UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Q1 Productivity and Costs report was very impressive. It’s great news for economic growth. Annualized productivity growth rose from -3.8% to 5.4% which beat estimates for 5.4% despite the 0.4% positive revision to Q4 results. Output growth was 8.4% and hours worked were up 2.9%. Unit labor cost growth was -0.3% which was above estimates for -0.6%. This was down from 5.6% growth in Q4. Compensation growth of 5.1% was offset by the high productivity growth we mentioned earlier. It’s amazing for corporations if productivity can grow quicker than wages. That offsets the big cost increase that’s coming this summer now that we are seeing labor shortages.

Now let’s look at results compared to Q4 2019 because that was the last quarter not impacted by the pandemic. Business output is down 0.6%. Hours worked were down 4.3% which makes sense because we don’t have as many people working. Productivity is up 3.9% which makes sense anecdotally. There has been a large increase in software spending which is supposed to make workers more efficient. Compensation is up 8.1% and unit labor costs are up 3.9% from before the pandemic. It’s fun to see just how much the pandemic re-worked the economy. We will finally see the long term impact after it’s over.

Q1 Was A Winning Earning Season

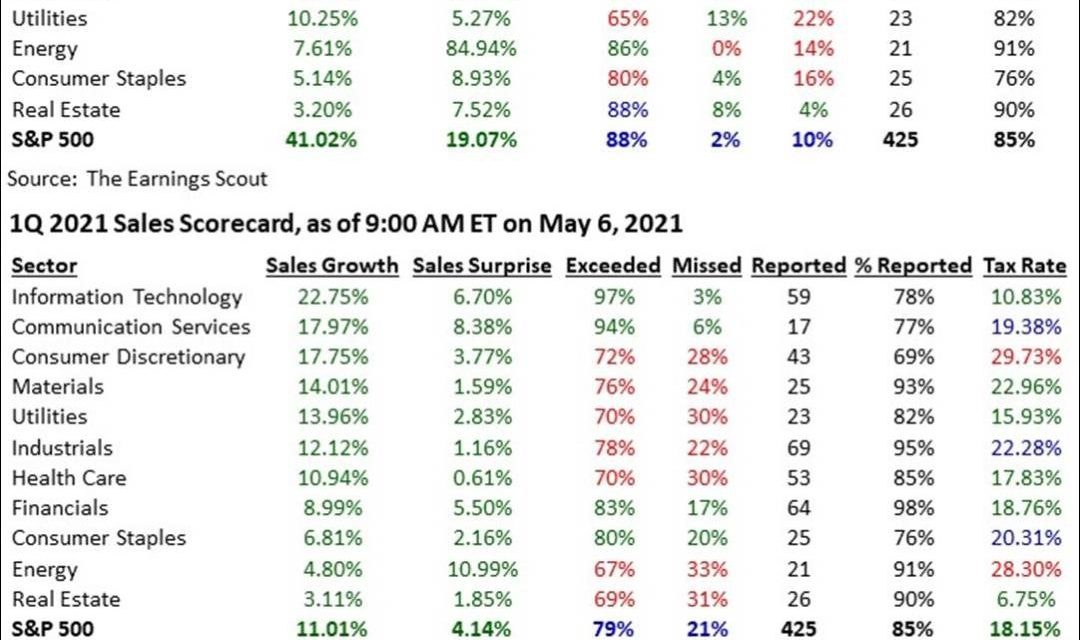

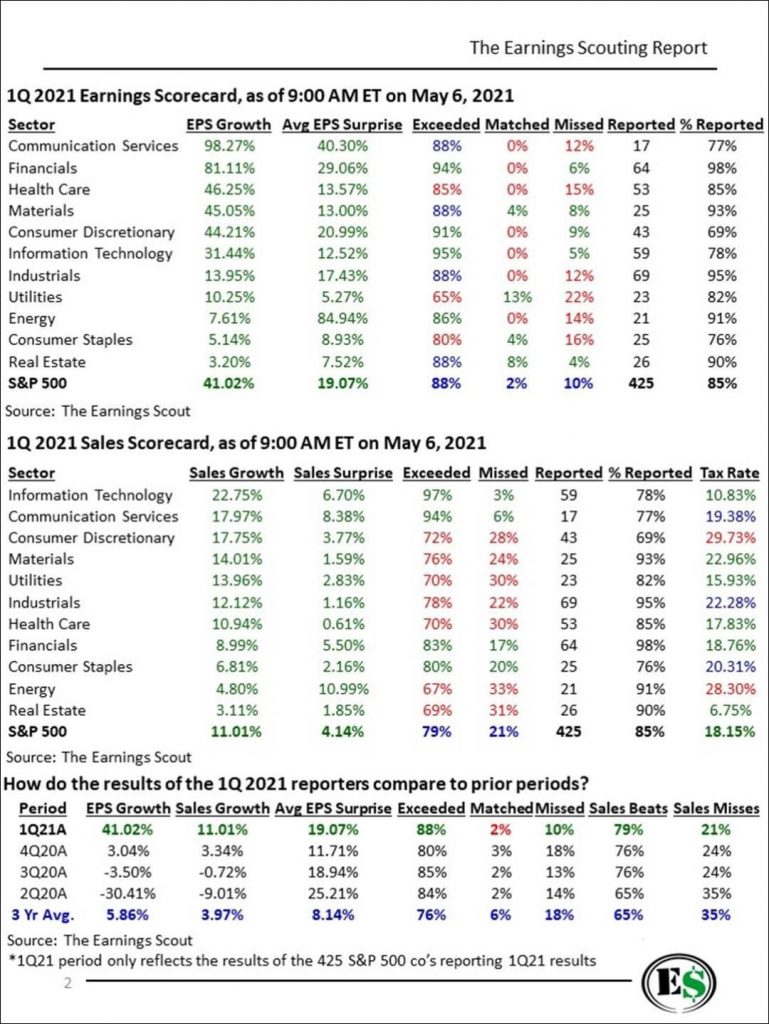

With Q1 earnings season 85% over as of May 6th, we can look at the almost final results. This quarter was amazing. EPS growth has average 41.02%. The average EPS beat was 19.07% and 88% of firms beat estimates (3 year average is 76%). The 3 year average beat is 8.14%. Keep in mind the past few quarters are pushing that average higher than it is usually.

94% of financial beat estimates and EPS growth was 81.11%. This was one of the best earnings seasons ever for the sector. Sales growth was also amazing. S&P 500 sales growth was 11.04%. The average beat was 4.14%. 79% of firms beat sales estimates which is above the 3 year average of 65%. The average tax rate was 18.15%. Tech firms only paid a 10.83% tax rate. Taxes are about to move a few percentage points higher based on Biden’s corporate tax increase and the 15% global minimum tax rate implemented by the G-20.

It’s amazing to watch the increase in EPS growth estimates in Q2 and Q3. Q2 will have peak earnings growth since we will be lapping the worst of the pandemic’s impact on the economy. Q2 EPS growth was expected to be 37.92% at the start of the year. With the vaccine distribution going so well and a stimulus passing, the consensus EPS growth estimate has risen to 56.53% as of May 6th. Q3 EPS growth estimates have risen from 13.98% on March 1st to 18.94%. Finally, growth will normalize in Q4 as analysts expect 15.95% growth. We could see estimates come down like they usually do leading up to Q4 since the comp will be much tougher than the first 3 quarters of the year.

Reopening Shift

The economy went through dramatic shifts in the past 14 months. There was an extremely quick increase in the use of technology to connect people and order goods/services. The entire economy went digital within a few months. We are lucky to live in such a technologically connected world. Had this pandemic occurred 15 years ago, technology wouldn’t have been able to save the economy like it did in 2020. In the long term, we will benefit from all the innovation that occurred last year.

The table above shows the website growth rates for various stores. There was a massive increase in online shopping and pet buying/adopting last spring. We are now lapping that spike which is why Chewy’s web traffic is only up 8% from last year. Similarly, GameStop’s web traffic is down 18% from last year because people spent much more on gaming last spring because they were stuck inside. Some video game bulls believe all the spending will be maintained because the industry is in secular growth mode. While it is a long term growth story, it’s unlikely that time spent will remain at its peak when the pandemic is over.

Also on the negative side, Dick’s is seeing a 20% decline in traffic. That because last year there was a huge spike in sporting goods spending once we realized that outdoor activity was safe. There was a massive increase in spending on boating and fishing equipment. On the positive side, Vroom and Carvana are experiencing triple digit growth. Used car sales are still elevated. Restoration Hardware had the 2nd highest growth, but we think this a company-specific result rather than a macro one. Not everything is macro related even in a pandemic recovery.

Everyone Is In The Market

Now is one of the worst times ever to buy stocks that are popular with retail investors. Even if you think a stock that is widely owned by retail is great, it’s better to be patient before buying it. This is one of the most crowded markets ever. 41% of household wealth is in stocks.

As you can see from the chart below, the spike in TD Ameritrade Accounts as a percentage of the US population is higher than in the tech bubble. E-Trade didn’t get as high, while Robinhood peaked at a higher level than any platform did in 2000. Retail is always late to the game. Many of the momentum stocks have already started falling in the past few weeks. The next step is the burst in the crypto bubble.

Conclusion

Productivity exploded in Q1 which is a great sign for corporations because they are about to deal with high wage inflation. Q1 earnings season was amazing. Yearly growth will peak in Q2, but Q3’s results will also be really good. Web traffic shifted dramatically last year. Now the comps are being lapped which is bad for the COVID-19 beneficiaries. Watch out for investing in stocks that are popular with retail investors. They won’t do well when the bubble in retail trading activity pops.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.