UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

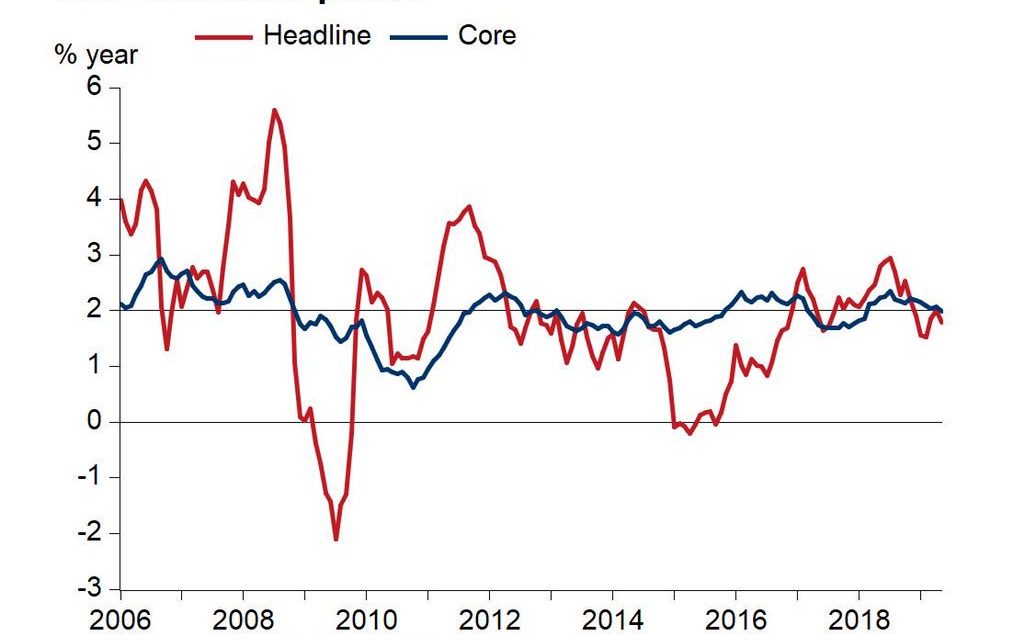

As discussed in the article on the May PPI report, inflation needs to fall to give the Fed room to cut rates. We don’t know the exact inflation rate where cuts make sense, but anything lower than April’s inflation is a strong start. The Fed and the market got their wish with the May CPI report. Specifically, monthly CPI was 0.1% which met estimates and was below April’s 0.3% rate. As the chart below shows, headline yearly CPI was 1.8% which missed estimates for 1.9% and April’s 2% reading.

This looks great versus the 2.8% weekly wage growth reading released in the BLS report last week. Declining nominal wage growth isn’t a problem if inflation falls.

Inflation Falls

Headline inflation has been below core inflation for a few months because of the decline in oil prices. In May, energy inflation was -0.5%. That helps the consumer, but doesn’t impact Fed policy. Luckily for the Fed, core monthly CPI was also weak as it was 0.1% which missed estimates for 0.2% and met April’s reading. Yearly core CPI was 2% which missed estimates and April’s reading which were both 2.1%. Unrounded, core CPI was ever so slightly below the magic 2% mark.

To be clear, the Fed says it wants inflation to increase, but since the market is pressuring the Fed to cut rates, it will probably give in. If the Fed is going to cut rates, it’s better to have low inflation. The market knows the economy is in a slowdown. The decline in inflation didn’t break that news. It just tells us what the Fed can do and how strong real wage growth is.

Specifics Of May CPI

It’s no surprise housing catalyzed inflation because housing is 42.202% of the CPI index. People spend the most money on acquiring shelter; it’s a basic human need. Services less energy services drove core CPI as its prices were up 2.7%, while commodities less food and energy commodities prices were down 0.2%. Apparel brought down the latter category as its inflation was -3.1%. Shelter drove the former as its inflation was 3.4%. Medical care services inflation was 2.8%. Like the PPI report said, transportation services inflation was weak as it was 1.1%.

The chart below shows the changes in contribution to core CPI from July 2018 to May 2018.

To be clear, core CPI was 2.3% in July 2018. It was this mini-cycle’s peak. Core services drove CPI down the most as motor vehicle insurance alone pushed it down 22 basis points. The second biggest drag was hospital services at 9 basis points. Owners’ equivalent rent was a small 6 basis point drag in relation to the big drop in rates and home price growth in that period. Specifically, from July 2018 to May 2019, the 30 year fixed rate fell from 4.53% to 4.07%. The decline in rates has recently increased refinancing. In July 2018, the Case Shiller national home price index was up 6% yearly. As of March, it was up 3.7%.

As we just mentioned, motor vehicle insurance suppressed core inflation the most by far since last July. Without it, core CPI would be about one tenth off its recent peak. The decline in the yearly growth rate has been absurd as the chart below shows. It was almost 50% in early 2018. It’s now in the low single digits. @InvingSwisher discussed on Twitter that accident rates had increased sharply and insurers had to quickly catch up by raising premiums. The catch up concluded in early 2018.

Correcting A False Narrative

The chart below that shows the number of people in America at each age isn’t mistaken. It’s simply demographic fact which implies millennials are at the age where they should be buying houses and forming families. The most common age in America was 27 in 2018. While that’s not a chart crime, there is a false narrative that goes along with it. The narrative is that this population bump of people in their 20s means the U.S. economy is in fantastic shape. That’s not entirely true.

As you can see from the chart above, the percentage of people from 25-40 has increased in the past few years, but it’s below what is was in the 1990s. That’s because baby boomers are living longer. More importantly, the birth rate is plummeting. That poses future risk to the U.S. economy as it does for the rest of the developed world and China. In 2018, the number of babies born was the lowest in 32 years; it was the 4th straight year of declines.

Massive MBA Applications Report

The MBA Applications report in the week of June 7th had eye popping weekly growth mostly because people refinanced their homes at a quicker rate. The composite index was up 26.8% after increasing 1.5%. Refinancing was up 47% weekly after rising 6%. Refinancing increased because the 30 year fixed mortgage rate fell from 3.99% to 3.82% in the week of June 6th. That’s the lowest rate since September 2017. Even though refinancing growth spiked, the refinancing index is at a historically low level. The better news was that purchase applications growth was 10% on top of a 2% decline. Yearly growth improved from 0.5% to 10%. The 2 week average of that is 5.25%, meaning the solid trend continued.

As you can see from the chart below, the national 30+ days delinquency rate for mortgages was 4% in March which is the lowest level in 13 years. That’s a great sign for the housing market which leads the economy.

In the last cycle, the 90+ days delinquency rate increased from 0.9% to 1.8% from Q2 2006 to Q2 2007. That’s 6 months before the recession started. This cycle won’t see as high of a spike in delinquencies because buyers were more qualified.

Conclusion

CPI disappointed estimates. If the economy is going to slow, inflation falling is better for the Fed, if their objective is to cut rates. Auto insurance is the main reason inflation has fallen from July of last year. The birth rate signals U.S. demographics won’t be so good in the next generation. The number of births in 2018 was the lowest since 1986. Mortgage delinquency rates are very low, which supports the narrative that there is no housing bubble ready to burst like last cycle.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.