a little better compared to before the pandemic. Total shipments are up 2.6% and core capital goods excluding aircrafts shipments are up 6.1%.

This Is Madness

Small retail traders are speculating in options which is moving the whole market. When this trend eventually breaks, we think there will be new limits on access to options. Think about how insane the regulations are for a second. You need to be an accredited investor to buy into a startup, but you can easily get access to options. Both are risky, but only options can take down the entire financial system. As you can see from the chart below, small traders have bought 60 million call contracts in the past 3 weeks. This has never been seen before. It will end badly.

Conclusion

The Fed didn’t raise rates or even discuss when it will taper. It won’t discuss that until the virus is under control. The Fed has no motivation to quell speculation because it doesn’t think they are to blame for it. Job postings have fully recovered. Core durable goods orders and shipments were very strong in December. Small traders are gambling in call options which has the potential to impact the whole market when the trend reverses.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.