UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

There is a natural fear that if the economy isn’t regulated, risks will occur which can hurt bystanders. For example, people fear that if the banks aren’t regulated, then they will make risky loans and go bankrupt. However, if banks are allowed to operate in their best interest, many will avoid risk because it hurts shareholders if they fail because they tried to boost returns by taking too much risk. It’s important to keep banks and all companies responsible for their own failures. If they aren’t responsible, there is a moral hazard. If the banks are protected from failing by the government, then they have the benefit of reaping the rewards when they take more risk, but they aren’t responsible for all the losses when they fail – something we have covered previously in our article Does FDIC Insurance Put You At Risk Of Losing Your Money?.

Moral Hazard Encourages Risk Taking

It’s wrong to have failures rewarded while banks who act appropriately get hurt. After the financial crisis, the bank stocks that took bailout money outperformed the ones that didn’t. Imagine if a school kid didn’t do his homework and ended up failing his test. Then he’s allowed to re-take the test and gets a better grade than the kid who did study. Rewarding irresponsibility is a bad idea. It’s also worth noting some banks were forced to take bailout money even though they didn’t need it. It’s wrong for the government to decide who needs to be saved instead of letting the market self regulate and determine the winners and losers.

Even though rewarding failed banks is a bad idea, it still seems to be the go-to strategy when the banking system faces its next crisis. By the way, this isn’t even a politically popular position since both socialists and capitalists often argue against bailing out banks with taxpayer money. The main logic behind bailouts is an unfair question. The question is if you had to choose between bailing out a large bank or letting the entire system fail what would you do? Clearly, it makes sense to bail a company out if those are the choices, but the question is incorrect.

Dodd Frank Makes Too Big To Fail Problem Worse

An implied bailout encourages risk, so if the government says it won’t bailout companies, there’s a smaller chance of a big failure. Furthermore, the government regulations, which are aimed to prevent major institutions from taking too much risk in this moral hazardous situation, are creating the too big to fail problem. The chart below from Mercatus Center shows the banking regulations since 1970. There had been a steady growth in regulations in the past few decades. Then, after the financial crisis, Dodd-Frank was passed. It caused a vertical leap in the total banking regulations.

Source: Mercatus Center

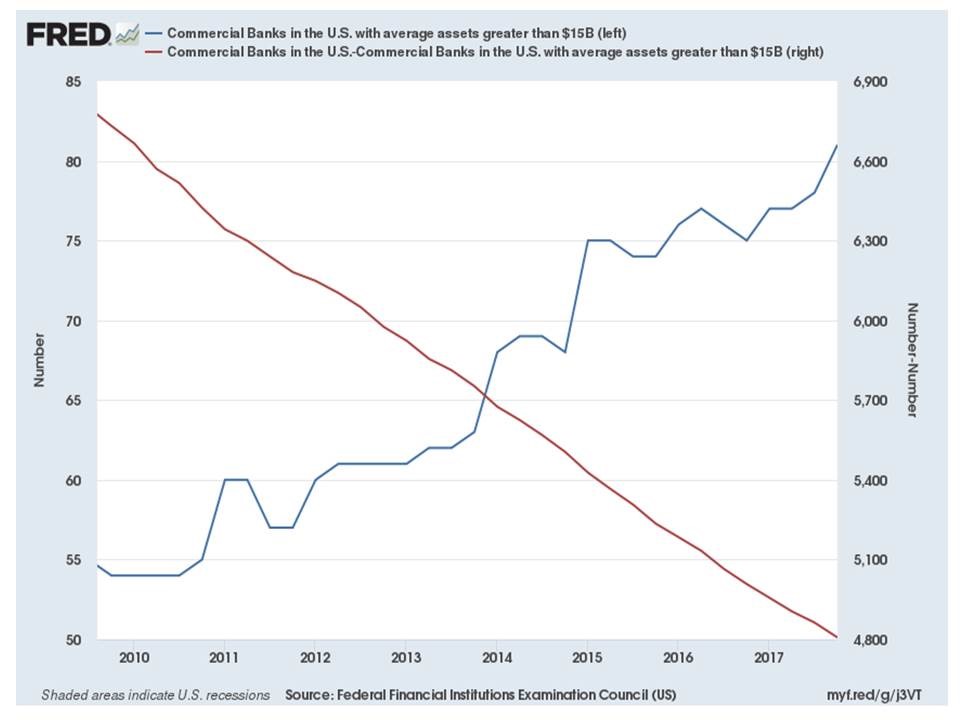

Regulations increase the cost of doing business for banks. Dodd-Frank caused costs to soar. This particularly hurt small banks because they have the most trouble dealing with all the restrictions. Not only have costs soared, but also the regulations are complicated to understand. If a bank’s profitability is restricted and it faces the potential of getting fined because it doesn’t understand the law, it makes more sense to shutdown the bank than stay in business. The FRED chart below shows the total commercial banks with assets greater than $15 billion and the total banks with less than $15 billion in assets. As you can see, the number of large banks has increased 55% and the number of small banks has declined by 28%. There are virtually no new banks.

Source: FRED via @DonDraperClone Twitter

Free Market Competition Allows Failure Without Bringing Down The System

The regulations put the small banks out of business while the large ones have taken market share. This means each bank is more important than ever. The great thing about having more small banks is that if one fails, it wouldn’t cause the entire banking system to fail. The question of what you would do when a large bank failed wouldn’t exist because there wouldn’t be banks which could take down the system. The system is more fragile now than before Dodd-Frank was passed. Banks don’t need regulations after a crisis, in a free market economy. They will learn from their mistakes. For example, in the fracking industry, many went bankrupt after the oil crash from 2014-2016. Companies which succeeded, learned to cut costs to make due in the new environment which has lower oil prices. Now, the oil production is higher than ever before. If the bad companies were saved, too much oil would have been produced which wouldn’t have allowed the system to flush out and eventually create a new up cycle.

More Competition Is Better For The Consumer

More small banks would create more competition and would provide more choices for the consumer. We’ve recently seen a bank, which was bailed out during the financial crisis, get in trouble because employees opened fake accounts for customers, so they could reach bonuses earned through opening a certain number of accounts. The government wouldn’t need to punish the company in a free market because customers would leave the firm in droves. There would be more options to choose from.

Critics of capitalism always claim that big businesses would become too powerful, but there are countless examples of where the government actually creates monopolies and oligopolies instead of dismantling them. Big business is motivated to get cozy with lawmakers to craft laws in their favor and to ensure that they get a bailout and not other firms in case of a crisis.

Conclusion

Dodd-Frank makes the financial system less safe because big banks were allowed to gain an inordinate amount of market share. The worst part of this situation is that it will probably be repeated because President Trump is trying to de-regulate the banking system near the end of the business cycle. When there’s another recession and a crisis, the de-regulation, which only happened a couple years before the problem, will be blamed for the crisis and new regulations will be created. Because regulations have the allure of creating safety, they aren’t blamed for the problems even though they create them.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.