UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

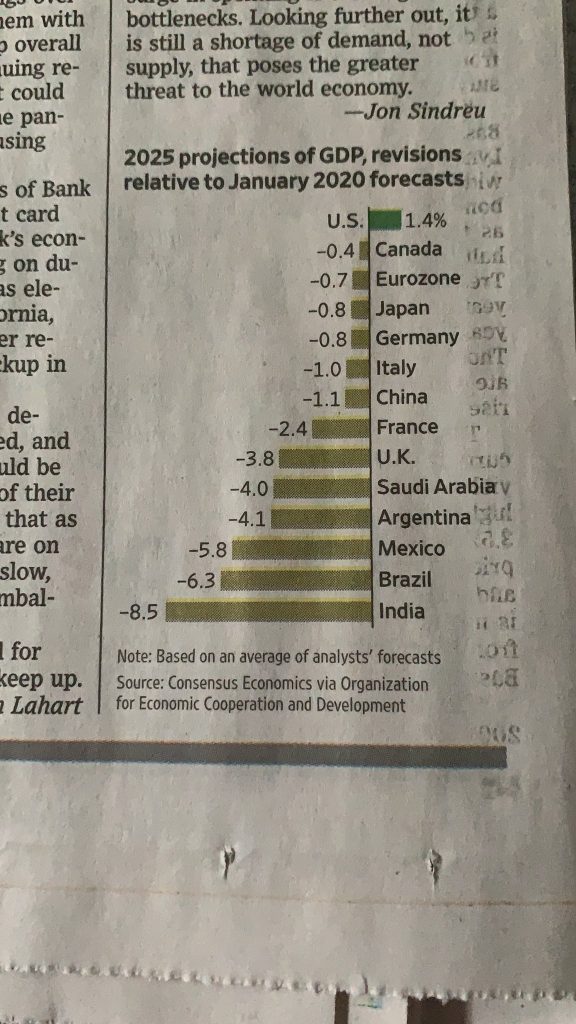

Many investors are worried about the American stock market because it takes up a large portion of global markets. In fact, the big tech firms are larger than many developed economies. Investors are also worried about the high CAPE ratio. We will discuss valuations in the next section. Let’s not ignore the positives. There has been a major step change in US economic growth expectations in relation to other economies.

As you can see from the chart below, 2025 US GDP expectations are 1.4% higher than they were in January 2020. That’s compared to Mexico, Brazil, and India which have estimates that are 5.8%, 6.3%, and 8.5% lower. Investors believe the poor management of the COVID-19 crisis in many emerging markets is part of a broad trend which undermines the government’s authority and support by the populace. The pandemic certainly isn’t a one-off negative for countries that dealt with dramatic hardship. We’re not picking a side. It’s just easy to see leadership issues resulting from the poor management of the pandemic.

It’s sometimes difficult to determine what the world will look like following the pandemic. It’s key to avoid broad sweeping claims that either nothing will change or that everything is different. Of course, some claims are patently absurd, but many aren’t. We won’t know COVID-19’s long term impact on the global geopolitical environment for a couple years. Even after we see the post-pandemic future, many will argue over what caused the changes. Of course, the cause won’t matter to investors. The only thing that matters is what the future looks like.

Stock Valuations Make Sense?

The thesis that stocks are wildly expensive is pervasive. Many retail investors use the so called expensive market to justify taking reckless risks. Extreme risks without fundamental backing can never be justified. Investors tend to make mistakes when they have the overarching thesis that the US market is overvalued. That’s because they take untested alternative approaches.

Besides taking extreme risk, the other major mistake is investors stop looking for ideas. They don’t look for ideas because they believe there is an ‘everything bubble.’ While a stock market crash would cause almost all stocks to fall, long term returns will be strong for good companies trading at low valuations. Most investors who claim there aren’t great opportunities haven’t spent time looking for them!

It’s a contrarian take to claim the US market is fairly valued. Many investors are distracted by the sideshow that is the rally in meme stocks. However, if anything, the extreme rallies in those stocks have taken away from the bull market. They have caused hedge funds to de-gross. This bubble isn’t signaling an impending crash. This is noise. Its foolish to sell a strong business because someone else is making a dumb decision. You don’t sell strong stocks because someone gambles on the lottery, so why sell if they invest in a meme stock?

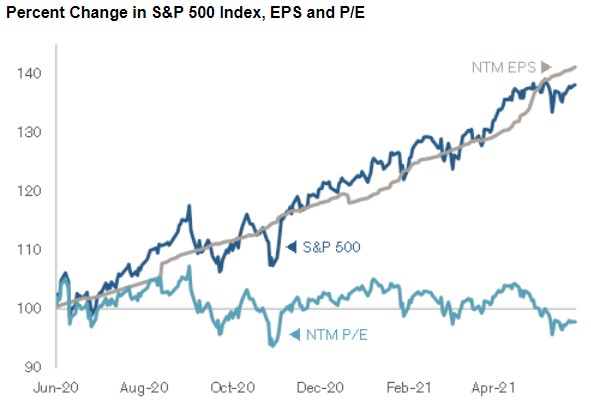

The contrarian opinion might be correct. The forward PE ratio predicts medium term returns, not the CAPE ratio. Obviously, individual businesses are valued on future expectations not the cyclically adjusted past. As you can see from the chart above, the forward PE ratio has been stable since June 2020. The stock market has risen with earnings expectations. Some will claim these are just expectations, but estimates have been beaten by more than average. Estimates have been too low. The stock market’s rally in the past 15 months has been accurate.

Hunger Is Increasing

Policymakers must balance encouraging work with avoiding a spike in homelessness/hunger. The states have undermined federal authority by ending unemployment benefits early. It’s tougher than normal to make policy decisions because people aren’t reacting the way they normally would. For example, in some situations people may have refrained from working for health reasons or because their children weren’t able to go back to school. That’s not normal behavior. Some believe very few people decided not to work to stay home and collect benefits. Clearly, the states think the benefits are unnecessary now that the pandemic is largely over.

The chart above shows hunger has already increased following the end of the stimulus. It might increase further when unemployment benefits go away. Economic policy is always a blunt tool. If policymakers could help who people really need money without causing unintended consequences, there wouldn’t be policy discussions. Everything would be obvious. The hope is the better labor market in the next few months will lower the hunger rate.

Watch Out For Stock Based Compensation

Stock based compensation isn’t a cash expense, but it dilutes shareholders. It shouldn’t be ignored by growth investors. You don’t want to need a ton of new buyers just to keep the stock at the same price. Most growth companies award stock based compensation to managers and employees. The key is to avoid situations where it is out of control.

Management will probably try to hide it if it’s excessive. The chart below shows some of the most egregious examples of dilution. It shows stock based compensation as a percentage of shares outstanding for some of the recent major IPOs. You need to be extremely bullish on Snowflake and Palantir to justify accepting 39% and 35% dilution.

Many value investors don’t think stock based compensation should be adjusted out of financial results. Those who are okay with such dilution have actually done well in the past decade. However, if sentiment and competitive dynamics shift, these stocks can plummet because the supply of their shares is so high.

Conclusion

US GDP growth expectations have increased since last year unlike other countries especially the ones that botched the vaccine rollout. Earnings estimates have matched equity performance. There is no stock market bubble. Hunger has increased following the end of some stimulus programs. Investors should be very careful of excessive stock based compensation when they invest in growth stocks. No one is saying you need to avoid it entirely. Just make this one of the factors you look at when deciding to invest in a company.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.