UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The Fed funds futures market is often wrong about the intermediate term future. A potential example of this is the big shift in expectations in the past 10 months. Sure, the market projected lower rates in 2019 than the Fed, but it wasn’t expecting at least 3 cuts like it is now. There is a 56.8% chance the Fed will cut rates at least 3 times this year. If rates aren’t cut this year, that will strike a blow to the Fed funds futures market’s short term prediction accuracy. Its short term predictions are usually spot on because the Fed doesn’t like shocking the market. If the futures market is wrong, the Fed will try to shift expectations. This all leads to the point that we are very likely to see our first cut of the cycle in the next couple months. There is an 85.6% chance of at least one cut by the July meeting.

False Narratives About Rate Cuts

There are two false narratives going around. The first is that the Fed can’t cut rates when the stock market is near its record high. In the past few years, we’ve seen the Fed funds futures market expect more hikes/fewer cuts when stocks were up and it expect fewer hikes/more cuts when stocks were down. In the past few months, we’ve seen the market expect more cuts while the stock market has rallied. The stock market has rallied during this slowdown. The market could be wrong to rally, but the Fed must react to the weak economic reports which have led to forecasts of 1.9% Q2 GDP growth. Specifically, the Fed cut rates when the market was at a record high in July 1995, August 1991, July 1990, and July 1989. It can do that again.

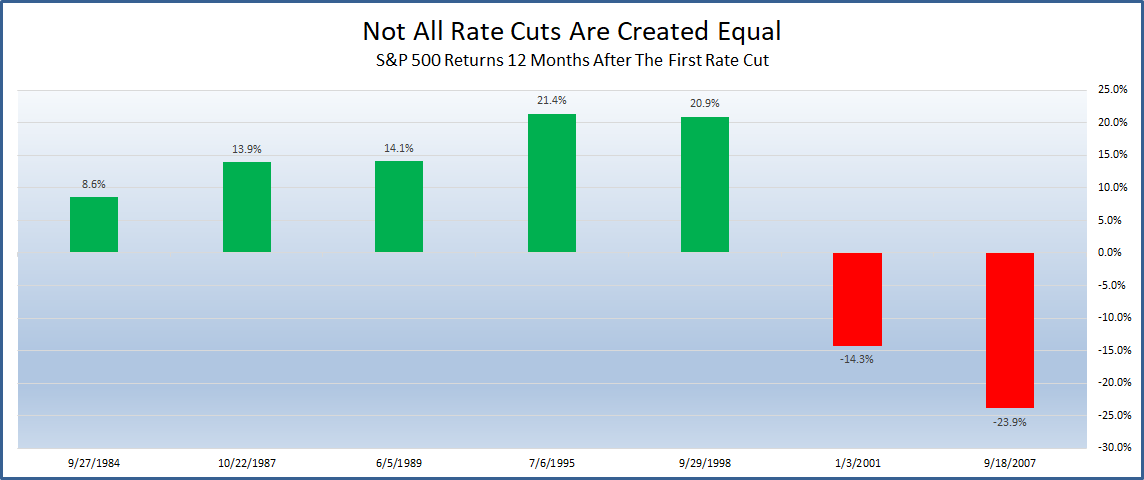

The second false narrative is that rate cuts mean the cycle is over and we’re headed for a bear market. That’s not true. If the Fed preemptively cuts rates to stop a slowdown from becoming a recession, there won’t be a bear market recession. As you can see from the chart below, in 5 straight cycles stocks had positive returns after the first cut. There were only negative returns in the past 2 cycles.

Earnings Estimates Stable

Earnings estimates have barely declined in June which is great news for stocks. As you can see from the table below, Q3 EPS estimates have only fallen 8 basis points to 2.21% growth.

One reason estimates haven’t fallen much is because very few firms report in the 3rd month of the quarter. For comparison’s sake, Q2 EPS growth estimates fell 28 basis points in March. Q1 EPS estimates fell 0.72% in December which is no surprise because analysts and investors were panicking in December. If Q2 estimates fall less than 36 basis points by the end of the month, Q2 will start earnings season with higher estimated growth than Q1 started with. Q1 ended up well because estimates were handily beaten as the bar was lowered too far. As you can see, growth ended up at 5.19%.

Management Teams Are Super Bearish

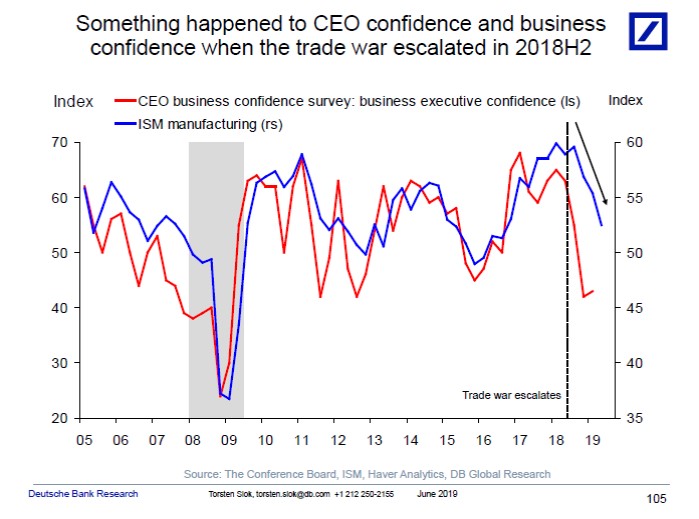

Unlike last May when we reported on how optimistic Fortune 500 CEOs were, management teams are now very bearish. That might all be recency bias as the economy was in much better shape 12 months ago. It’s fine to state how business is going, but you can’t just extrapolate trends to predict recessions like CFOs are doing. Specifically, almost 50% of American CFOs see a recession by Q2 2020. Almost 70% of them see a recession by the end of 2020. Their bearishness might be because of the trade war with China. To be clear, just because that percentage of them sees a recession, doesn’t make those the odds of a recession. The situation isn’t binary. The odds of a recession greatly increase if there is an all out trade war. They decrease without one.

As you can see from the chart above, CEOs are similarly bearish on the economy. The CEO business confidence index is near the cycle lows. Somehow, 63% of CEOs didn’t see a recession in the next two years when asked in May 2018. They changed their minds quickly. The percentage of American CFOs who see a recession by Q2 2020 is actually the lowest out of Europe, Asia, Japan, and Latin America. Over 75% of Japanese CFOs see a recession by then. Over 90% see a recession by the end of next year.

Productivity Improves

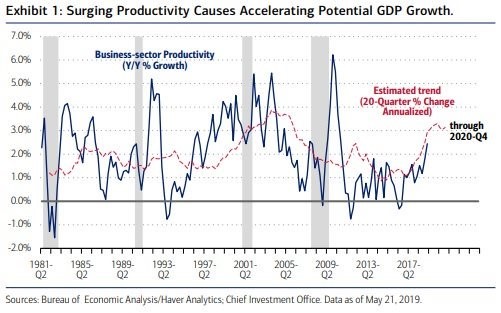

Stanley Druckenmiller made headlines when he said the economy is in a productivity boom because of the internet and that productivity is being measured incorrectly. That’s ironic because productivity growth has been increasing lately. As you can see from the chart below, the estimated 20 quarter percent change annualized is near the highest point in 30 years.

Productivity growth has been low this cycle, but it has been increasing lately. We hear all the time about how the mobile internet has made us more productive, but how social media apps also waste our time. The correct measurement of productivity growth is an open ended question, but many are questioning the BEA’s calculation.

Low Unit Labor Costs

In Q1, workers became much more productive which is great for employers because it pushed unit labor cost growth into negative territory. Specifically, productivity growth was 3.4% and unit labor costs were -1.6%. In Q4, those growth rates were 3.6% and -0.9%, so this isn’t a new trend. In Q1, output growth was 3.9%, hours worked growth was 0.5%, and compensation growth was only 1.8%. As you can see from the chart below, unit labor costs predict core CPI. If that’s the case, core CPI will fall in the next year.

That supports Fed rate cuts. The decline in core inflation isn’t transitory. Although technically, no change is permanent.

Conclusion

The Fed is very likely to cut rates by its July 31st meeting. That rate cut doesn’t mean the end of the world. In the best case scenario, tailwinds from this rate cut and a trade deal with China boost economic growth in late 2019 or early 2020. EPS estimates haven’t fallen much in June which is great news. CFOs see a recession coming and CEOs are similarly bearish. Last year, CEOs didn’t see a recession in the next 2 years. There are 11 more months to go without a recession to prove that guess accurate. Productivity growth is strong, but it might have been undercounted during this expansion. Unit labor costs signal weak core CPI in the next 4 quarters.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.