UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The Chinese economy had been seeing declining growth for the past 7 years up until 2017 as it transitions away from being based on manufacturing and toward services and consumption like the United States. Because the Chinese policy makers are more concerned with preventing financial bubbles, diversifying the economy, and preventing pollution, most economists think there will be a deceleration in 2018. We’ll discuss the future trajectory of the economy later in this post, but let’s first review 2017.

As we mentioned, Chinese GDP growth in 2017 accelerated for the first time in 7 years. GDP growth exceeded the government’s goal of 6.5% and beat 2016’s growth which was 6.7% as it came in at 6.9%. It was 6.8% in Q4. Growth has been coming from exports. The “global synchronized growth” term which has become popularized in the past year, is driving this improvement as exports increased the most in 4 years. Keep in mind, these buzzwords are usually backward looking. After a weak 2016, economists were all talking about tariffs and populism causing a decline in trade. Sometimes these buzzwords make short term trends seem like more than they are. There’s always a reason for changes in growth, but the changes aren’t always sustainable.

Trade Growth Drives Chinese Economy In 2017

The increase in demand for semiconductors and other tech products has boosted growth. That could change, but 2017 didn’t see any restriction as there was an increase in America’s trade deficit with China. It’s wrong for policy makers to only think about the negative effects cheap Chinese goods have on U.S. firms who can’t compete. Instead pundits should think of the capital freed up to invest in firms which are globally competitive or the extra money consumers have because they bought cheaper products. One factor to keep in mind for the U.S. is that this bilateral trade deficit has a net negative effect on GDP. Exports help GDP growth and imports hurt it. U.S. GDP is driven primarily by consumer spending, but trade is also important.

The Official Stats Can Be Misleading

China is trying to transform its economy to be more reliant on consumer spending, so stats measuring the strength of the consumer are becoming more important to review. December retail sales growth was 9.4% which was the slowest growth since February 2006. On the bright side, November, which includes Singles Day, which is a massive shopping holiday in China, saw 10.2% growth. Disposable income growth was 7.3% in 2017 which was up from 6.3% growth in 2016.

The main problem with any data from the Chinese government is its reliability. The Chinese government is widely considered to falsify data. However, you can’t just say everything is a lie and throw your hands up in dismay. The chart below helps us figure out where growth is compared to the official number. The Capital Economics China activity proxy shows growth had improved in 2016, but recently started to decelerate again. The firm expects 4.5% growth in 2018, ignoring the official report.

Official GDP Growth Versus Estimated GDP Growth

Central Bank Tightening

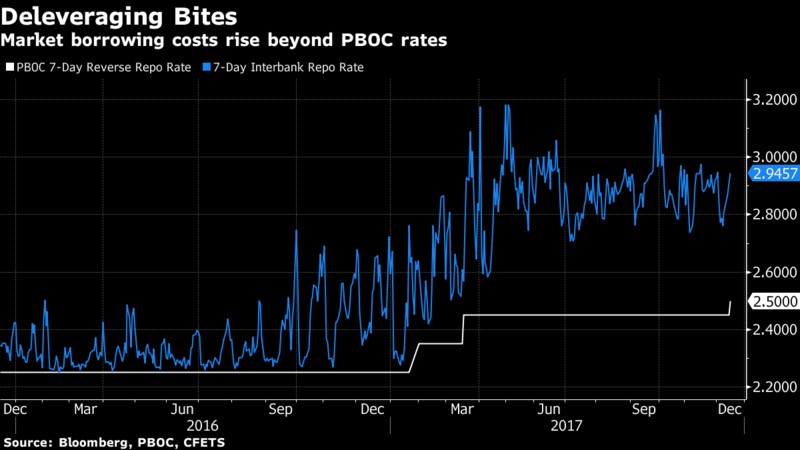

The estimates for 2018 economic growth are conservative partially because of tight monetary policy. The official government projection is for 6.5% growth again. The chart below shows the People’s Bank of China has been increasing the 7 day reverse repo rate.

Financial Conditions Tightening

Furthermore, the market is pushing for more tightening as the 7 day interbank repo rate is higher than what the PBOC has it set at. Money supply growth is also set to slow after it grew 9% in November 2017 which was a record low; it is heading towards 7-8% growth in the next few years.

The Details Of The Fixed Investment Growth Deceleration

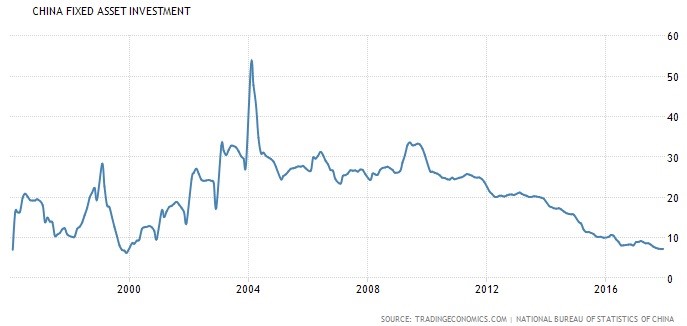

Chinese fixed asset investment in 2017 was up 7.2% which was the slowest growth rate since 1999 which had 6.3% growth as you can see in the chart below.

Fixed Asset Investment Growth No Longer Growing At An Unsustainable Clip

Fixed asset investment has increased 20.61% per year from 1996 to 2017. You can see the government attempting to quell bubbles as the public investment growth was 10.1% in December which was down from 11% in the first 11 months of the year. It was up 18.7% in 2016. Private investment growth was 6% in December which was up from 5.7% growth in the first 11 months of the year and 3.2% in 2016. These are great steps, but the public investment growth is still almost double private growth. Besides moving away from public sector investment this deceleration shows the Chinese economy moving away from being based on manufacturing and towards being based on services.

Chinese Property Explosion

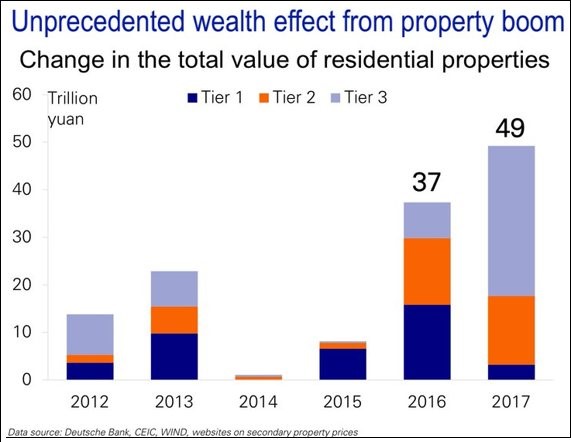

Obviously, China has a pollution problem. You can tell that by visiting the country. If you’re wondering why China is so worried about financial bubbles, look at the chart below which shows the Chinese property market has created a massive wealth effect.

Chinese Property Explosion Centered In Tier 3 Cities

The tier ranking system is based on the size of cities. Tier 3 had the biggest increase because the Chinese government is trying to help solve the problem of urban density by having people move to the less populated cities. The tier 3 cities have more affordable housing, although, that’s clearly changing, evidenced by the huge increase in value in 2017.

Tiers Explained

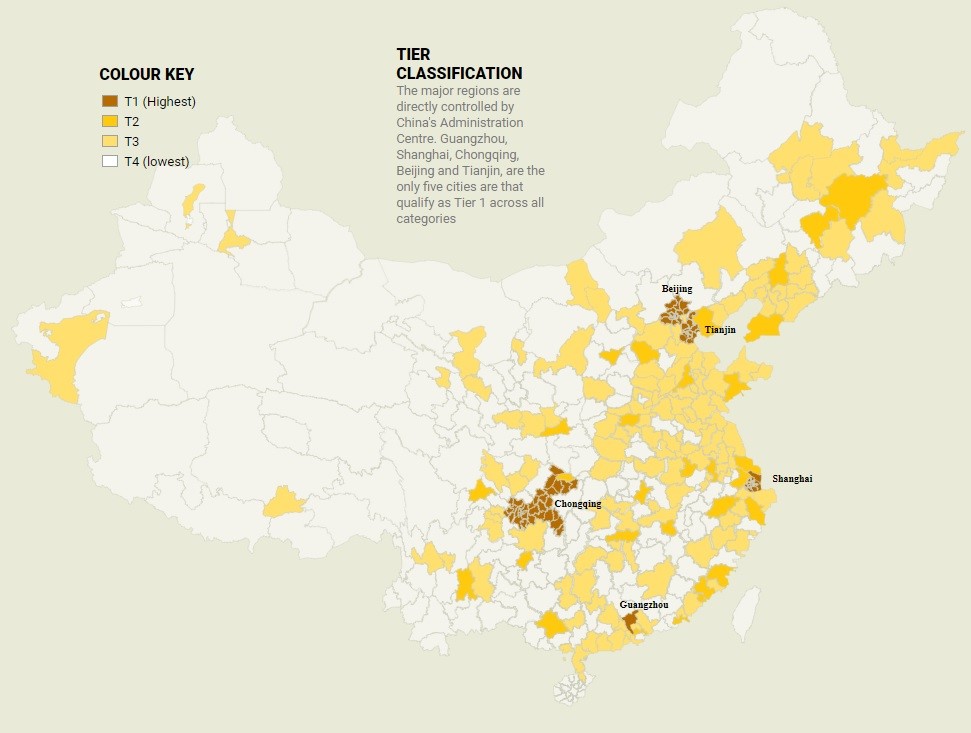

The map below shows where the cities in each tier are located. In terms of economic qualification, all 1st tier cities have $300 billion in GDP, 2nd tier cities have GDP between $68 billion and $299 billion, and 3rd tier cities have GDP between $18 billion and $67 billion. In terms of political qualifications, tier 1 cities are directly controlled by the central government, tier 2 cities are provincial capital cities and sub-provincial capital cities, and tier 3 cities are prefecture capital cities. Finally, in terms of population, tier 1 cities have 15 million people, tier 2 cities have 3-15 million people, and tier 3 cities have 150,000 to 3 million people.

Map Of Tiered Cities

Conclusion

There is growing evidence to suggest that China could face further declines in economic growth with monetary policy tightening, fiscal spending on fixed investments and retail sales decelerating. The Chinese government is trying to avoid problems which have already been created, namely the property bubble which has shown explosive valuation increases in tier 3 cities. A further weakening USD could also be a negative catalyst for the Chinese economy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.