UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The housing market is doing well as there is underlying demand from millennials getting older. The lower 30s age range is the sweet spot for first time home buying. Then there are cyclical support which is the decline in interest rates and the movement away from cities to the suburbs because of COVID-19. It doesn’t hurt that household wealth is at a record high partially because of the stock market. This summer housing activity was taken from the spring as the economy was truly shut down in March and April, which are typically high points in the year for the housing market. The delay did nothing to stop people from buying. If anything, it encouraged buyers because the recession lowered rates.

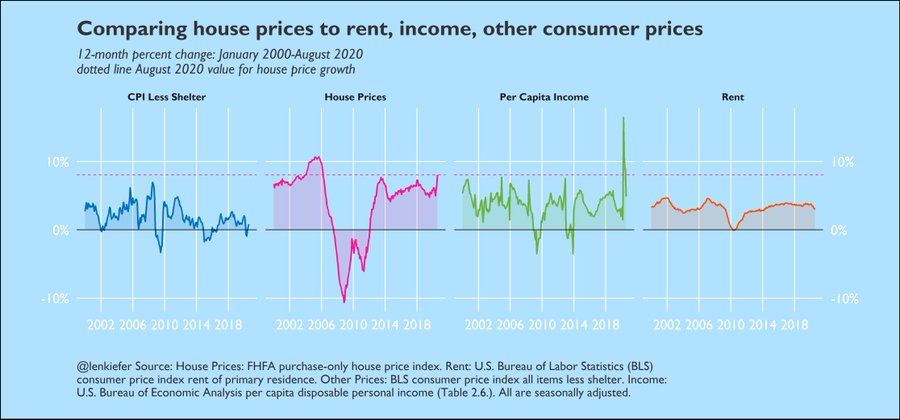

The biggest negative on housing is how expensive it is getting. As you can see from the chart above, house price growth is much higher than rent inflation and income growth. Income growth briefly spiked because of the stimulus, but that was temporary. House inflation is much higher than CPI less shelter since shelter drives inflation and commodity prices have been low. If rates rise, it will put more emphasis on how expensive housing has gotten. That’s a double negative for the homebuilding stocks. The actual housing market isn’t going to take a dive like in 2008 as the economy and labor market would be doing well if rates were to rise. This isn’t like the housing bubble where mortgages went underwater. We’re just discussing a cyclical slowdown in home price growth due to affordability issues.

Huge ISM PMI Beat

The market was caught leaning in the wrong direction in late October because the October ISM PMI report was fantastic. Investors were expecting a cyclical slowdown, but the ISM PMI rose from 55.4 to 59.3 which beat estimates for 55.7 and the highest estimate which was 57. As you can see from the chart below, this was a 2 year high. We are almost back at the 2017 peak which is great news for industrial production which was weak in September. The new orders index spiked 7.7 points to 67.9 and the production index rose 2 points to 63. This report is consistent with 4.8% GDP growth.

This isn’t to say there won’t be somewhat of a slowdown in November or December because of COVID-19. We have to discuss what the data shows, not what it could show. It’s easy to get caught being too bearish when you see record high cases. However, the economy has adapted to this new world for the time being. A transportation equipment firm stated in the comments section, “Sales continue to be strong — up 4 percent this September compared to September 2019. The year-to-date level is still 21 percent below last year due to the [COVID-19] shutdown, but sales are stronger than expected and forecast to stay strong through the first quarter of 2021.” 16 of 18 industries had higher new orders and only textile mills saw a decline.

The prices index was up 2.7 points to 65.5. Only the price of caustic soda fell. However, this report shows lumber prices were up which is weird because they crashed in October. As you can see from the chart above, energy prices and the prices index have diverged. Maybe if the economy is really going into a new cyclical recovery, there will be a recovery in oil prices. Energy has been in the dog house like no other sector ever. Energy stocks are down over 60% more from their peak than the overall market. That’s the worst relative performance since 1928. It’s so bad, people seriously discuss the notion of energy being obsolete even though OPEC projects demand growth until 2040.

Global Recovery?

The Markit manufacturing PMI wasn’t as great as the ISM report, but it was still good enough to reach the highest level since January 2019. The PMI rose from 53.2 to 53.4. Just like in the ISM reading, the price index spiked. It was the highest since the start of last year. One weak point was export orders which fell for the first time since July because of economic restrictions due to COVID-19.

The global PMI was stronger too. The global manufacturing PMI rose from 52.4 to 53 which is a 29 month high. As you can see from the chart above, global manufacturing breadth hit 80.8% as the cyclical recovery looks nearly complete. Diffusion indexes recover quicker than actual production, but undoubtedly, we will see improved yearly manufacturing growth in October. The global new orders index was up from 53.8 to 55. Input prices were up from 54.7 to 55.2. Inflation could be coming soon.

As we mentioned, Europe is undergoing lockdowns to fight COVID-19. Many don’t think lockdowns are worth the economic consequences, but politicians do them anyway because they aren’t pragmatic. The shutdowns will have huge impacts on Europe’s GDP in Q4. America should far exceed Europe’s GDP growth. The Atlanta Fed GDP model shows Q4 growth in America will be 3.4%. That’s much different from Europe.

As you can see from the table above, Goldman’s new estimate following the lockdowns is -2.3% growth in Q4 which is down from 2.2% growth. It went from right in line with America to a contraction. France will be the worst off because it has the most economic restrictions. Growth is expected to be -3.8%. If Goldman showed predictions for Switzerland and Belgium, they would be very bad too.

Conclusion

Home price growth is too high. It won’t continue as it will make housing unaffordable. The ISM manufacturing report was a huge winner. It signals the cyclical recovery is alive and well despite the rise in COVID-19 cases. Imagine how well the recovery will go once we get a vaccine and a fiscal stimulus. Europe is set to vastly underperform America in Q4 as it is undergoing costly lockdowns. The only hope European investors have is the lockdowns end in December. There won’t be a vaccine quick enough to get the economy back to normal in December. The best hope is the vaccine starts to go out to the most vulnerable by then.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.