UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Redbook same store sales growth rose from 2.5% to 6.5% in the week of December 19th. It had been in the low single digits for a while. Any sort of improvement goes against the data we have reviewed which has been weak. However, Redbook always has the most up to date information, so it’s possible the week before Christmas showed improvement. We will get a boost from the stimulus, but that’s after the holiday. Buckle up for what should be a bad retail sales report.

In line with our summary of the consumer data this holiday shopping season, the Conference Board Consumer Confidence index fell because the present conditions index tanked. As you can see from the chart below, the overall index fell from 92.9 to 88.6. That’s near the cycle low which is quite bad when you consider the economy was in a recession and many were calling for a depression in March and April. We expected this weakness though because the virus has spread and actually killed more people per day this month. Furthermore, by the end of this survey period which was December 14th, consumers didn’t know if a stimulus would pass. Now that one is coming, look for more optimism in January.

The present conditions index fell from 105.9 to 90.3. The good news is the expectations index rose from 84.3 to 87.5. That’s because consumers see the vaccine going out. Since the end of this survey, Moderna’s vaccine was approved. The net percentage of consumers claiming business conditions are good fell from -16.1% to -23.5%. Based on the decline in the high frequency data shown in the chart below, they are probably right. The December Richmond Fed manufacturing index actually went up from 15 to 19 which beat estimates for 12 and the highest estimate for 14. The manufacturing part of the economy is the most resilient at this point in the cycle.

The net percentage of consumers saying jobs were plentiful fell from 6.9% to 0.2%. That’s an accurate assessment of the labor market based on initial claims as they fell in November and started to rise in December. We should get negative job creation in December, following positive creation in November.

The data on expectations improved modestly. The net percentage of consumers expecting business conditions to improve in the next 6 months rose from 4% to 7.1%. Consumers might not be positive enough here. Conditions are very likely to be better by June. The stock market doesn’t seem to have played a big role because stocks have done so well, yet expectations are only modest given the excitement about the vaccines. Obviously, the market has recently been led by the secular growth tech stocks which aren’t in tune with the cyclical economy, but consumers don’t follow the market close enough to know that.

December Decline!

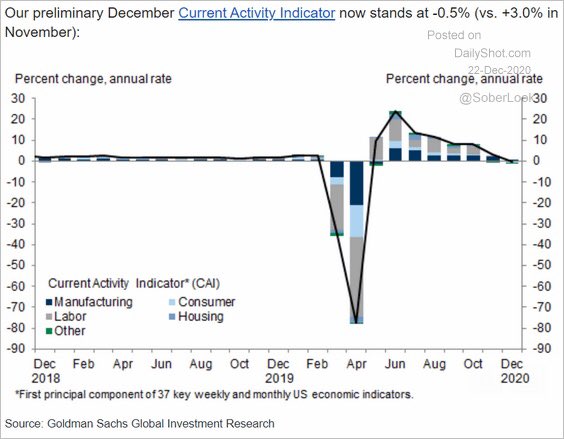

Goldman Sachs’ current activity indicator went from 3% to -0.5% in December. That’s the first negative reading since April. This looks like a disaster similar to the chart above, but investors have their eye on the prize which is a return to normalcy once the vaccines go out. Since the virus mostly kills people of older ages, the vaccines going to them first should have a quick impact on the death totals per day. This thesis, which is really just basic logic, will be tested in February as the Moderna vaccine picks up distribution.

Shocking Correlations

We have shown quite a few amazing charts this year because we had an unusually quick recession which caused the fastest stock market crash and rise ever. After those took place, we found ourselves in a mania led by tech stocks. Investors blamed low rates for high valuations and gained confidence from the crash. This is just like how the crash in 1987 gave investors confidence in the 1990s except this situation was more condensed.

Furthermore, the fact that the stock market quickly recovered from a recession and rallied even though the economy was weak for most Americans, made investors not fear a recession. Essentially, they don’t fear anything except a rate hike. Since none are coming next year, they think the party will continue through 2021 and probably through 2022.

We think it’s a negative if a stock is just a play on rates because it means the company has no control of its stock’s destiny. There isn’t much of a point of reviewing the business if even if it does well, the numbers don’t work because the stock is too expensive with higher rates. To those who say large cap growth isn’t a rates play, we present the chart above. As you can see, the current correlation between the returns of large cap growth stocks and the 10 year bond is the highest ever by a lot. We don’t think a spike in yields is going to change that correlation. It would cause a selloff.

Equal Weight Tech Could Outperform

The valuations and euphoric activity probably inspire fear among tech investors. The good news is there should be stocks that avoid most of the coming decline when the fervor ends. As you can see from the chart below, after the tech bubble burst in 2000, the equal weight index beat out the market cap weighted index which means the smaller companies, which were cast aside during the euphoria, actually outperformed. It gives credence to the notion that the stocks that haven’t exploded and have reasonable valuations won’t crash just because they are in the tech sector. Sure, there will be some selling in all tech if the Nasdaq falls, but it won’t be a disaster for some of the cheaper names.

Conclusion

Present conditions in the consumer confidence index tanked as the consumer fears COVID-19 and didn’t know about the coming stimulus when the survey was done. The high frequency data points are in freefall as Goldman’s measurement of the economy showed a contraction in December. Large cap growth is highly correlated with the long term treasury bond. We could see the equal weight tech index beat the market cap tech index when there is an inevitable bear market in tech as the euphoria dies down.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.