UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

We have been starting to see a stabilization in initial jobless claims which is a problem because they are still high. The economy needs a fiscal stimulus and COVID-19 solutions to take the next step in the recovery. The decline in continued claims is a mirage as people are moving off traditional benefits to pandemic and extended benefits. The increase in PEUCs was actually larger than the decline in continued claims in this report.

These bad results signal the October jobs report will be weak. Headline job creation will probably be helped by an improvement in government jobs added, but private sector jobs added will probably fall sharply. Because that report will come out so close to the election, it’s not going to encourage more stimulus. Either a stimulus passes in October or we might need to wait until the end of the year during the lame duck period.

The Details Of The Report

Specifically, initial claims in the week of October 3rd were revised up 5,000 to 845,000. In the week of October 10th, there were 898,000 initial claims which was above the consensus of 825,000. California’s data wasn’t updated even though they started accepting claims. As we have been discussing for the past 2 weeks, there was an influx of claims because of the backlog created by not accepting any for 2 weeks. We didn’t realize California wasn’t going to report results for 2-3 weeks until they normalize.

When we first discussed how California was keeping claims the same 3 weeks ago, we did it in the context of an improving labor market which meant claims were artificially kept high by the state. California wasn’t updating us on the improvement. Now the context is different as the labor market is reversing course. Keeping claims where they are artificially suppresses the national total. California is about 20% of the country’s claims.

Non-seasonally adjusted initial claims were up from 809,000 to 886,000 which is the highest since the week ending August 1st. That means claims are the highest since the $600 in federal help ended. It turns out, people didn’t go back to work just because some of the benefits expired. Speaking of expiring, if nothing is done, the pandemic benefits will expire in December. In all likelihood, something will get done. The government wouldn’t let millions of people go without any income. It’s pretty much a certainty that COVID-19 will be with us by December, so there is reason to support workers as they struggle to find jobs.

Continued Claims Jam

PUA initial claims fell 91,000 to 373,000. That’s why the total with NSA initial claims was down 1% this week. However, California stopped reporting PUAs and Arizona isn’t reporting PUAs. Both states have had crazy high totals. The high totals were wrong. Just because the data is getting more accurate doesn’t mean the labor market is improving.

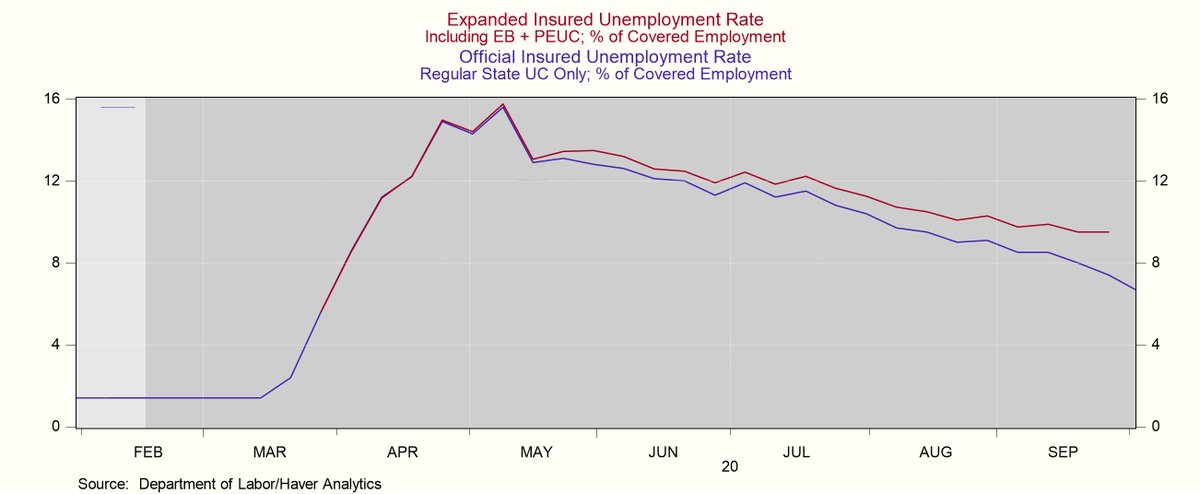

Continued claims are a misnomer because millions of people are running out of their normal 26 weeks of benefits because the recession started in March. We will see a sharp decline in continued claims throughout October and into early November as these benefits continue to expire. Specifically, in the week of October 3rd, there were 10.018 million continued claims which was down from 11.183 million. As you can see from the chart below, in the past 4 reports if you add in extended benefits and pandemic benefits, continued claims have hardly fallen. Shifting people from one form of benefits to another doesn’t mean the economy is getting better.

Furthermore, Georgia, Kentucky, Florida, and Hawaii aren’t reporting any PEUCs which means pandemic continued claims are even higher than the chart shows. Even without those states, there was an 818,000 increase in PEUCs. That’s greater than the decline in continued claims (2 weeks ago). The labor market isn’t healing which makes sense because the areas that survived in this new economy have already brought back their workers. The areas that don’t do well in the new economy, can’t bring their workers back.

Fewer Rents Being Paid (Compared To 2019)

Most rents are being paid, but there are still issues. As you can see from the chart below, the percentage of rents paid increased 0.6% in October compared to September. It’s possible that the declines in August and September from July were related to the decline in federal help with unemployment benefits. The 2.4% decline in rents paid compared to last year equates to 271,000 households. Just because the percentage is small, doesn’t mean this isn’t a big deal. We could easily see this reverse if another stimulus package passes.

More Air Travel?

You wouldn’t think that with the COVID-19 pandemic getting worse in the Midwest that the number of people flying would be increasing, but it is. As you can see from the chart below, the 7 day average of TSA throughput in October hit 859,548 which is above the spike due to Labor Day. It’s still below 2 million where it was in March, but any improvement helps. You would think this will reverse course as COVID-19 cases increase, but we will see.

Time For Euphoria Again

This is a speculator’s market again. As we mentioned in a prior article, traders are using the same playbook that has worked for years and worked well this spring. They are buying the dip. Few speculators are gone from August. They just went into temporary hibernation. As you can see from the chart below, this week the NAAIM exposure index rose from 73.05 to 102.93 which is about 3 and a half points below the peak in late August.

Conclusion

The labor market is getting worse which means the October labor report will be bad. The economy needs a stimulus and a COVID-19 solution. More people paid rent than last month, but it’s still down 271,000 from last year. Flying has increased in October despite the spike in cases in the Midwest. Speculators are back in the market. They don’t get scared by 10% declines. In fact, that correction made them more bullish.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.