UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Ever since the positive vaccine data came out, we have been previewing the spike in travel spending. It’s finally here. As you can see from the chart below, airline spending by the traditionalist generation has more than doubled since late last year. These retired folks spend a lot on vacations. They are about to make up for their missed vacations last year. This is just the beginning of the spending boost.

Spending on lodging hasn’t recovered much yet, but it will this summer. Millennials should be a few months behind traditionalists because they will get the vaccines later. 2.079 million vaccines are going out per day. Most seniors have gotten it. At this pace 75% of America will be vaccinated in 6 months. With the recent approval of the J&J vaccine, it should happen even sooner. As of Friday March 5th, there were only 42,541 Americans in the hospital. It’s closing in on the lowest level since the pandemic began in the spring of 2020.

Jobless Claims Rise Slightly

In the week of February 27th, jobless claims rose from 736,000 to 745,000 which was 15,000 below estimates. We should see a decline in March. Our expectations for an improvement are increasing quickly. Non-seasonally adjusted claims rose 32,000 to 748,000 and PUAs rose 9,000 to 437,000. As you can see from the chart below, in the past 3 weeks, the movement in California’s PUAs + PEUCs has more than made up the national change.

The latest change to the stimulus plan is benefits will be $300 instead of $400 per week. They will last until September. The good news is the first $10,200 won’t be taxed. That means about all the extra benefits won’t be taxed. That’s a nice bonus after losing $100 per week.

Continued claims fell from 4.419 million to 4.295 million in the week of February 20th. In the week of February 13th, the total number of people on all benefits programs fell from 19.045 million to 18.027 million. In other words, this stimulus is still extremely important to the near term financial wellbeing of millions of people even though the pandemic is under control.

Job Cuts Crash

The February Challenger Jot Cub report showed much fewer cuts than in January. The labor market is beginning to heal. Cuts fell from 79,552 to 34,531. That’s a 39% decline from last year when the pandemic was just starting. The Senior VP of Challenger stated a full recovery could be on the horizon. That’s exactly correct. It will be quicker than most economists expect. There were 146,403 announced hires. 66,486 of those were from retail.

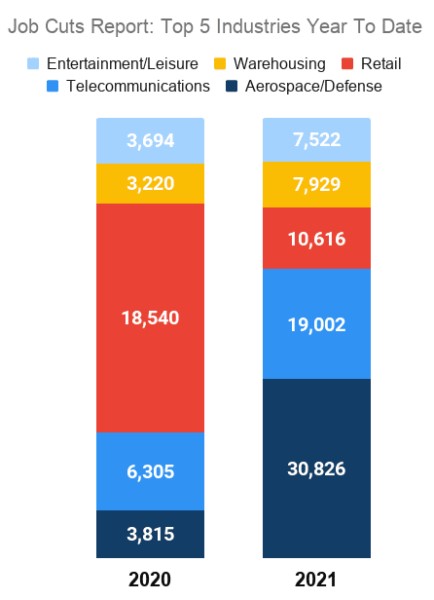

Energy was hit hard though. There were 3,736 cuts in this industry which means there have been 5,672 this year. That’s up 59% from last year. There aren’t many workers left in this industry. It’s awful to get fired right at the end of the cycle. The recovery is in sight since oil prices have been rising. The chart below shows the top 5 industries with the most job cuts in the first 2 months of 2020 compared to this year. There was a steep decline in cuts in each industry.

Breaking it down by geography, the West is the only region with more layoffs year to date this year than last year. The good news is that increase was all because of January. In the West, cuts fell from 62,276 in January to just 9,692. The decline occurred because of the monthly drop in Texas and Washington. They fell from 20,779 and 29,277 to 885 and 497.

Inflation Surprise

In a previous article, we mentioned it wasn’t high inflation that causes equity valuations to fall. Instead, inflation volatility causes multiples to fall because uncertainty increases. That’s exactly what’s occurring now. As you can see from the chart below, the inflation surprise index is spiking. It shouldn’t be a surprise that prices are increasing given the issues in the supply chain and the spike in demand. Plus, we have interest rates at zero and a $1.9 trillion stimulus coming.

If anything is going to cause inflation it’s this combination. Powell reiterated this week that he thinks the coming bout of inflation will be transitory. The only way inflation and growth increase in the long term is if this cyclical boom changes demographics. That’s tough to predict. We will wait another 6 months to see if a “baby boom” results from the full reopening.

Goldman Follows The Herd

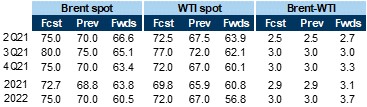

OPEC+ decided this week to keep its production quotas unchanged for April which went against expectations for a 1.5 million barrel per day increase. This pushed the price of WTI oil to $66 and Brent to $69. According to Goldman Sachs, shale, non-OPEC, and Iran will be inelastic to prices until the 2nd half of the year. That gives the oil market room to run in the next few months.

As you can see from the table above, Goldman now sees WTI oil rising to $77 and Brent rising to $80 in Q3. Keep in mind, the equity prices are starting to price in that forecast already. You want to get out ahead of these predictions, depending on your time horizon for investing. It’s not bullish to see such optimism. It’s also not immediately bearish. The only way we get big moves in commodities is if institutional investors become bullish. October was the beginning of this bull run. Now we’re somewhere in the middle of it.

Conclusion

Traveling is finally starting to come back. We are in inning one of the coming spike in travel. Jobless claims were elevated in the last week of February. We haven’t yet seen the big recovery in the labor market we are expecting to start this spring. March should have a lot of improvement. There was a sharp decline in job cuts and a big increase in hiring. If this is a leading indicator for the labor market, good news is coming soon. The inflation surprise index is spiking. Prices are just beginning their increase. Goldman got more bullish on oil following OPEC’s decision not to increase production in April.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.