UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Governor Cuomo from NY stated that he would lift almost all COVID-19 rules for businesses and social settings when the one dose vaccination rate hits 70%. It’s currently at 68.6% which means we are very close to normalcy. Despite this, most workers haven’t gone back to the office. In New York City, the office occupancy rate is 18.2%. The 10 city average occupancy rate stayed at 29% in the week of June 2nd which is shocking because we expected the rate to improve in June. If it doesn’t improve in June, when will it improve? We are within 3 months of having a great idea of how the new workplace will look in the future.

As you can see from the top chart above, the 7 day moving average of diner reservations is 7.3% below pre-pandemic levels. Other indicators show restaurant spending is back to normal. There is a chance spending temporarily gets above pre-pandemic levels this summer. We should see if that will occur from data in a couple weeks. The bottom chart shows the hotel occupancy rate increased to 61.8% as of May 29th. It’s about 10% below where it was in May 2019. The occupancy rate should be higher than ever this summer when pent up demand is unleashed. There will be limits on international travel, but there will be a spike in domestic travel.

Homebuilders Are Beefing Up Their Lot Supply

There has been a housing shortage ever since the end of the first wave of the pandemic. Prices have been rising. We need an increase in supply since rates aren’t going high enough to suppress affordability. It’s ironic that interest rates are low in part because population growth is low. Low rates make housing more affordable which allows people to start families. If the home ownership rate increases and stays high, we might see a higher birth rate. We will focus on if there is a post pandemic baby boom. That’s a 2022 story. Therefore, we still start to get data on that mid next year. It will be interesting to hear anecdotal evidence from friends and family as well.

As you can see from the chart below, homebuilders aren’t messing around. They are getting aggressive. The weighted average growth in lots controlled rose 23% in Q1 which lapped 6% growth last year. The 2 year growth stack increased from 21% to 29%. New supply is coming soon. This is just as some buyers have pulled back due to tough buying conditions. Ironically, some buyers pulling back makes the market healthier. This is the opposite of a bubble because banks haven’t been giving out loans as willingly as 2019 let alone 2004 (a whole different world).

Fed Meeting Coming Next Week

The next Fed meeting is next week on June 16th. The Fed is about to more openly discuss tapering QE now that the pandemic is winding down. The Fed knows the labor market is still a few quarters from being full, but it’s also aware financial conditions are extremely easy. Tapering QE next year when the labor market is nearly full will be fine. It’s not like the Fed is going to hike rates in 2022. There shouldn’t be a big impact on markets. In fact, the market has been projecting hikes sooner than reality.

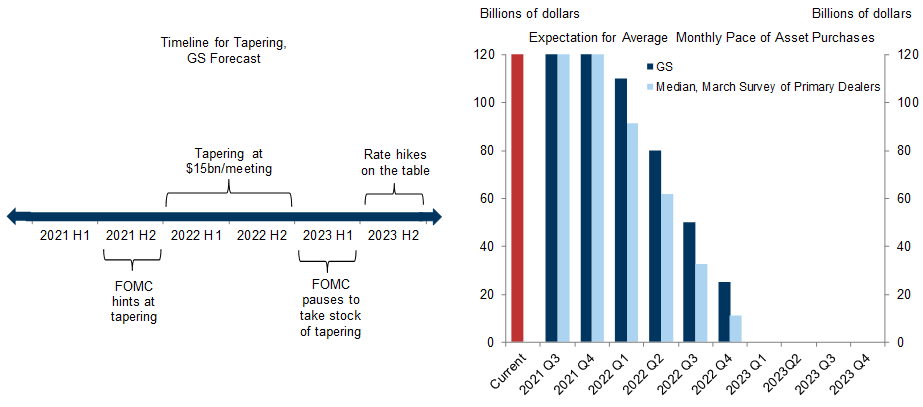

The Fed isn’t pressured by high inflation at all because it knows it is transitory. It wouldn’t make sense to hike rates next year because of high inflation this summer anyway. The graphics above show Goldman Sachs’ expected tapering and rate hike timeline. The consensus is going to quickly coalesce around rate hikes in 2023 when the Fed becomes more open about its tightening policy. The Fed hasn’t wanted to discuss it because there was no need to when the labor market was in disarray and the pandemic was ongoing. That is changing.

The first step will be to discuss tapering. Then the tapering will occur. Next, the Fed will discuss hikes. Finally, the Fed will start hiking in 2023 if everything goes according to plan. Obviously, a recession would ruin the timeline, but that’s unlikely. Rather, we will see several short slowdowns like we saw in the last expansion. The last expansion would still be going if it wasn’t for the pandemic.

Inflation Peak Is Here

Inflation is in the process of peaking this summer. Producers have invested in more supply; pent up demand will wain in the next few months. The supply chain issues will mostly go away in the 2nd half of the year. The May CPI report will show high inflation again, but this is old news. Investors are focused on when inflation will fall. We have known inflation would be hot in May for months. As you can see from the chart below, the G5 credit impulse implies lower expected US inflation. We are in a temporary post-pandemic period with elevated inflation which will end in a few months.

The Wealthy Are Self-Made

As you can see from the chart below, 83.7% of very high net worth and 71.9% of ultra high net worth individuals were self-made. This term has gotten very political over the years because no one is truly self-made. Getting a $250,000 loan from your parents like Jeff Bezos got helps a lot. However, 99.99% of people wouldn’t have been able to build a massive company like Amazon with that money or with even more money than that. A successful business is more than just money.

Conclusion

The economy is headed back to normal; we just don’t know what normal looks like. The location of work will either be in the office or at home. We will see the final results by the early fall. Many companies are bringing workers back to the office in stages. The Fed will more openly talk about tapering at the June meeting, but no details on timing will be given. Inflation is peaking. Look for CPI to fall off its peak this fall. Most rich people were self-made. It’s good that most rich people didn’t inherit their wealth because that’s an oligarchy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.