UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Surprisingly, we are getting improved jobless claims reports. This is the 2nd week they fell. This supports the thesis we have discussed a bunch of times which is that more people don’t stay unemployed just because of higher benefits. People want to work. Virtually no one wants to stay home for an extra $300 per week until March. Specifically, in the week ending January 23rd seasonally adjusted claims fell 67,000 to 847,000.

The bad news is last week’s report was revised up 14,000 to 914,000. It still showed a decline though. Non-seasonally adjusted claims fell 101,000 to 874,000 this past week. PUAs fell 20,000 to 427,000 which is why total unadjusted new benefits fell 9%. That’s the first decline this year. As we mentioned would happen in our article last week, the total number of people on all benefits rose in the week of January 9th. It was up from 15.99 million to 18.28 million. In the week ending January 16th, continued claims fell from 4.974 million to 4.771 million. The recovery would be in amazing shape without the pandemic benefits.

Stimulus Increases Spending

It makes sense more people are spending this stimulus than the one last April because people were in survival mode then. They hoarded resources because the pandemic was very uncertain. Obviously, it ended up being quite terrible, but not terrible enough to shut down the American consumer. We showed a poll in a past article that said most people would spend their $1,400 check on bills. That’s kind of a vague answer. You can spend a lot of money with your credit card on discretionary items; your credit card statement counts as a “bill”, but you still bought discretionary items.

We will lean towards saying that was an inconclusive poll because the chart above shows the marginal propensity to consume was higher with the January 2021 stimulus compared to the one last April. If we got a $1,400 stimulus in March even more people would spend it because more people would be employed. That’s not a bad thing at all. Restaurants and clothing stores need all the money they can get from customers.

The rich saved the most money to the surprise of literally no one. That’s why they didn’t get pandemic checks. The top 20% of households saved an average of $50,000 since the pandemic started. As the chart below highlights, the 2nd highest quintile saved $9,000 on average. This is because there are fewer places to spend money. A lot of the money is going into the stock market. We truly have a financialized economy. The stock market has become more important than how actual businesses are doing. As you can see, the bottom 60% have spent most of the savings they have gotten through fiscal transfer payments.

Housing Still Looks Great

The housing market is still doing well. That’s partially where the top 40% are spending their money. In December, new home sales rose from 829,000 to 842,000. That’s a little better than it looks because that’s only a 1,000 increase from the original November report. There is no surprise housing felt no impact from the pandemic. It’s still unthinkable that we had thousands of people dying per day and the housing market was still resilient.

The chart below shows housing supply increased from 4.2 month to 4.3 months which is the highest reading since June. It’s still very low though. We need to see the 3 month average get above 5.5 to start worrying. It’s at 4.03 months right now.

Staples Are Relatively Cheap

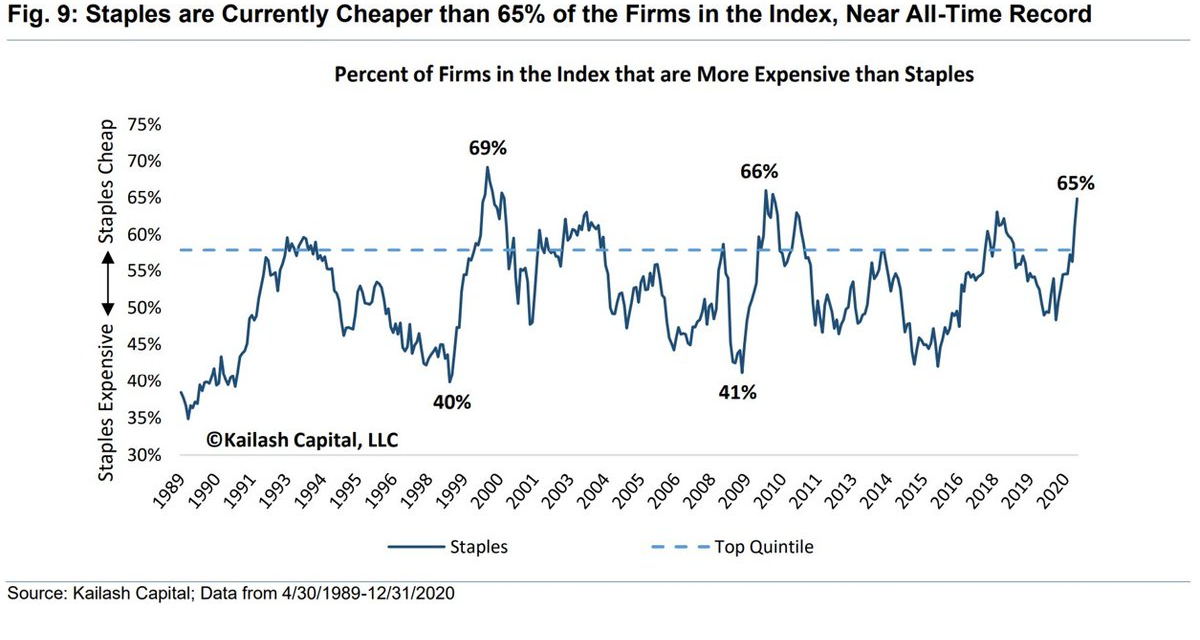

We are seeing a lot of speculation in the market. No one wants to hear about staples which is why they are so cheap. Plus, many staples sold off early this year when rates were rising. Staples don’t like rising inflation because that means rising costs. As you can see from the chart below, 65% of stocks in the index are more expensive than staples. That peaked at 66% after the financial crisis and 69% during the dot com bubble. In all likelihood the expensive stocks will fall more than the staples rally when sentiment turns. However, in a stock market crash, losing only a few percentage points (or even making money) sounds nice.

2021 Welcome To Tail Risk

You thought 2020 was a crazy year with the pandemic, stock market crash, extreme rally in stocks, and bubble in tech stocks? 2021 looks like last year on steroids. This is reintroducing us to tail risk. Fat tails are the concept that extreme market movements have a higher probability than they would in a normally distributed curve (because of human nature). Essentially, 1 in 100 year events in markets happen regularly.

The bonanza is being led by retail and momentum traders. The narrative is that traders have the possibility of making a lifetime’s worth of gains in a few weeks (don’t try this at home). For example, at one point a cryptocurrency rose over 800% in a week. It takes over 10 years for a good stock to make that amount. The chart above shows the tail risk in action. As you can see, the total call option volumes for stocks and indices have gone vertical. This is creating systemic risk. It’s not just retail traders. They are the scapegoats for extreme speculation. It’s possible that money managers are chasing what retail traders do which is a reversal of normalcy. Of course, nothing about this market is normal. It’s very likely to end in a ton of volatility. These returns aren’t sustainable.

Conclusion

Jobless claims fell again. We aren’t willing to say the slowdown is over, but it’s always good to see the data improve because it means when the economy accelerates in Q2, it will increase off a higher base. More people are spending their stimulus checks than last time. The top 40% made up all the savings since the pandemic started. Staples are cheaper than most of the market. That’s because most stocks are expensive. 2021 is the year of tail risk. That’s the only way to describe the chart we showed on options trading. Options are weapons of mass financial destruction. The end of this speculation won’t be pretty.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.