UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

December’s PCE report showed weak consumer spending and solid personal income growth based on monthly data. Specifically, monthly personal income growth was 0.6% which beat estimates for 0.1%. However, November’s growth rate was revised down from -1.1% to -1.3%. That’s an extremely easy comp. Yearly growth rose from 3.5% to 4.1%. Income growth was helped by dividends and the last minute stimulus bill and hurt by the decline in PPP money. There should be a bigger boost in January due to the stimulus. Real disposable income was up 0.2% monthly.

Consumption growth was -0.2% which actually beat estimates for -0.5%. However, it was a pretty bad reading since growth was revised down 3 tenths to -0.7% last month. Real consumer spending was down 0.6%. As you can see from the chart above, spending on services is 7.5% lower than before the pandemic and spending on goods is 5.1% higher. Spending on durable goods is stronger as people improved their homes. Since income went up and spending went down, the savings rate increased. It was up from 12.9% to 13.7%. That’s a very large increase. It looks small on the chart, but it’s substantial and pushed an already high rate higher.

Headline PCE inflation was up 2 tenths to 1.3% and core inflation was up 1 tenth to 1.5%. Since that’s what the Fed uses, it feels no pressure to hike rates. It’s quite different from the prices paid index in the ISM report and the large rise in commodity prices recently.

Q4 Employment Cost Index

The Q4 employment cost index was up 0.7% quarter over quarter and 2.7% year over year. That’s an increase from last quarter of 2 tenths and 1 tenth. Private wages and salaries were up 0.9% quarterly and 2.8% yearly.

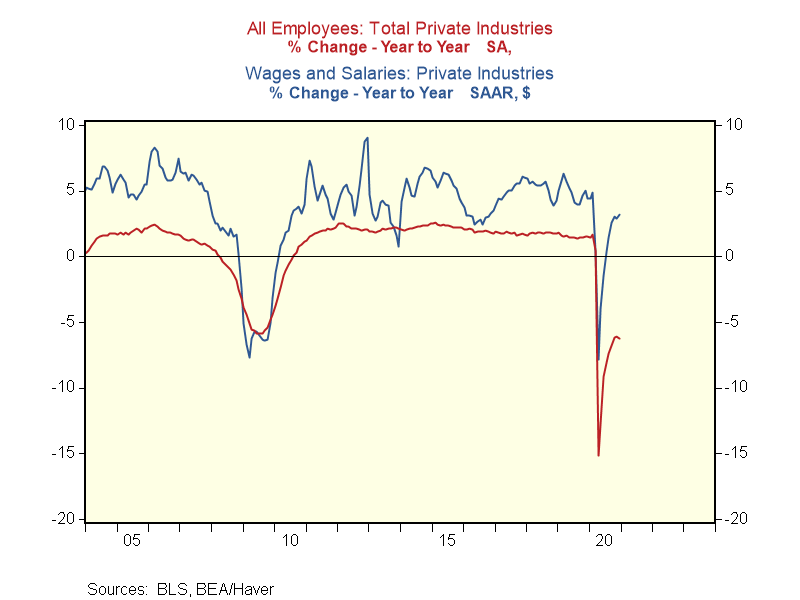

The amazing aspect of this report is private payrolls are down 6% yearly, private wages and salaries are up 3%. As the chart below shows, this recession is much different from the last one. The discrepancy lies in the fact that highly paid workers were able to keep their jobs by working from home, while low paying jobs in the leisure and hospitality industry were cut.

Card Spending Trends Remain

A lot of the same spending trends are staying true in the Bank of America data. Firstly, retail spending excluding autos was in the double digits throughout the middle of the month which is very good. Secondly, spending on online electronics was strong throughout this period although it did weaken from 72% to 64% growth. Once the economy reopens and the tough comps are lapped, that should go strongly negative. We aren’t there yet (wait until April).

People spent their $600 checks on clothing, but that pop fizzled as growth fell from 17% to 7%. Spending on entertainment, lodging, and airlines is still devastatingly bad. These companies are in deep trouble. They need enough liquidity to last them another 6 months to be safe. Spending at restaurants and is down 11% which doesn’t sound bad, but fine-dining is down much worse. A lot of spending has moved to fast casual restaurants, away from family-owned restaurants.

Final Consumer Sentiment

January’s consumer sentiment reading fell unlike consumer confidence. The index was down 1.7 points to 79. The current conditions index was down 3.3 points to 86.7 and the expectations index was down 6 tenths to 74. We don’t have access to how political the confidence index is, but the University of Michigan always highlights the political nature of the sentiment index. As you’d expect with the Dems winning both Senate seats in Georgia which gave them control over the upper chamber, confidence fell further among Republicans and rose further among Democrats. The whole index fell because confidence among independents fell slightly. Since October, confidence among Democrats is up 23.2 points to 91.8 and is down 45 points to 51.4 among Republicans.

SPACs Are Getting Very Big

SPACs weren’t a common way to raise capital prior to 2020. As the bottom chart below shows, from 2017 to 2019, about 20% of IPOs came public via SPACs. That’s dramatically different now as it’s up to 60% due to the roaring speculation in markets. Promoters make a lot of money from SPACs, so they have all the incentive in the world to keep the funnel going.

As we recently saw with the explosion of short squeezes, the momentum can keep going way past the point where there is any logic. It feeds on itself until it can’t grow any larger. The speed of the gains aren’t just attracting retail investors to the party. It’s also money managers. Plenty of money managers know its risky to get involved with short squeezes and SPACs, but they need to meet performance goals. Having the ability to sit out of manias will lower your portfolio’s volatility. Everyone has a different personality and goals. Some people don’t care if their portfolio is volatile, but at least recognize that you have the option to avoid following the stampede.

There’s nothing stopping you from keeping a high cash position in your portfolio when you or the markets are uncertain. That sounds insane in the current market, but maybe the fact that it is so unpopular makes it a good idea. Don’t feel pressure from outside sources to make certain moves because you have no restrictions and no investors to please. When you have an advantage, take it! You don’t necessarily always have to be contrarian. In fact, being contrarian all the time, might not work. It’s just worth recognizing that you have the option to be one without career risk.

Conclusion

The PCE report showed solid income growth and weak spending growth on a monthly basis. Income and spending should increase in January because of the stimulus. Surprisingly, wages and salaries are up yearly because the people who get paid the most are still making money by working from home. Spending is still up in the areas that benefit from people working form home and down in the areas hurt by the inability to travel and gather. The vaccine is working to limit the virus, but we are still weeks away from significant changes to the economy. Consumer sentiment fell slightly in January. SPACs now dominate the IPO market. Our followers have asked if the data on IPOs includes SPACs. Yes, it does.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.