UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

In this article we will discuss the June 13th Fed Minutes which were released on July 5th. Just because the statements are a few weeks old doesn’t make them worthless. They give us a better understanding of the Fed’s outlook. We can use this outlook to understand the perspective and potential for future actions of the FOMC members. Additionally, this allows us to sort through the noise that accompanies third party reports and headlines in order to have a better understanding of what is fact and what is fiction with regards to potential for future policy decisions.

One of the themes of the Minutes was the fear that the economy might grow too fast which would cause accelerated inflation and push the economy into a recession. Usually it’s Fed rate hikes in response to inflation which push the economy into a recession. On the topic of an overheating economy, the Minutes stated, “concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn.”

The Fed is concerned with inflation and expensive asset prices. The core PCE inflation is a few basis points below 2%, but the year over year comparisons will get tougher after August. It will be important to see if inflation can remain high for the first time in this cycle. Either housing inflation will need to increase even higher or another category will need to see prices increase at a faster pace. As of now, there still isn’t sustained inflation close enough to cause a change in guidance based on the symmetric policy the Fed has asserted this year. To review, this policy signals that the core PCE inflation rate should average 2%. The 2% level is not a ceiling.

The CAPE ratio is at 32.83 meaning the S&P 500 is expensive. However, if you look at the forward P/E, the multiple is only 16.1 which is below the 5 year average of 16.2 and above the 10 year average of 14.4. The stock market is only expensive when you add in the low earnings during the recession and the early part of the recovery. If you assume a recession won’t occur in the next couple years, it’s fair to say the S&P 500 isn’t exorbitantly priced.

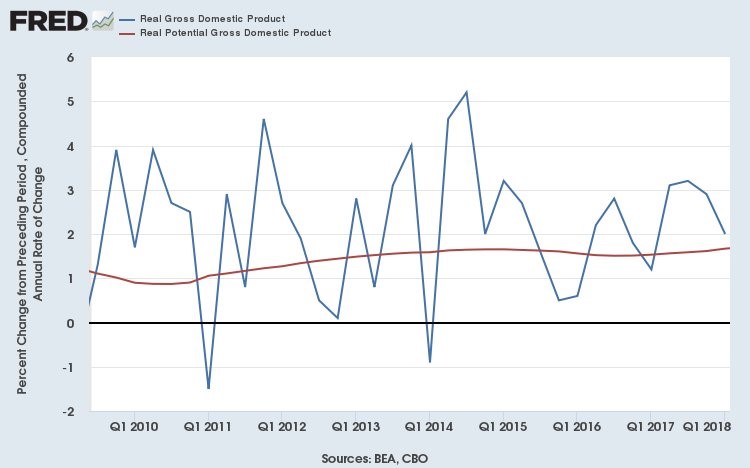

As of July 6th, the Atlanta Fed GDP Nowcast expects 3.8% Q2 GDP growth which is high. However, the Fed shouldn’t worry about growth above the long run potential rate because it has been temporarily above this rate several times in this expansion. As you can see from the FRED chart below, which shows the potential GDP growth rate and the actual historical growth rate, GDP growth has fallen after every short-term period of heightened growth.

Source: FRED

The Fed shouldn’t overreact to a strong Q2 GDP report because it will likely be followed by weakness regardless of whether monetary policy is tight or loose.

Is Policy Neutral?

The Fed also discussed whether the current Fed funds rate is still dovish. Because of the recent rate hikes, the Fed thought it was fair to remove the boiler plate sentence at the end of statements which said the fund rate would remain “below levels that are expected to prevail in the longer run.” This signals the era of ultra-accommodative Fed policy is officially over.

Furthermore, the Fed discussed the possibility that the rate could be above what it considers “neutral” by next year. Keeping the dovish forward guidance boiler plate sentence “was no longer appropriate in light of the strong state of the economy and the current expected path for policy.” Fed members themselves disagree on where the neutral rate is. The higher rates go, the more likely the Fed is on the hawkish side which means its policy is constricting economic growth. It’s fair to say, with the latest changes, forward guidance puts policy already on the hawkish side.

Tariffs Causing The Fed To Be Cautious

The most prominent aspect which is causing the Fed to consider hiking rates slowly besides the symmetrical inflation policy is trade tensions. In the Minutes, the Fed stated, “Most participants noted that uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending.” While the current tariffs in place are small, the threat of them increasing prevents businesses from making new plans.

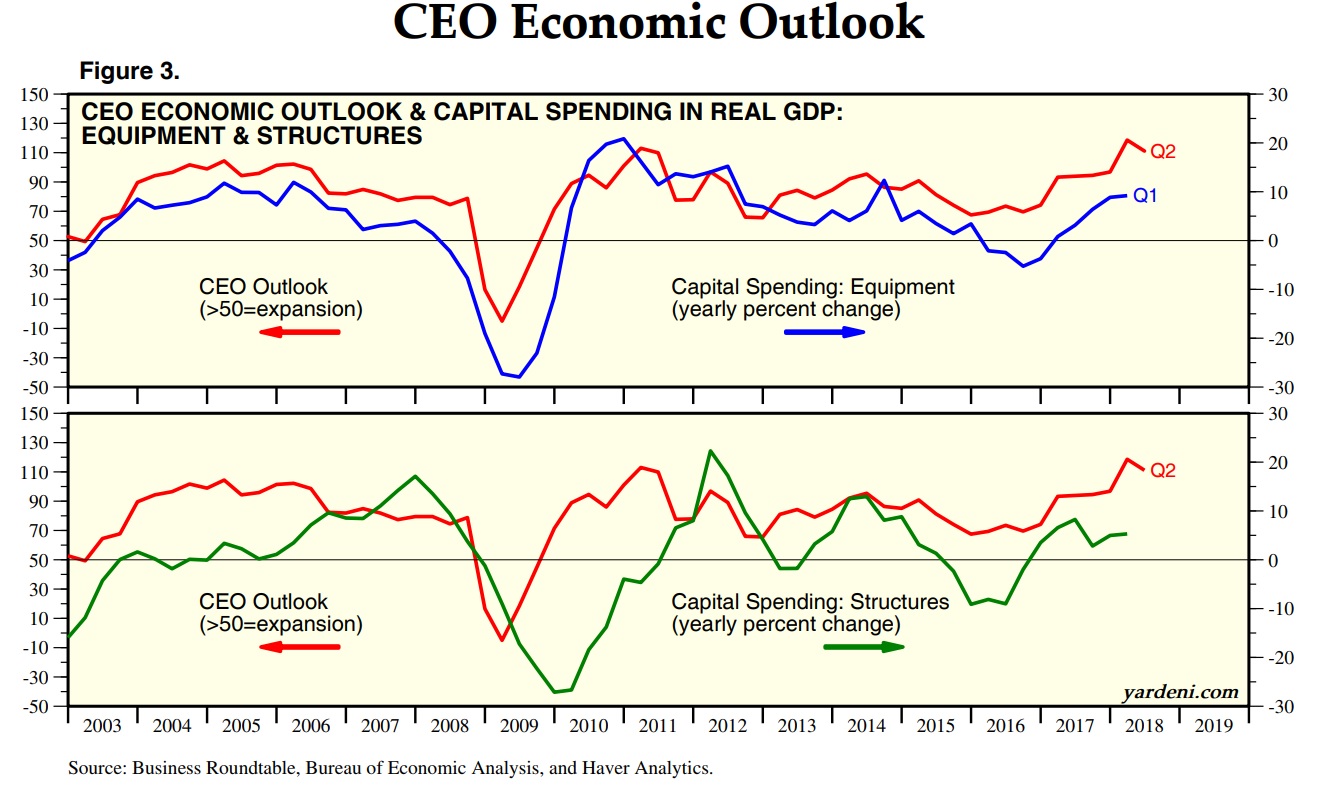

The Yardeni chart below shows the historical S&P 500 capital expenditures and CEOs’ economic outlook.

Source: Yardeni

There’s no sign of weakness in capital spending on equipment as of Q1, but management teams are becoming cautious until clarity on trade policy returns. In the June Manufacturing ISM report the management of an electrical equipment, appliances, and components company stated. “U.S. tariff policy and lack of predictability, along with [the] threat of trade wars, [is a] causing general business instability and [is] drag on growth for investments.” The drag will increase as the rhetoric is ratcheted up.

The potential for the Fed to become more dovish because of trade tensions could mitigate their effect on the stock market. The Oxford Economics chart below shows the effect tariffs, pending tariffs, potential tariffs will have on global trade.

Source: Oxford Economics

The current and pending tariffs will have a small impact on global trade growth, but the threatened tariffs will have a medium sized impact on trade which could cause a temporary but sizable decline in trade. The scary part is the threats keep increasing which means the potential for a recession caused by tariffs is getting more likely (it still has a low probability now).

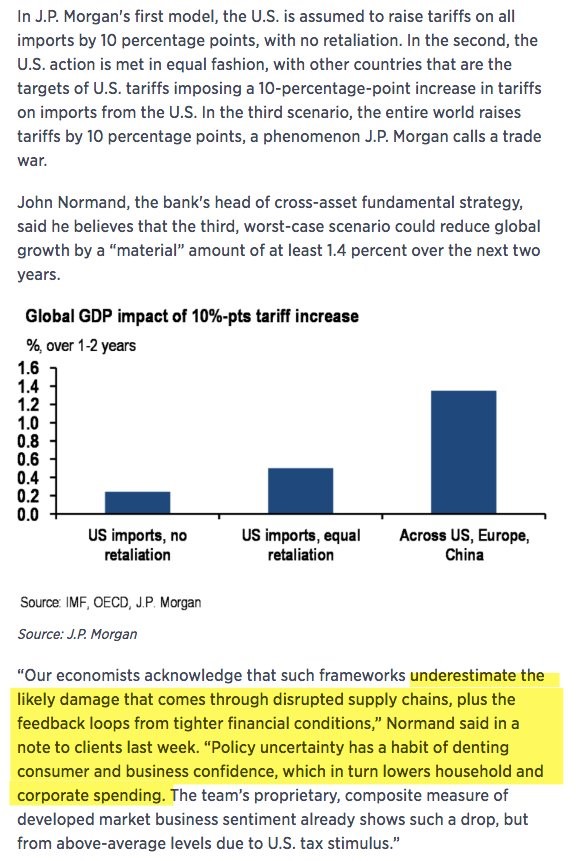

The chart below from JP Morgan gives another group of scenarios which can occur if the trade war continues.

Source: JP Morgan

A 10% tariff increase across America, Europe, and China could reduce global GDP growth by 1.4% in the next 1-2 years. That’s not counting the negative feedback loop that is tighter financial conditions.

Conclusion

The Fed Minutes were ‘status quo’ since the chances of 3 or 4 total rate hikes in 2018 remain about equal. The biggest risk to the economy is a trade war which we highlighted. There could be a pullback in rate hikes as a result which could help stocks. It all depends on how bad the trade war gets and how much the Fed pulls back on hawkish policy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.