UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Just like the U.S. Markit manufacturing report, the global PMI fell 2 tenths. The global PMI is closer to 50 though which means global manufacturing growth is barely positive. Specifically, the index fell from 50.3 to 50.1 as the global PMI is being dragged down by Europe with particular weakness in Germany (2nd weakest PMI) which is being hurt by weak Chinese demand. Germany’s PMI fell from 44.1 to 43.7. Even though 44.1 sounds weak, it was a 5 month high. The good news from this German report was output expectations hit a 15 month high and new orders had the smallest decline of 2019.

The 4 weakest PMIs are all from Europe. 9 European countries (including U.K.) had a below 50 PMI and 2 were above 50. Greece actually had the highest PMI. 2nd was India and 3rd was America. As you can see from the chart above, even though the global PMI fell slightly, the percentage of countries with manufacturing PMIs above 50 rose to 51.7%. That’s the highest since May 2019. The breadth of the manufacturing sector appears to be improving. If Germany follows its expectations index, we should see a full-fledged global cyclical recovery.

Within the global index, output fell 6 tenths to 50.4 and the employment index fell 5 tenths to 49.6. On the positive side, the new export orders index rose 3 tenths to 49.2 and future output rose 8 tenths to 58. Just like in the ISM and U.S. Markit report, the prices indexes rose. We could see increased inflation in 2020. Input prices rose 1 point to 51.3 and output prices rose 9 tenths to 51. This report doesn’t include the recent rise in oil prices due to geopolitical reasons. That’s probably a good thing because that increase could be temporary.

Global Coordinated Central Bank Easing

The last manufacturing recession was made worse by the collapse in oil prices. US mining production fell more than in the financial crisis. That makes sense because fracking growth from the end of the financial crisis to 2014 was rapid. Oil prices cratered in late 2014 and 2015. Bad news became good news because the best catalyst for higher prices is ironically lower prices since supply is cut. The rebound in oil prices helped end the manufacturing recession. The current manufacturing slowdown in America is broader based, but less deep because there wasn’t a crash in mining production.

This manufacturing cycle might turn with the help of global central bank easing. As you can see from the table above, the net number of central banks easing policy was 50 in 2019. That’s in stark contrast with 2018 which had 11 net countries tightening. There were only 17 easing in 2016 which was the back half of the last manufacturing recession. The Fed’s rate cuts should fully impact the economy in the middle of 2020 if you believe like the Fed does that it takes about a year for them to do so.

5% Chance Of An Average Recession In 2020

The current median estimate for Q4 GDP growth is 2% (12 estimates). We are waiting for the December retail sales and PCE reports to give us a much fuller picture of the strength of the consumer in Q4. This matters a lot because the consumer has driven almost all of GDP growth in the past 2 quarters. Business investment growth will be low or negative. Private residential investment growth will be positive again, but its impact might be canceled out by non-residential investment growth. It appears trade will play a big role in Q4’s growth as the trade deficit shrunk.

Looking to the future, the ECRI leading index in the week of December 27th increased 0.2 to 147.8, but the growth rate fell slightly to 2.3%. The index has been signaling near trend growth for most of 2019, so that’s what we could see in 2020. It’s not as negative as the leading economic indicators report which is very close to showing negative growth which is consistent with recessions.

The chart below shows Oxford Economics’ calculation of the probability of each 2020 GDP growth possibility. The baseline estimate is 1.7% growth.

25% of scenarios show below 0% growth and only 5% show recessions as deep as the average one in the past 50 years. A key point is there doesn’t need to be negative real growth in the entire year for there to be a recession. Secondly, with the economy growing at such a low rate, below 0% growth isn’t as far below the long run trend rate as it once was. We’ve recently seen a few developed countries hit technical recessions (growth below 0% for 2 straight quarters) without close to the repercussions of the 2007-09 global financial crisis.

Conference Board Consumer Confidence Falls Slightly

Even though the December Conference Board consumer confidence index fell in December it signaled solid news for the holiday shopping season since the November reading was revised higher and the Present Conditions index in December improved. The overall index fell 0.3 to 126.5 which missed estimates for 130.2. The Present Conditions index rose from 166.6 to 170, but the Expectations index fell from 100.3 to 97.4.

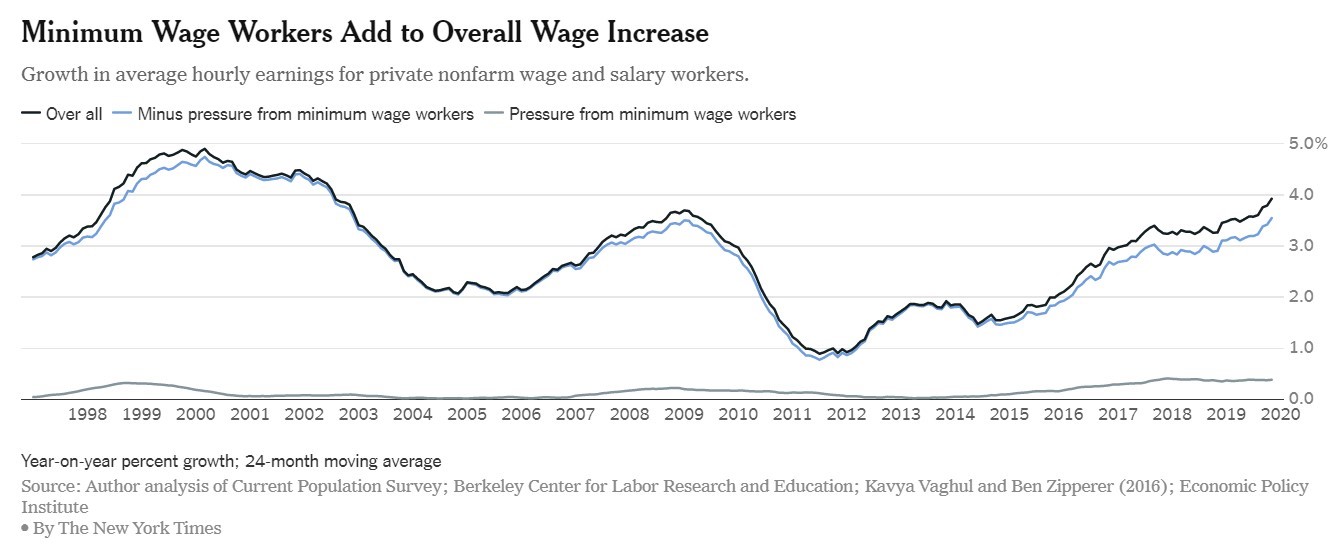

Upper income people are being helped by the soaring stock market and lower income people are being helped by minimum wage hikes. You can see in the chart below the wage growth pressure from minimum wage workers. The 24 month moving average of yearly growth pressure in 2019 was 0.38%. The pressure is the highest at the low end obviously.

The middle of the labor market will need to rely on cyclical changes. They don’t look to be headed in the right direction though as expectations got worse in this report. 15.3% of consumers expected more jobs in the next 6 months (down 0.8%) and 14.9% expected fewer jobs (up 1.5%). That’s a net decline of 2.3%. Income expectations fell too as the percentage expecting an improvement fell from 22.9% to 21.1% and the percentage forecasting a decline increased from 6.2% to 7.7%. That’s a net decline of 3.3%.

Conclusion

The global manufacturing PMI fell slightly in December, but the percentage of PMIs above 50 increased. The global economy might see a cyclical turnaround in 2H 2020 because of the high net number of global central banks that cut rates in 2019. Q4 GDP growth is expected to be 2%, but that’s subject to consumer spending in December. Oxford Economics sees a 5% chance of an average recession in 2020. The rise in the stock market and the rise in minimum wages are helping upper income and lower income people. The bad news for the rest of workers is expectations worsened in December.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.