UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

A high ISM manufacturing index is a bad sign for the economy and cyclical assets over the next year. Therefore, you can point to the modest 1.8 decline in the January PMI to 58.7 as a positive. On the other hand, you can say the economy is rolling over. Another perspective is to say the ISM is a diffusion index. The comps are getting tougher as the manufacturing sector improves, meaning for orders and production to be stronger than last month there is a higher threshold than there was a few months ago.

We’ve probably covered all the potential ways to look at the headline print, which is the equivalent of 4.4% GDP growth, so now let’s get into the details of the report. As the chart above shows, the production and new orders indexes had big swoons as they fell 6.4 and 4 points to 61.1 and 60.7. They’re still firmly in expansion though. The most notable figure in this report is the prices index as it rose 4.5 points to 82.1. That’s the highest reading since 2011. The CRB commodity index hit a 52 week high on Monday as it is up 75% since its April low.

It’s almost comical to see such a strong increase in commodity prices with such a low CPI (or vice versa). Regardless of what the CPI shows, it’s not good for the economy to be overheating this much. Hopefully, supply suppresses prices because yearly manufacturing growth hasn’t even gone positive yet. As of December, yearly growth was -2.6%. It probably won’t go positive until March due to comps.

Within the report, a plastics & rubber products firm stated, “January 2021 started with strong orders for plastic components in auto, electrical and other sectors. The industry outlook is optimistic. Looking at investing in new equipment for anticipated demand later this year. Reshoring is taking hold, with new customer potential.” That doesn’t sound like manufacturing is headed for a cyclical slowdown. It shouldn’t be for at least the next 6 months.

When Will The Fed Hike Again?

We mentioned in a previous article how our article where we showed that rate hikes were being priced in for 2022 ended up being a near term top in the 10 year yield. Since that more recent article, the 10 year yield has risen again. It’s back up to 1.089% after flirting with falling below the 1% marker late in January. The 10 year yield should rise to 1.5% if the vaccination process goes smoothly and another stimulus passes. Since we are close to ending the pandemic in America, there is no doubt the vaccination process is more important than the stimulus for yields and cyclical stocks in the short term (next 3 months).

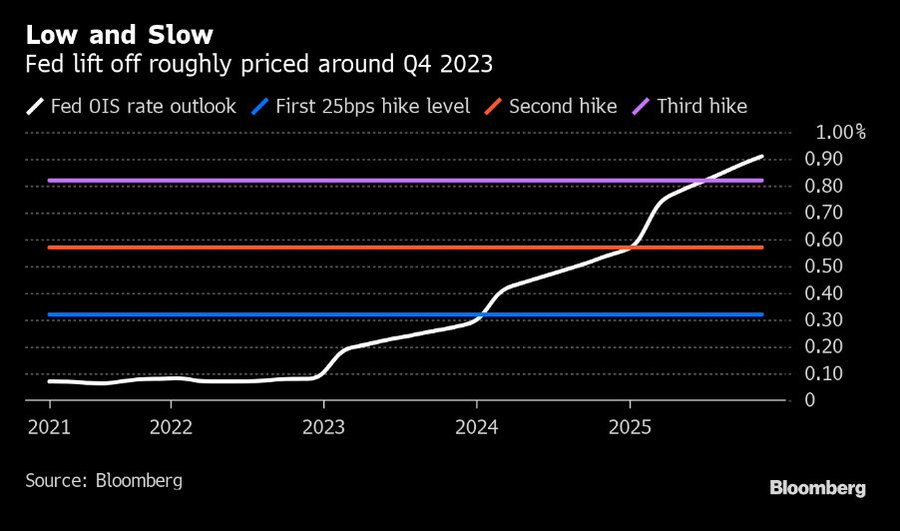

The chart above shows the current expectation for the Fed funds rate in the next 5 years. Now, the market doesn’t see the first hike until early 2024. Expectations will fluctuate greatly based on near term sentiment because it’s so far out in the future. 1 year from now, expectations won’t fluctuate as much unless the recovery doesn’t go smoothly and rate hikes are still more than 2 years away. The takeaway here is if the economy reopens fully this summer, we could easily see expectations revert to seeing a hike in 2023.

Wow! What A Recession

Main Street still sees this as a recession even though they are speculating wildly in stocks. They are operating under the philosophy, “when the music is playing, I dance.” They see the market doesn’t react to their own heartache, so they buy and ignore the economy. If you personally haven’t lost your job because you are a white color professional working from home, you might forget how bad the recession was and how much damage the labor market has incurred.

As you can see from the chart below, we’re near the low point of the drop in employment in the financial crisis. The 2007-2009 recession was considered the worst recession since the Great Depression. Furthermore, if you exclude the worst hit industry in nominal terms, which is food services, the recovery matches the prior two recessions using the same timeline. Of course, the 2008 recession ended up getting worse.

The table below shows the worst hit industries in percentage terms up until December. It’s no surprise the movie industry has seen a 42.1% decline in jobs. There still hasn’t been a return to normalcy because New York and California have restrictions. Spectator sport jobs are down 39.3% because most sports don’t have many fans in attendance. The Super Bowl plans to have 22,000 fans with 7,500 being vaccinated healthcare workers. If the game was a month later, it might have been possible to have a full stadium. On the opposite side, if the game was a month earlier, there probably wouldn’t be anyone in attendance.

Short Selling Isn’t A Thing

Normally, short term stock action is meaningless, but sometimes it has long term implications. For example, the short VIX trade unwinding in early 2018 caused some products to stop trading. The action early this year has been more severe as the rise of pretty much any stock with a high short interest is causing many investors to stop shorting and stop publishing short reports. The hardest market to short ever went out with a bang. Now, there simply aren’t many shorts left. As you can see from the chart below, the median stock has a 1.6% short interest which is 1 tenth above the bottom at the trough of the tech bubble.

Conclusion

The ISM manufacturing index fell modestly. When you look at the details, the decline was more severe. Even still, the manufacturing recovery should continue through most of 2021. Now investors don’t see a Fed hike until 2024. The damage to the labor market caused by the recession was severe and still exists. The market for short selling was so bad in January that short sellers with decades of experience gave up. There weren’t that many shorts to begin the year with. Sentiment for short sellers is so bad, that it reminds us of the sentiment among energy investors last year.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.