UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Manufacturing has been in an uptrend in the past few months. Even though the ISM PMI has been high, this improvement probably has at least a few more months to go because yearly industrial production growth is still negative. The January Richmond Fed manufacturing index fell slightly from 19 to 14. The volume of new orders index was cut in half to 12. The local business conditions index rose 6 points to 10.

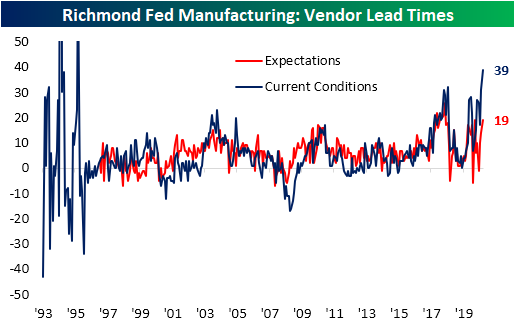

As you can see from the chart above, the vendor lead times index spiked to 39 from 31. This was the 3rd highest reading ever. This means the time a purchase order is placed until the goods are ready is increasing. The trend of higher prices continued in this survey as the prices paid index was up from 2.1to 3.11 and the prices received index was up from 1.76 to 2.09. We mentioned the recovery has room to run because usually a high ISM PMI reading is bad news. That’s because there is little room to improve from it. Usually, it’s a terrible time to own cyclicals when the PMI is high because stocks start to price a slowdown. Investors sense the cycle can’t get any better.

This time is different because of the reopening and the massive stimulus. As you can see from the chart below, when the nominal ISM is this high, it signals bad news for the 30 year bond yield in the next year. The nominal ISM is the prices paid index combined with the ISM manufacturing PMI. The bottom right chart shows all instances of when the nominal reading got above 69. It’s now at 69.2.

Consumer Confidence Rises Slightly

Redbook same store sales growth in the week of January 23rd rose from 2.2% to 3.9%. We expect a decent retail sales report because of the stimulus. The January Conference Board consumer confidence index rose from 87.1 to 89.3. The present situation index fell from 87.2 to 84.4. However, the expectations index spiked from 87 to 92.5. It’s hard not to be optimistic with the decline in new COVID-19 cases and the coming $1.9 trillion stimulus. Alaska has the highest percentage of people with the vaccine. Its 7 day average of new cases has fallen from 704 on December 8th to 178 on January 26th.

As we mentioned, there might be job losses in January. It will be close to zero. We just don’t know which side it will be on. The current assessment of the labor market in the Conference Board survey supports this thesis. The percentage of people saying jobs are plentiful fell 4 tenths to 20.6% and the percentage saying jobs are hard to get rose 9 tenths to 23.8%.

The chart above shows the inverted job differential compared to the unemployment rate. Remember, the unemployment rate is a rosy picture of the labor market. The unemployment rate is similar to continued jobless claims which excludes those getting pandemic benefits. Reality is much worse, but it could start to get much better as early as March. Consumers’ outlook on business conditions was much better as you’d expect since the expectations index rose. Those expecting business conditions to improve in the next 6 months rose 4.2% to 33.7% and the percentage expecting conditions to worsen fell 3.9% to 18.1%. That’s a net improvement of 8.1%.

The Global Workforce Was Decimated

The COVID-19 crisis was a global phenomenon, not just an American one. America didn’t limit the spread as much as it could have, but it’s one of the top countries in vaccine distribution. That means within a few weeks, investors’ attention is going to switch to the rest of the world. The job losses across the globe were epic. The recovery will probably be quicker in America than the rest of the world because of its enormous stimulus.

As you can see from the chart below, in 2020 there was a loss of 250 million global full-time workers compared to Q4 2019. The ILO’s forecast sees the equivalent of 90 million full time jobs being eliminated this year. The most important question facing economists and policymakers is what the economy looks like post-pandemic. The recession accelerated the transition to automation which lowers the number of service sector jobs permanently. How will these workers adapt and what should be done to help them?

The Housing Market Is Very Tight

As you can see from the chart below, there aren’t many existing homes for sale and home prices are rising.

The golden rule of supply and demand is at work. Interest rates are low, demographics support higher demand, and there isn’t much supply. This is causing home prices to increase drastically. Specifically, the Case Shiller home price index rose 1.4% monthly in November. It rose 9.5% yearly which is the highest growth since February 2014. Real estate agents are desperately calling and texting homeowners trying to get them to sell.

The 20 city home price index was also up 1.4% monthly. It was up 9.1% yearly which was the fastest growth since May 2014. This price growth is unstainable. It will likely fall within the next few months as comps get tougher and affordability worsens. The FHFA price index signaled an even stronger market as monthly growth was 1% and yearly growth was 11%. That’s the highest yearly growth in the survey’s history (it started in 1991).

Conclusion

The Richmond Fed manufacturing index cooled off slightly. When the ISM PMI is this high, it usually means the 30 year yield will fall in the next year. Redbook same store sales growth improved slightly. Present consumer confidence weakened, but future confidence improved decently. ILO estimates 90 million jobs will be eliminated this year globally. The FHFA home price index had its highest yearly growth ever. This isn’t necessarily a housing bubble, but these price increases aren’t going to continue. They can’t because housing will quickly become unaffordable.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.