UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Surprisingly, there are popular bearish narratives even as the stock market is a few percentage points away from its all-time high and the economy is in one of the greatest quarters of this expansion. Since there are popular bearish narratives, there are myths for us to bust on the bearish side. We will bust false bullish narratives in future articles. The goal for investors should be to be objective. Being objective will allow you to avoid investing based on false premises. Avoiding bad ideas is just as important as finding good ones.

Is Good News Bad News?

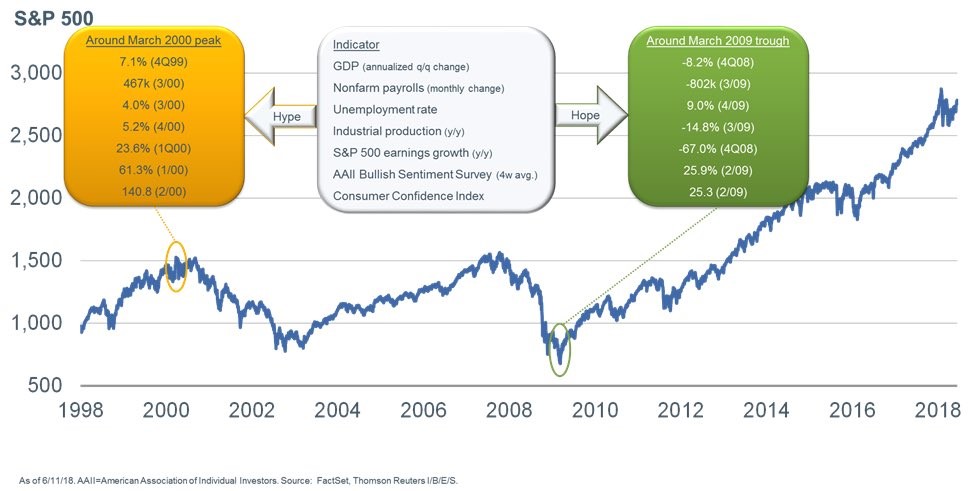

The chart below shows various economic data points from the March 2000 peak and the March 2009 trough.

Source: LizAnnSonders Twitter

There were great results in March 2000 and terrible results in 2009. This leads to the false conclusion that the current good economic news and earnings reports are actually bad. That’s not true. Firstly, these are cherry picked dates. We can point to many other dates where the economy and earnings growth looked strong and stocks continued to move higher. The 4 week moving average of jobless claims first fell below the all-important 300,000 mark in September 2014 and that wasn’t a signal to sell stocks as the bull market is still continuing as of June 2018.

The industrial production index was down 3.8% year over year in August 2008. That was a very weak reading as the previous cycle bottomed at -5.2% and the 1991 recession bottomed at -3.5%. However, there was a big crash between the time that report came out in September 2008 and the bottom in March 2009. Year over year industrial production growth peaked this cycle in June 2010 which was the beginning of the bull market. At that point, we only knew growth was very strong. We didn’t know it would be the growth peak. Even though it was the peak, stocks rallied afterwards. In the 3 cycles before that, the industrial production growth peak was no where near the next recession.

There’s a key distinction which can be applied to the analysis of confidence indicators. Obviously, they peak when the stock market peaks, but you don’t know when that peak will occur just by looking at the data. Just because confidence is strong doesn’t mean it’s the peak. Consumer confidence was 110.4 in February 1998 which at that point was the highest figure since the data started being calculated in 1978. If investors decided high confidence meant to sell stocks, they would have missed out on big gains for the next two years. It’s not good to have exuberance in stocks, but no one truly knows how much excitement is too much.

This chart looks great because it implies there is an easy way to determine troughs and peaks, however, you can’t just sell on good news and buy on bad news. The only takeaway from this chart is that future projections are vital. You can’t just extrapolate present results on to the future because cycles show the economy is rarely stagnant in rate of change terms.

Is Earnings Growth Bad?

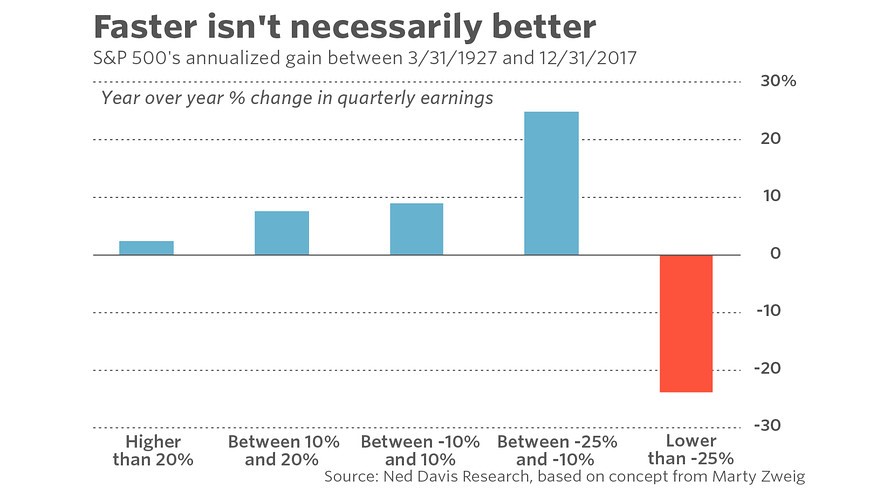

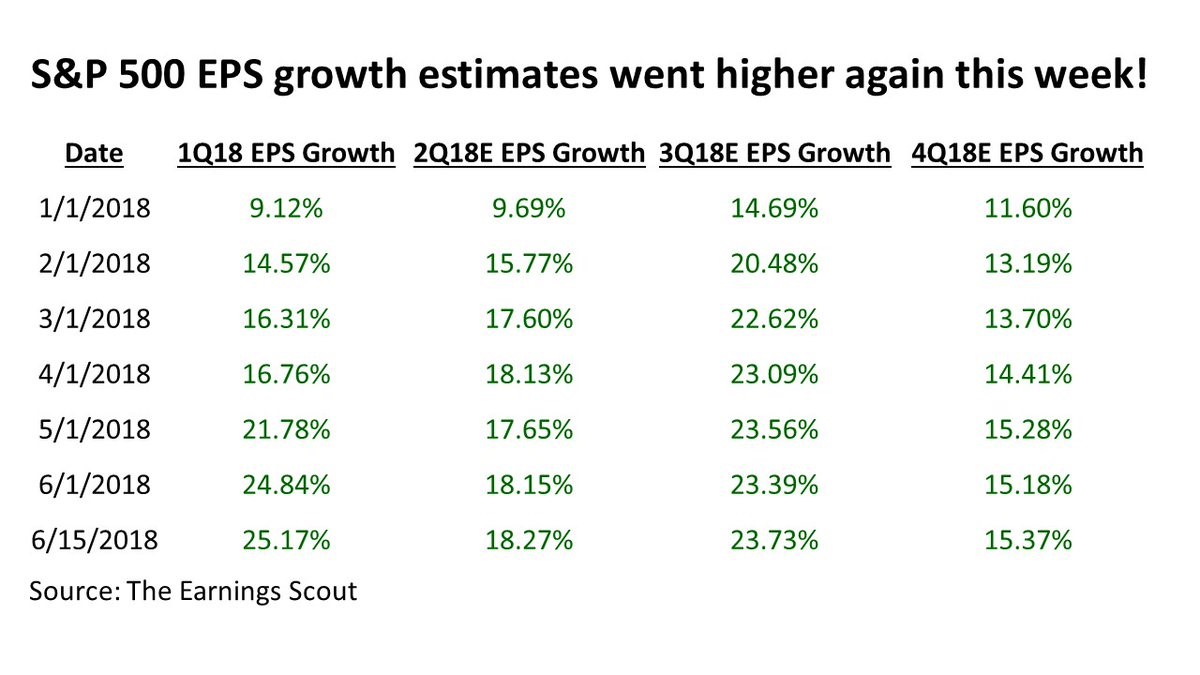

One catalyst bearish investors love to promote is that earnings growth is going to peak in Q3 2018. They state that because earnings growth is projected to fall, it means stocks will also fall. It’s a poor thesis because it takes what is already priced in to the markets and claims it’s a reason to sell stocks. Everyone looking at analyst projections, seen in the Earnings Scout table below, knows that earnings growth will peak in Q3. That’s not a reason to sell stocks unless you have the thesis that earnings estimates in the quarters afterwards are too high. Remember, markets are forward pricing mechanisms, therefore you need to have an understanding of future data, and not make decisions solely based on current data.

Source: The Earnings Scout

Bearish traders are correct to point out that 2019 earnings estimates matter to stock prices today. The problem is the lack of a catalyst for why the estimates are too high. Earnings growth peaked in Q4 2003 at 36.66%, but growth was in the double digits for the next 14 quarters. Peak growth doesn’t imply no growth will follow. Another example is in Q3 2010 when earnings growth peaked for the cycle at 123.45%. That was the beginning of the bull market, not the end. The key data point to watch is the change in the analysts’ future estimates. Q4 growth being below Q3 looks bad but it isn’t if the estimates for Q4 keep moving up.

The Ned Davis Research chart above promotes an odd point that earnings growth doesn’t matter because stocks have worse annualized gains the faster growth is. For example, the current great earnings growth was priced in by the amazing performance in 2017. The claim that falling earnings growth is bad, but also saying lower growth is better for stocks overlooks a key point – stocks trade on the changes in future earnings, not past results. Keep in mind, when the latest results are reported, they are from the past quarter. Guidance tells us how the current quarter will look, meaning it’s the present. All the information analysts have combined leads to future projections and current stock prices. The peak earnings growth we mentioned in Q3 2010 was priced in by a rebounding stock market in 2009. Earnings results do matter. Wishing for earnings to fall between 10% and 25% per year for stocks to do well sounds odd and doesn’t make sense.

Conclusion

We’ll leave you with the point that you shouldn’t be bearish because the yield curve is flattening. Stocks do well when the curve flattens. Stocks only do poorly when the yield curve steepens after an inversion. One example of great results in a flattening yield period is the late 1990s when the difference between the 10 year treasury and the 2 year treasury fell from 57 basis points from the start of 1997 to 3 basis points by the end of the year. Stocks rallied 33% in 1997 and then rallied 28% in 1998 and 21% in 1999. The yield curve is a guide for where cycles may start and stop, but not a perfect timing metric for stocks. Even correctly predicting when recessions will occur won’t guarantee you great returns. The truth is timing stocks and the cycle are very difficult. Basic arguments won’t win you great long term returns.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.