UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Jobless clams are once again suggesting that the labor market improved in the month. This time claims weren’t impacted by Ohio’s normalization. In the week of May 15th, initial jobless claims fell from 478,000 to 444,000 which was 16,000 below the consensus and 6,000 below the lowest estimate. It was a great reading. We are getting closer to a full labor market almost every week. Non-seasonally adjusted claims have fallen 3 straight weeks. They fell from 492,000 to 455,000 in this past report. PUAs fell from 104,000 to 95,000.

The most important aspect of unemployment benefits isn’t the latest reading. It is the incoming changes almost half the states are making in the next couple of months. At least 21 states are going to end the emergency unemployment benefits before the September 6th deadline. The map above shows many of the end dates. This comes out to 3.5 million people coming off benefits in the next couple months. 940,000 people will lose the extra $300 in weekly benefits given by the federal government. 1.4 million people will lose PUA benefits plus the $300 extra. 1.1 million will lose PEUCs plus the $300 extra.

We are in a weird period where the pandemic is very close to over. There are millions of people on unemployment benefits programs even though there are millions of job openings that are going unfilled. Specifically, in the week of May 1st, the total number of people on all benefits programs fell from 16.86 million to 15.98 million people. That’s still a ton of people who should be working given the state of the labor market. It’s a weird situation for there to be labor shortages and almost 16 million people getting government help.

We are very sympathetic towards anyone who lost their job during the pandemic. However, the government shouldn’t pay people extra for being unemployed when there are this many jobs available. Undoubtedly, some employers have openings they aren’t serious about filling. However, there are labor shortages in many industries. Many people believe there is no such thing as a labor shortage because employers can just raise wages. While they can raise pay, many businesses operate on thin margins.

Fun With Valuation Math

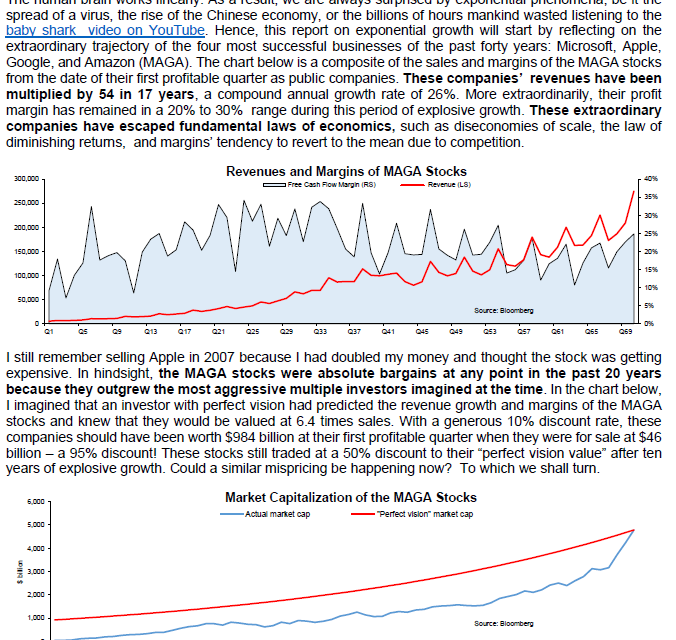

It was obvious earlier in the year that some of the stocks with multi-billion-dollar valuations and zero sales were bubbles that would crash down to earth. Furthermore, there were many tech stocks with above 20 sales multiples. Investors are trying to find the next big tech company, but they are only discovering fool’s gold. It will be very difficult for software companies to replicate the success of Microsoft, Amazon, Apple, and Google. These firms multiplied their revenues by 54 in 17 years.

Vincent Deluard went through with the mathematical calculations to show how insane some valuations still are. The screenshot above shows his math. He states that 14 of the 351 Russell 3000 stocks with PS multiples above 10 are projected to have a market cap greater than $4 trillion in 2038 based on his calculations. That’s pretty unlikely. It’s actually possible that no companies will have that market cap in 17 years. It depends on how well the major tech companies do and how well stocks do overall. 11 of them are expected to have $500 billion in revenues. It’s hard to imagine this many healthcare and tech companies doing this well. Amazon had $386 billion in sales last year.

Finally, the real kicker is that 59 companies are priced to do better than the major tech firms did in the past 17 years. It’s entirely possible that none of these companies will do this well. The next great company might not be well known now. Keep in mind that in the early 2000s, few investors believed Amazon would be this successful. It doesn’t seem likely that the next great company will rocket from being a consensus pick to becoming one of the best companies ever without extreme volatility in the meantime.

Investing isn’t that easy. If you expect there to be extreme volatility in the near term, would you buy stock in something you believe to be the next great investment? This depends on how confident you are in each prediction. Surely, you wouldn’t make a major bet on a company that has an extreme valuation at a sentiment/cyclical peak.

Very Low Z-Score For Tech

The past few months have been much different than 2020. Tech has been weaker than the rest of the market especially the innovation stocks. As you can see from the chart below, the z-score for tech’s allocation is the lowest since 2003. It’s worth noting that this doesn’t mean tech is at its bottom. It’s possible that the whole market rolls over and tech performs in line with the market. It’s also possible the allocation was lower at points between 2000 and 2003. It would be great to have that extra 3 years of data.

The only thing we know for certain is that this “new market regime” won’t be permanent just like the last one wasn’t. It feels the easiest to go long the market’s favorite industries at exactly the wrong time. That being said, the commodities stocks aren’t as overbought as tech stocks were last year.

Conclusion

About half of the country won’t have pandemic unemployment benefits in place by the middle of the summer. The good news is this means there won’t be a major impact to the labor market all at once in September. Imagine millions of people trying to get a job all at once in September. That would be chaotic. Most of the companies that trade at over 10 times sales won’t be as successful as investors think they will be. Fund managers’ tech allocation is low. That doesn’t mean the selloff in tech is done though. Stay nimble if you are trading in and out of rotations.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.