UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The market is pricing in an economic recovery after the vaccines go out. It sounds nice to want to hedge your bet because it’s uncertain if the vaccines will get distributed effectively, but that diminishes your return potential. If you want to make outsized gains, you need to pick a side. It’s perfectly fine to bet against COVID-19 being delt with properly. You can make money either way if you are right. You are assured mediocre returns if you hedge, depending on what your time frame is of course. That’s logical because you aren’t taking much of a risk if you hedge. By the time COVID-19 is beaten, there will be very little profits to be had in the reopening plays, assuming the market prices it in ahead of time. You need to take risk to make money.

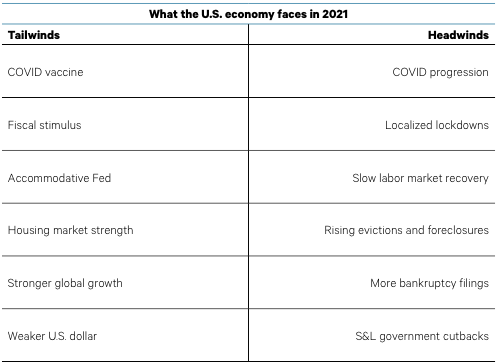

Of course, the market isn’t only impacted by the virus. Certain companies and macro bets are more sensitive than others. The table above goes through a few of the potential tailwinds and headwinds the market faces. Besides the virus, investors need to worry about monetary policy, fiscal policy, and the cycle. It all keys off the virus of course. However, you don’t want to take your eye off these factors as well. It’s especially worth reviewing them because we all have better experience dealing with them.

Even if you were wrong about the virus in the spring (in believing it would be over quickly), you still turned a profit on the long side because of help from the Fed, changing sentiment, the resiliency of the economy, and fiscal stimulus. That’s not to ignore the fact that uncertainty over COVID-19 diminished throughout the year which helped boost sentiment. It’s key to know who you are playing against in markets just like in poker. 2020 has been the year of retail investors which means you must also consider what they are thinking (or not thinking).

What Slowdown?

Our general outlook is for a slowdown from mid-November to the end of February. Technically, you can argue being cautious is fair because you can make bullish bets on a recovery in line with how the market is acting, while having a separate macro framework. Focusing on the potential slowdown is worth it even if the market doesn’t care. It won’t be easy to look away from macro for a few months and then come back to it as the economy reopens.

With that being said, the flash November Markit PMI was so good it makes those expecting a slowdown based on declining consumer sentiment and increasing initial jobless claims (due to COVID-19) look silly. This is certainly a cyclical upturn for manufacturing even with the spike in COVID-19 cases. Specifically, the composite index rose from 56.3 to 57.9 which is a 68 month high. Services activity rose from 56.9 to 57.7 which also was a 68 month high. As you can see from the chart above, the flash manufacturing PMI rose from 53.4 to 56.7 which is a 74 month high.

The Chief Business Economist at Markit stated, “The upturn reflected a further strengthening of demand, which in turn encouraged firms to take on staff at a rate not previously seen since the survey began in 2009. However, the surge in demand and hiring has pushed prices and wages higher.” This is music to the ears of the Fed and those betting on the reopening of the economy. Even in the heart of the 3rd wave, employment and inflation are increasing if this data is correct. There will be a mini-boom in inflation and economic activity in the spring. The boom will reach higher heights if it starts from a higher level. The Fed is still pushing for 2% inflation throughout the cycle.

Some firms might start investing in their production capabilities soon to prepare for the reopening which would help the economy recover quicker. You can’t say the economy will be in inning one of the cyclical recovery in the spring if we are already at a 74 month high in the manufacturing PMI. Of course, PMI data compares sequential changes in activity. The yearly growth rates in manufacturing and industrial production are still negative. This low growth rate means there is plenty of room for the cyclical recovery to run. Once the easy comps are lapped, we will see massive yearly growth readings.

More Good Housing News

The October new single family housing sales report was very good. There was only a decline from September because of a strong revision. September new home sales were revised from 959,000 to 1.002 million. October sales were 999,999 which beat estimates for 975,000. That’s 22% yearly growth. The chart below shows in this recession and subsequent recovery new home sales have gone vertical as this is the good part of the K-shaped economic recovery.

New home builders are trying to compete with existing homes by building cheaper ones. The goal is to make houses smaller since millennials are having smaller families. The median new home price was $330,600 which was down 0.3% sequentially and up only 2.5% from last year. That’s not a large increase considering the strong demand for housing. With the higher price growth in existing homes, home owners are generating the biggest benefit from this boom.

Of course, builders are doing very well as supply is low. Their confidence is at a record high. New home supply is 3.3 months which is a record low. Demand jumped so quickly, supply couldn’t keep up. That won’t be the case in 2021 though as supply is set to spike. As you can see from the chart above, new homes sold, but not yet started spiked 91.5% to 385,000. Starts are also increasing rapidly. Builders have strong backlogs, so they can build more without oversaturating the market.

Conclusion

You need to make a bet on the vaccines either working or not working if you want to make a profit. There are no free lunches. We’ve spoken a lot about how the economy could struggle in the lead up to the vaccines being distributed. However, the Markit PMI from the first half of November hit a 68 month high. Housing remained on fire as new home sales were up 22% yearly in October.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.