UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The Fed kept rates at zero at its December meeting to no one’s surprise. Furthermore, it will continue buying bonds at a rate of $120 billion per month. As we have mentioned, financial markets and actual people are in dramatically different positions. We have the loosest financial conditions ever and the Nasdaq 100 is up 45.06% year to date. On the other hand, small businesses are struggling to make it and almost 8 million people have entered poverty since June.

The fiscal stimulus will be a bridge to get us to the spring when the economy can reopen. It won’t suddenly get these people out of poverty. More can be done to help those who are the worst off. The good news is the vaccine will help those people get back to work. The main problem is it is expensive to be poor. It’s expensive to go without health insurance and pay high interest on credit card loans. Sadly, it’s tough to be healthy when you’re poor which means you will need healthcare more. The Fed did all it could and more to save the stock market, but the federal government didn’t do enough to prevent this onslaught of poverty.

QE Keeps Going

As a reminder, the Fed isn’t going to unwind this version of QE like it did last cycle. It is just going to keep the balance sheet the same which will eventually shrink as a percentage of the economy. It’s highly unlikely to shrink as much as it went up in the past few quarters. The Fed stated it will continue at this run rate of QE “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.” We have open ended QE which the market loves.

The FOMC also stated, “These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.” Let’s just say the Fed’s QE is a very ineffective policy tool if the goal is to help small businesses and help the median person. Surely, it’s better to have loose financial conditions, but it’s not going to directly help people who don’t own stocks.

Even with all this QE, the market was modestly disappointed because the Fed didn’t lengthen the duration of the bonds it is purchasing. The Fed has been discussing doing this. This is the policy approach it took in the aftermath of the financial crisis. The reality is Fed guidance does more to help markets than the specific act. The Fed saying it would buy corporate bonds helped junk yields fall even though it hardly bought any junk bonds. It’s also silly to try to suppress the long term bond yield because the 10 year yield is 93.5 basis points. There is nothing to suppress, yet at least.

Fed’s Economic Predictions

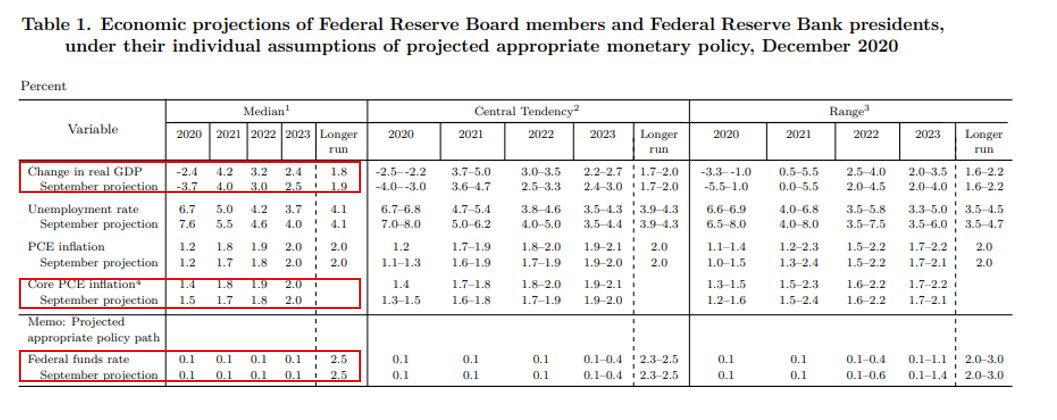

The Fed made large changes to its economic predictions for 2020 in admittance that it basically got everything wrong. The year is over, so this doesn’t matter much. Yes, we have a couple months of data to look through, but everyone is looking to 2021. As we mention all the time, every prediction is a policy tool. If the Fed wanted to be dovish in 2020, which it did, it made sense to have more negative predictions than would occur. That could explain why you see the real 2020 GDP growth estimate rising from -3.7% to -2.4%. Of course, it’s also hard to make predictions especially this year. Many would have laughed at you for being optimistic in late March.

Let’s focus on the Fed’s changes to its projections about the future rather than 2020. The Fed raised its projection for real GDP growth in 2021 and 2022 by 0.2% as they are now 4.2% and 3.2%. The estimate for the unemployment rate was changed from 5.5% and 4.6% to 5% and 4.2%. With the longer run rate expected to be 4.1%, the economy will basically be at full employment by the end of 2022. Of course, there are currently millions of workers in the leisure and hospitality industry that have been displaced. The hope is those jobs come back after the vaccine goes out. We think there will be a massive boom in spending on travel and restaurants because people will want to go out. Think of all the events that were canceled in 2020 that need to be made up such as the Olympics.

If you look at the estimates for GDP growth and unemployment in 2023, you see the Fed is projecting higher growth than the long run rate and a lower unemployment rate (than the long run rate). You’d think that would be a recipe for rate hikes, but the median estimate shows no hikes through 2023. There are now 5 members out of 17 who see a rate hike in 2023 which is up from 4 in the last meeting. The reason the Fed doesn’t say it will hike rates in 2023 is its forecasts for core PCE inflation in the next 3 years are 1.8%, 1.9%, and 2%. The Fed might be underestimating those forecasts to avoid scaring the market into thinking a hike is coming. The economy could easily produce more inflation than those guesses.

Conclusion

Nothing changed in terms of policy, but the Fed updated its economic predictions which were interesting. To us it seems like the Fed underestimated its inflation guesses in 2022 and 2023 low to avoid scaring the market into thinking a hike is coming. However, once the pandemic is over in the spring or the summer, we will see more open discussions of rate hikes and a slowing to QE. The Fed could easily raise rates in 2023 and might even raise them in 2022 if economic growth really accelerates.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.