UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

In terms of President’s appointments, the Federal Reserve chairperson doesn’t get much news coverage relative to the importance of the job. The amount of coverage is similar to what Treasury Secretary gets even though that position is far less important. That’s because of two reasons. The first is monetary policy is obscure and complicated to most people. The news media benefits from getting viewers to watch their content, so they don’t have an interest in explaining what monetary policy is. Even if they did cover this story as heavily as they should, it would be unlikely that they would do a good job because they’d only have people who were former Fed members on their shows, which could do more harm than good as they exhibit bias. Bias is fine, but when you only have one side of the spectrum, it creates a distorted understanding of the world that is not entirely accurate.

The second reason why the media doesn’t cover this story as heavily as it should is because it’s living in the past. The Federal Reserve chair used to not be as important as it is now because it didn’t hold as much power. There was a time when the Fed controlled the short-term interest rate and didn’t even make statements. Now the Fed has added forward guidance to the policy mix and is relying on it heavily. Guidance packs a much more powerful punch than decisions at each meeting. That’s because guidance affects how the market prices in the chances of future decisions being made.

The Fed can use guidance to alter expectations for what it will do in the next 2 years or more. As you can see, 2 years of policy is more important than one decision. By the time the Fed makes its decision at the meeting, almost everyone already knows what it will do. When the market prices in over a 70% chance of a hike, there’s a hike; if not, the Fed does nothing. The same is true for a cut. The most important part of Fed meetings isn’t the decision the Fed makes on rates; it’s the guidance.

The other new policy is quantitative easing. That’s when the central bank buys assets. In the Fed’s case, it has bought mortgage bonds and treasures. In other cases, such as the Swiss Central Bank, central banks have bought stocks and corporate bonds. The fact that it’s possible for the Fed to buy stocks makes the Fed hold immense power. It might not be allowed by the Congress if free market believers are in charge, but buying stocks would probably only happen in a crisis. During times of economic crisis, the government bends the rules in an attempt to stabilize the status quo. Politicians don’t want the ship to sink on their watch, so they don’t care about pesky principals.

The fact that the Fed buying stocks is discussed, limits downside in stocks. Investors think the Fed has their back, creating moral hazard. As you can see, forward guidance under chairperson Bernanke and Yellen is for the Fed to listen to what the stock market wants, avoiding tightening the Fed’s policy (raising rates). That has a big impact on the market without the Fed doing anything. The final point on this scenario worth noting is that Presidents used to not have opinions on the Federal Reserve. The Fed’s power to affect the economy grew in 2008. Before then it wasn’t as big of an issue. Yellen was picked because she had experience in monetary policy. It was a situation where the person at the helm was changed, but there wasn’t a change in philosophy.

The next Fed chair pick in February 2018 will be unique because the Fed holds more power than ever and President Trump ruthlessly criticized Yellen on the campaign trail. In terms of monetary policy, Hillary Clinton ran a campaign that was similar to the past. She modestly approved of central bank policy, mostly because Obama picked Yellen, however it wasn’t a campaign issue she focused on.

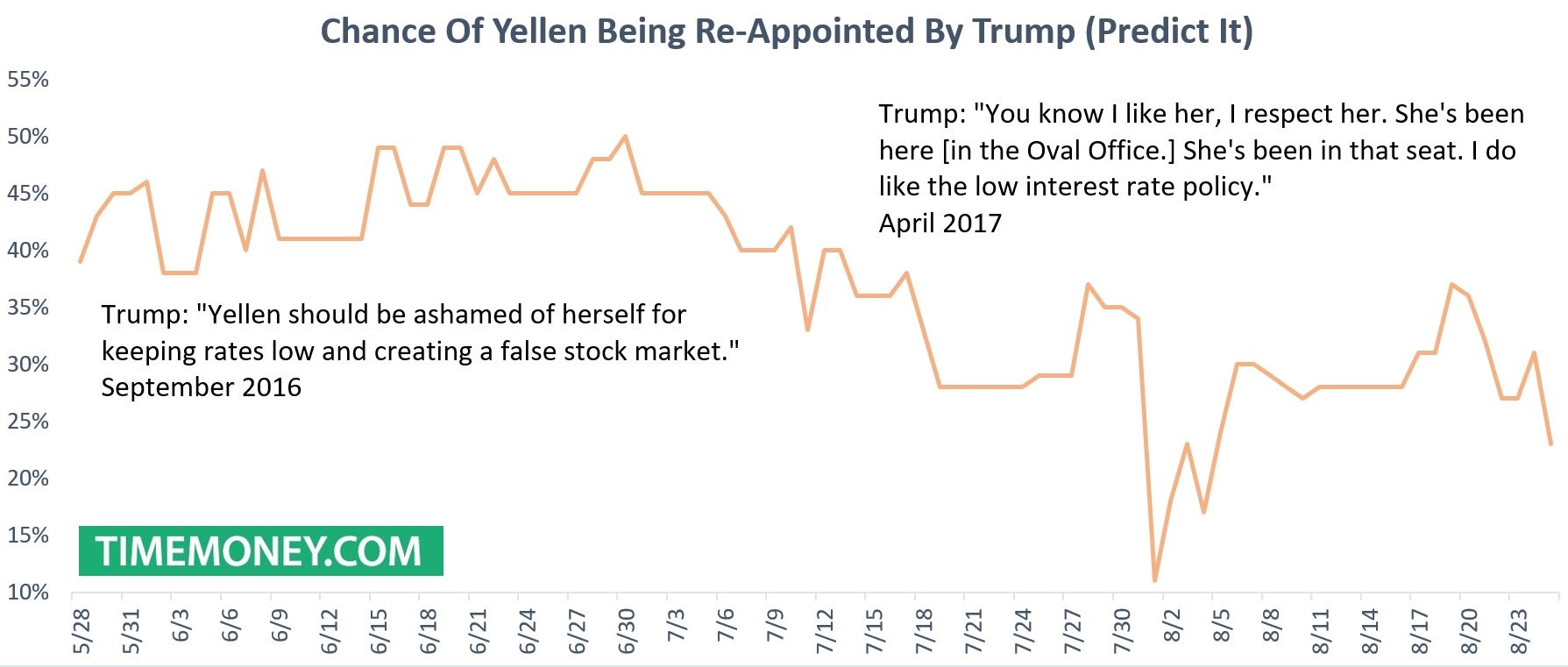

In trying to figure out who Trump will pick, let’s look at the Predict It betting odds. As you can see, Yellen’s odds are in the 20s. She’s the 2nd most likely person to be picked. It’s highly unlikely she will be picked because she stands for financial regulations which Trump is against. The chart below shows Trump’s specific attacks on Yellen on CNBC in September 2016. He has since moderated his tone in April 2017, complimenting her. That statement is why her odds are in 2nd place.

The logical follow-up question is either Trump was politically posturing or he supports Yellen. It’s possible Trump still doesn’t like Yellen, but didn’t criticize her because he didn’t want to roil the markets. If he knew he couldn’t change her position until next year, it makes little sense to make ruthless attacks. He needs her to do her job, completing the term, supporting the economy. The other possibility is Trump was politically posturing by criticizing her in 2016 to gain political points in the election, meaning he will keep her in the position. You can decide which scenario is more likely. The only way of knowing is after he makes his pick.

The person with the highest odds of being picked, with chances in the 30s, is the Director of the National Economic Council, Gary Cohn. Cohn doesn’t have monetary policy experience which makes the situation dicey. That’s consistent with the point made earlier. We live in a new world, where the next chairperson may not be of the same mold as Bernanke and Yellen. The argument against Cohn’s odds of being picked is that he may not accept the role. He almost stepped down from his current position because of the President’s response to the Charlottesville riots. Former Fed Governor Mark Olson told Cohn not to accept the role because he doesn’t have proper experience. That doesn’t mean Cohn will listen and it’s not surprising an insider wouldn’t want an outsider to get the job, but it’s still worth noting.

Conclusion

Trump’s pick as Fed chair could be the most important decision of his presidency depending on who he picks. The only thing we know is Trump likes low interest rates and doesn’t like regulations. It’s tough to find an insider who hates regulations, making it tough to make a decision. Someone with no monetary policy experience may not take the job. Secondly, it’s difficult to find someone who doesn’t like regulations and likes the Fed keeping rates low to prop up the economy. Those two points are philosophically opposites.

That’s why we’re in the situation where the two candidates who are the most likely to be picked don’t have high odds. It would be great if the press focuses on asking Trump about this instead of various non-stories. However, even if the press asked about the Fed, Trump might give a confusing answer like he did in April. We’ll have to wait until February 2018 to see who he picks.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.